- EUR/USD holds in positive territory into the closing bell on Wall Street.

- The ECB came as expected and the euro has attracted a bid.

EUR/USD is struggling to extend gains made in Thursday's North American session, capped at a high of 1.1841 and trading mid-range near 1.1830.

The euro is holding onto small daily gains following the European Central Bank meeting whereby it said it will trim emergency bond purchases over the coming quarter.

This is seen as the central banks first small step towards unwinding the emergency aid as the nation's inflation readings head towards their highest in nearly a decade.

“The ECB is delivering mainly as expected today,” analysts at TD Securities said in a report on Thursday. “Looking ahead, the focus will be on how the ECB defines "moderately" - anything less than €60bn/mo could be bearish.”

Meanwhile, the ECB's governor, Christine Lagarde, came with an upbeat assessment of the nation's economic progress.

She explained that there has been a strong recovery in employment, business investment and said that there is ample scope for private consumption to rise further.

The central bank has raised its growth and inflation forecasts for this year although the 2023 forecasts provide a better assessment of where the ECB expects the economy to be over its forecast horizon.

''That is what is critical for monetary policy,'' analysts at ANZ Bank argued.

The ECB left, however, its 2023 Gross Domestic Product projection unchanged at 2.1% and inflation was tweaked to 1.5% vs 1.4%, well below the 2.0% target.

''That predicted path implies the ECB will withdraw stimulus very cautiously and that interest rate rises remain a long way off. The focus in coming months will be on how to address the anticipated ending of PEPP next March (a temporary, pandemic facility). To end it abruptly risks a sudden tightening in monetary conditions that could undermine growth and inflation expectations,'' the analysts explained.

''We, therefore, expect some expansion of the APP programme (currently EUR20bn per month) and/or a new envelope of QE purchases. The ECB will announce more in December.''

Meanwhile, investors are also focused on when the US Federal Reserve is likely to begin paring bond purchases.

The US dollar has managed to find demand on the notion that the global economy is no better off than the US's recovery and despite last week's dismal jobs print, the nation remains on solid foundations.

The Fed. however, is unlikely to make a move until at least later after the weaker than expected jobs report on Friday.

That being said, we had four Fed officials on Wednesday saying that the central bank needs to make a move, though some cautioned a final decision requires more data.

As for Us data on Thursday, it has shown that the number of Americans filing new claims for jobless benefits continues to fall.

Last week, the claims fell to the lowest level in nearly 18 months, offering more evidence that job growth was being hindered by labour shortages rather than cooling demand for workers.

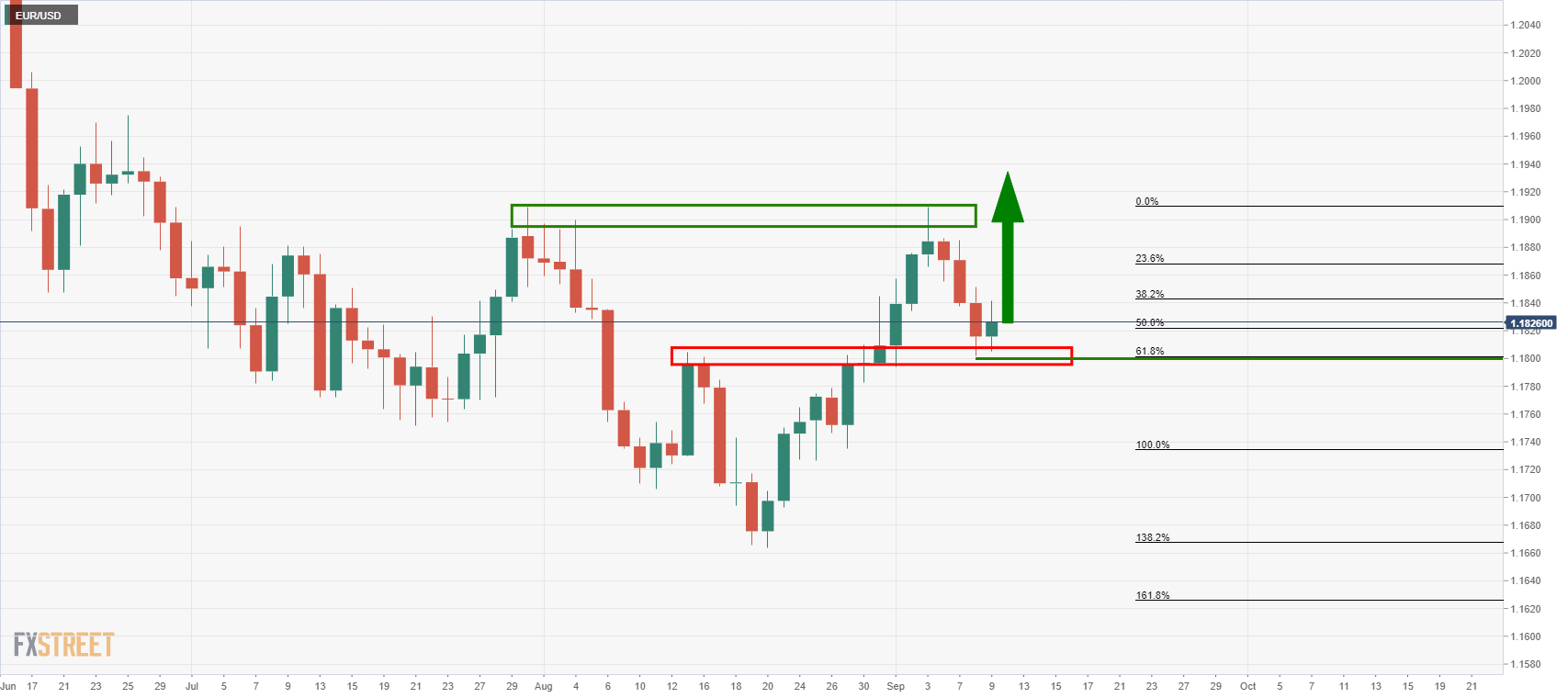

EUR/USD technical analysis

The price is supported at the 61.8% Fibonacci retracement and could be on the verge of a move to the upside to test prior highs for the possibility of an upside extension in the coming days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains below 145.50 after Tokyo CPI inflation data

USD/JPY is paring back gains to trade below 145.50 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.