The Reserve Bank of New Zealand has hiked the Official Cash Rate by 50 bps to 2% and the markets are now on the lookout for the pace of future tightening for which the Monetary Policy Statement, (MPS), will potentially shed some light.

''With fears of a hard landing at the core of what’s eating away at risk sentiment, as we’ve been saying for a while, if the RBNZ can strike the right balance between “we’ve got this” on inflation while signalling that it is cognisant of recession risks (not an easy job) while also preserving optionality, that’d likely be positive for the Kiwi,'' analysts at ANZ Bank said

RBNZ rate decision & MPS

- RBNZ raises the official cash rate 50 basis points to 2.00% as expected.

- RBNZ sees official cash rate at 2.68% in September 2022 (pvs 1.89%).

- RBNZ sees official cash rate at 3.88% in June 2023 (pvs 2.84%).

- RBNZ sees TWI NZD at around 71.8% in June 2023 (pvs 71.6%).

- RBNZ sees annual CPI 3.5% by June 2023 (pvs 2.6%).

- RBNZ sees official cash rate at 3.95% in September 2023 (pvs 3.1%).

- RBNZ sees official cash rate at 3.51% in June 2025.

All but one of 21 economists in the Reuters poll forecast the Reserve Bank of New Zealand (RBNZ) would hike the official cash rate (OCR) by 50 basis points to 2.00%. One economist expected a 25 basis point hike.

Meanwhile, "a larger and earlier increase in the OCR reduces the risk of inflation becoming persistent, while also providing more policy flexibility ahead in light of the highly uncertain global economic environment," the RBNZ said in a statement.

Full Statement

The statement is hawkish and this is supporting the kiwi higher as follows:

NZD/USD update

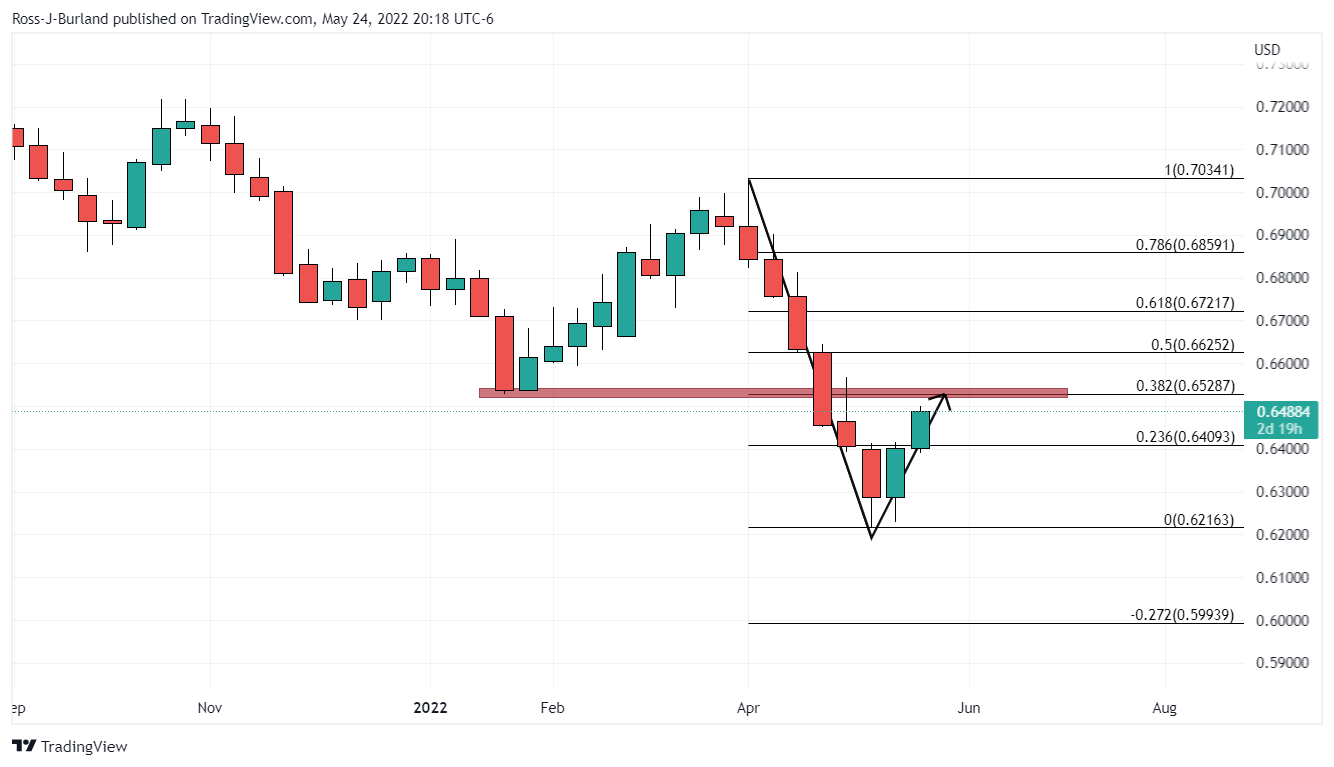

As per the pre-RBNZ technical analysis, NZD/USD Price Analysis: Bulls seeking a higher correction on weekly chart, the bears were in the process of mitigating some of the price imbalance the 4-hour chart as follows:

But following the test of the 38.2% Fibo, the decision has sent the kiwi higher to take on the resistance as follows:

The RBNZ is signalling higher rates ''to ensure annual inflation returns within its target range over the next two years.''

''Interest rate decisions will likely become more difficult over the second half of the year, especially as evidence of cooling demand starts to mount. As such, we anticipate they will return to more normal 25bp hikes as they assess how previous interest rate hikes are transmitting through the economy,'' analysts at ANZ Bank argued.

Meanwhile, the outcome leaves the weekly correction intact and the price is on track for a move into the prior swing lows that have a confluence with the 38.2% Fibonacci retracement level of the prior weekly bearish impulse as follows:

About the RBNZ Interest Rate Decision

RBNZ Interest Rate Decision is announced by the Reserve Bank of New Zealand. If the RBNZ is hawkish about the inflationary outlook of the economy and rises the interest rates it is positive, or bullish, for the NZD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.