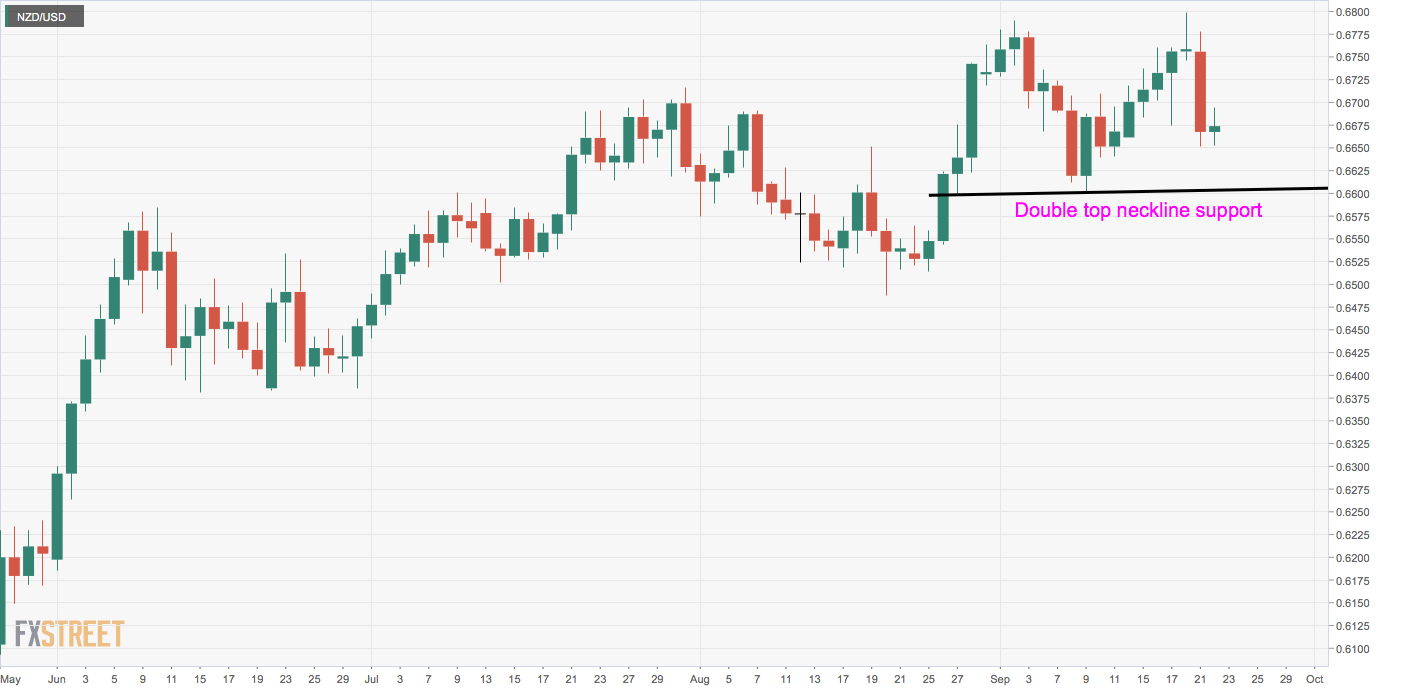

- NZD/USD has carved out a double top pattern on the daily chart.

- A close below the neckline support of 0.6601 would confirm a breakdown.

NZD/USD's daily chart shows a double top pattern – the buyers failed to chew through offers around 0.68 on Friday and on Sept. 2.

The Sept. 9 low of 0.6601 is the neckline support of the double top pattern. A close below that level would create room for a sell-off to 0.64 (target as per the measured move method).

A drop to 0.6601 looks likely, as the daily chart is showing a bearish reversal candlestick pattern. The pair fell by 1.23% on Monday, validating or confirming the bullish-to-bearish trend change signaled by Friday's inverted hammer.

At press time, the pair is trading at 0.6674, having hit a low of 0.6653 early today. A close above 0.68 is needed to invalidate the bearish candlestick pattern.

Daily chart

Trend: Bearish

Technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends losses toward 1.1100 on increased dovish ECB bets

EUR/USD accelerates decline toward 1.1100 in European trading on Friday. Softer French and Spanish inflation data ramped up Oct ECB rate cut bets, weighing on the Euro. However, the downside could be cushioned by a wobbly US Dollar, as US PCE inflation looms.

USD/JPY slides 1% toward 143.00 as Ishiba wins LDP leadership race

USD/JPY is seeing a fresh sell-off toward 143.00 in the European session on Friday. The pair loses over 300 pips, as the Japanese Yen rebounds on Shigeru Ishiba's win in the LDP leadership run-off. Sanae Takaichi, who favored keeping interest rates lower, was expected to win the race.

Gold price pulls back from record high ahead of US PCE Price Index, bullish bias remains

Gold price attracts some sellers on the last day of the week and retreats further from the all-time peak, around the $2,685-2,686 region touched on Thursday. The downtick is sponsored by the emergence of some US Dollar buying, which tends to undermine demand for the commodity.

US core PCE set to show continued disinflation trend, reinforcing Federal Reserve easing cycle

The core Personal Consumption Expenditures Price Index is seen rising 0.2% MoM and 2.7% YoY in August. Markets have already priced in near 50 bps of easing in the next two Federal Reserve meetings. A firm PCE result is unlikely to move the Fed’s stance on policy.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.