The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for October month is due early on Wednesday at 07:00 GMT. The key inflation data will join the current Brexit drama and the coronavirus (COVID-19) headlines to entertain the GBP/USD traders. The price economics gain more importance ahead of BOE Governor Andrew Bailey’s speech, scheduled for release at 16:30 GMT.

The headline CPI inflation is expected to recover from 0.5% prior to 0.6% on an annual basis. The Core CPI that excludes volatile food and energy items is likely to remain unchanged at 1.3% YoY. Talking about the monthly figures, the CPI bears the pessimistic consensus of -0.1% versus +0.4% prior.

In this regard, analysts at TD Securities said,

We look for core CPI to slip to 1.1% y/y in October (marker forecasts 1.3%), as general economic weakness weighs on inflationary pressures. Plus, with the growth in the share of online shopping this year, Amazon Prime Day shifting from July to October may have had an outsized effect. We look for headline CPI to come in at 0.4% y/y (expectations 0.5%), with some downward pressure from the OFGEM price review and reduction in electricity prices.

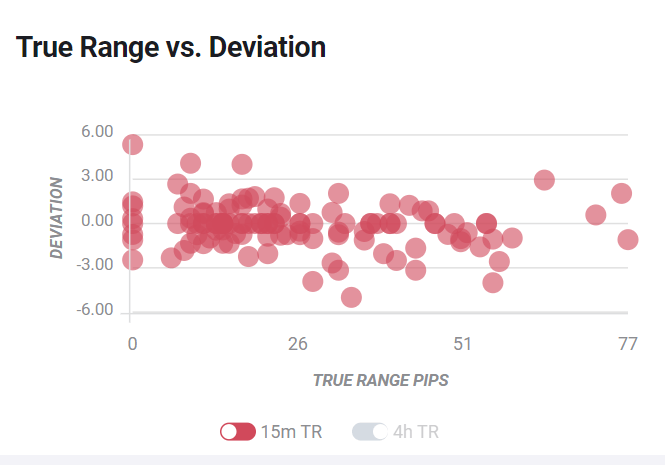

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the initial market reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3. The same suggests the importance of the key inflation data for GBP/USD pair traders.

How could it affect GBP/USD?

By the press time of pre-London open on Wednesday, GBP/USD cheers the broad US dollar weakness, coupled with the hopes of a UK-EU trade deal by early next week, to mark 0.07% intraday gains while picking up the bids near 1.3260.

Although recent updates suggesting France’s easing stand on the fisheries demand remove one more hurdle for a Brexit deal, there are many other points where the ex-neighbors, namely the European Union (EU) and the UK, don’t agree. Hence, the Brexit optimism may fade and can join the latest covid-19 resurgence-led woes to weigh on the quote. Downbeat inflation numbers, if matched forecast, may exert additional pressure on the GBP/USD pair.

Technically, a joint of 10-day SMA and an ascending trend line from November 02, currently around 1.3195, becomes the key for GBP/USD traders to watch.

Key notes

GBP/USD Forecast: Brexit hopes underpin the pound

GBP/USD Price Analysis: Buyers stay hopeful above 1.3195 support confluence

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.1100, looks to post weekly losses

EUR/USD continues to trade in a narrow range below 1.1100 and remains on track to end the week in negative territory. Earlier in the day, monthly PCE inflation data from the US came in line with the market expectation, failing to trigger a reaction.

GBP/USD struggles to find a foothold, trades near 1.3150

GBP/USD stays on the back foot and trades in negative territory at around 1.3150 on Friday. The US Dollar holds its ground following the July PCE inflation data and doesn't allow the pair to stage a rebound heading into the weekend.

Gold retreats toward $2,500 ahead of the weekend

Gold stays under modest bearish pressure and declines toward $2,500 in the American session on Friday. The 10-year US Treasury bond yield edges higher toward 3.9% after US PCE inflation data, causing XAU/USD to stretch lower.

Week ahead – Investors brace for NFP amid Fed rate cut speculation

Here comes another NFP week, with investors eagerly awaiting the results as they try to discern the size and pace of the Fed’s forthcoming rate cuts. The weaker than expected July numbers triggered market turbulence, instilling fears about a potential recession in the US.

Easing Eurozone inflation to back an ECB rate cut in September Premium

Eurostat will publish the preliminary estimate of the August Eurozone Harmonized Index of Consumer Prices on Friday, and the anticipated outcome will back up the case for another European Central Bank interest rate cut when policymakers meet in September.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.