- OTCMKTS: RHHBY is rising on Thursday while European shares are on the back foot.

- Roche is benefiting from a recent FDA green light for an influenza drug.

- The drugmaker's stock could advance once the dust settles from coronavirus vaccines.

Winter is almost here and cold temperatures also increase the chances of someone catching the flu, not only COVID-19. Roche Holdings AG (OTCMKTS: RHHBY) has been out of the spotlight when it comes to coronavirus but is making headway in other directions.

The US Food and Drugs Administration (FDA) has approved a supplemental New Drug Application (sNDA) for Xofluza, a drug used against influenza. Roche received a green light to sell the drug as a preventive treatment for those who came in contact with someone with influence.

The Swiss drugmaker said that Xofluza is unique in being a single-dose influenza medicine used for post-exposure prophylaxis. The nod from the FDA came after a Phase 3 trial showed that the drug is statistically significant in holding back the flu.

RHHBY stock forecast

OTCMKTS: RHHBY is rising on Thursday, defying the general downtrend in European stocks. The ongoing positive effect from the news on Roche's stock price is another sign of resilience. The FDA gave its approval already on Tuesday.

The world is gripped by COVID-19 news, ranging from rising hospitalizations in the US, lockdown moves in Europe, and optimistic developments on the vaccine front. This focus overshadows other diseases and drugmakers such as Switzerland's Roche. However, once markets fully price in a timetable for exiting the covid crisis, there is room for gains.

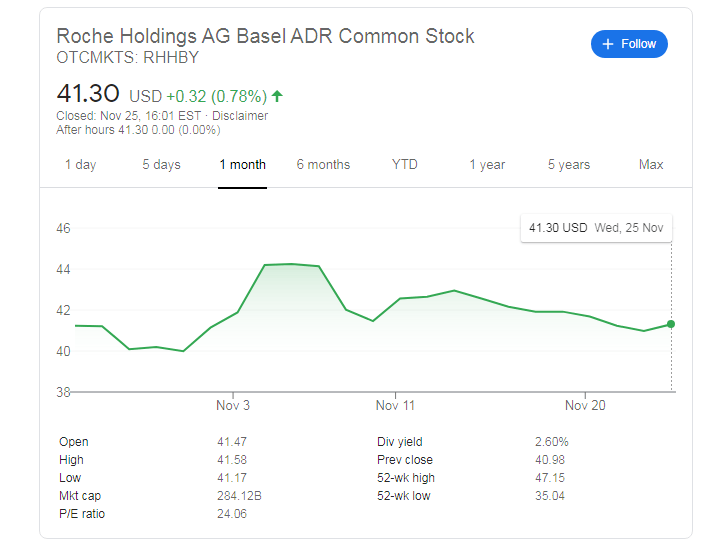

RHHBY is changing hands at around $41.30, bang in the middle of the past year's range. The 52-week high is $47.15 and the 52-week low is $35.04. Developments such as the FDA's nod for Xofluza may push shares toward the upper end of the range.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds near 1.0550 after Eurozone inflation data

EUR/USD trades marginally higher on the day at around 1.0550 in the European session. The data from the Eurozone showed that the annual HICP inflation rose to 2.3% in November from 2% in October, as expected. Financial markets in the US will close early on Friday.

GBP/USD loses traction, retreats below 1.2700

After climbing to its highest level in over two weeks at 1.2750, GBP/USD reverses direction and declines to the 1.2700 area on Friday. In the absence of fundamental drivers, investors refrain from taking large positions. Nevertheless, the pair looks to snap an eight-week losing streak.

Gold gains on haven demand due to rise in geopolitical risk

Gold stages a bigger rebound on Friday and enters the $2,660s during the early US session. A rise in safe-haven flows due to a breakdown in the Israel – Hezbollah ceasefire agreement is one of the catalysts, as is Russian President Vladimir Putin’s warning Russia could launch nuclear-capable missiles at Ukraine.

Bitcoin attempts for the $100K mark

Bitcoin (BTC) price extends its recovery and nears the $100K mark on Friday after facing a healthy correction this week. Ethereum (ETH) and Ripple (XRP) closed above their key resistance levels, indicating a rally in the upcoming days.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.