- Gold price remains on the defensive amid notable US dollar demand.

- Risk-off mood, subdued Treasury yields offer some comfort to gold bulls.

- Gold Price Forecast: XAU/USD risks further falls as technical setup turns bearish

Gold price is consolidating just below the $1900 level, as the bears take a breather after Tuesday’s $25 decline from five-month tops of $1917. The main catalyst behind gold’s drop remains the US dollar’s advance, in the wake of strong US ISM Manufacturing PMI. A pick-up in the US manufacturing kept bets alive for the Fed’s tapering. Meanwhile, tepid risk sentiment also underpins the dollar’s demand, despite subdued yields. However, gold bulls remain hopeful amid growing inflation concerns and a revival in India’s demand for the metal.

In absence of the first-tier economic data from the US, the broader market sentiment and the dollar dynamics will continue to remain in play. The main market-moving event for this week remains the US Nonfarm Payrolls.

Read: Gold Weekly Forecast: XAU/USD bulls not yet ready to give up on additional gains

Gold Price: Key levels to watch

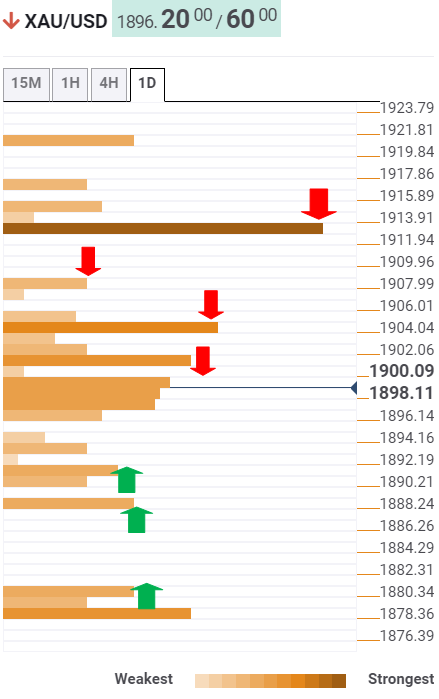

The Technical Confluences Detector shows that gold price is struggling around $1897, where a dense cluster of resistance levels is stacked up.

That comprises of the Fibonacci 23.6% one-day, Fibonacci 38.2% one-week and SMA5 four-hour.

The next critical hurdle for gold price awaits at $1901, the confluence of the SMA5 one-day and previous high four-hour.

The Fibonacci 23.6% one-week at $1904 could limit the further upside, as the bulls remain on track to test the Fibonacci 61.8% one-day at $1908.

A powerful barrier around $1913 will be a tough nut to crack for gold buyers. The previous week and month high coincide at that point.

To the downside, minor support awaits at the previous day low of $1892.

The next relevant support is seen at the Fibonacci 61.8% one-week at $1887.

The pivot point one-week S1 at $1880 could come to the rescue of gold bulls.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0500 on renewed USD weakness

EUR/USD gains traction and trades above 1.0500 in the American session on Thursday. In the absence of high-tier data releases, improving risk mood makes it difficult for the US Dollar (USD) to find demand and helps the pair push higher.

GBP/USD rebounds from daily lows, trades above 1.2650

After falling toward 1.2600 on disappointing macroeconomic data releases from the UK, GBP/USD gathers recovery momentum and trades above 1.2650. The renewed US Dollar weakness helps the pair find a foothold as risk flows dominate the action heading into the weekend.

Gold finds some support at $2,660, upside remains capped

Gold (XAU/USD) is showing mild recovery from session lows at $2660, on Friday’s early American session. The US Dollar (USD) index is going through a significant reversal from two-week highs, which provides some support to Gold although the rising US Treasury yields are likely to keep buyers in check.

Bitcoin and Ripple stalls while Ethereum eyes rally

Bitcoin faces resistance near $101,100, hinting at a potential downturn. At the same time, Ethereum eyes a rally if it can firmly close above $4,000, and Ripple holds support at $1.96, with a breakdown signaling a possible decline.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.