- AUD/USD bears are lurking, depending on equities.

- Trade wars, COVID-19 and the US dollar threaten the market's fascination with long AUD.

- Committed bulls seeking a test of the 200 DMA, 0.6660s.

FOMC minutes are released today was a non-event with markets looking for clues on what to expect, as the Fed has hinted more easing is on its way. Negative rates are not on the agenda, (at the moment, but the bond market is not totally buying it).

Bulls betting against a 'wave' of risks ahead

Meanwhile, trade wars are back to the fore and markets continue to follow the COVID-19 infection data and the gradual re-opening of many countries. A second wave is a risk which markets are holding on tight fo as things start to normalise after the lockdowns.

The odds of such an outcome are apparently quite high considering there are new cases in China, Russia and even South Korea which had been praised for its containment of the first wave.

As traders. we are inherently looking to the past for clues about what could occur in the future. Unfortaubely, when we look to the influenza pandemic of 1918 which had three major waves, starting in March 1918, its peak came during a second wave late that same year.

Alarmingly, the second wave was a stronger mutation than the first version of the virus and the U.S. Centers for Disease Control and Prevention (CDC) has said the second wave was responsible for the majority of the deaths in the US — the flu's likely country of origin. It is also worth noting that a third wave came in early 1919 and lasted until mid-year when, according to the CDC, the Spanish flu "subsided."

Trade wars in focus

In terms of trade wars, while Australia may not wish to admit it is in a trade war with China, seeking to avoid protracted negotiations, the latest is that it is preparing to take China to the World Trade Organisation if it does not reverse its decision to impose up to 80% tariffs, or, $1 billion in barley exports.

The tariffs follow an Australian and US lead push for a global coronavirus investigation from which originated in China's wet markets. There is a motion to establish an independent inquiry into COVID-19 is expected to pass the World Health Assembly on Tuesday night after the European Union and Australia secured the support of more than 120 other countries.

Then, when we look at the yuan and China's trade war with the US, the greenback is likely to remain in favour. AUD/CNH has rallied to a 78.6% Fibonacci retracement level and to the 2019/2020 prior support level. Should the dollar come back into vogue and trade wars really start to take up the front pages, we would expect to see AUD take the brunt of it with little room for AUD/CNH to go but plenty of downside in AUD/USD below 0.6680.

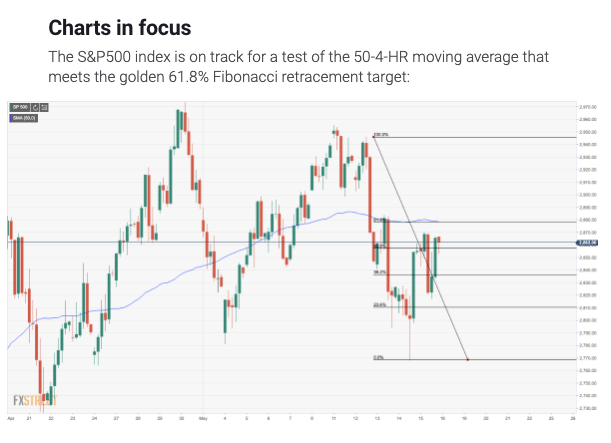

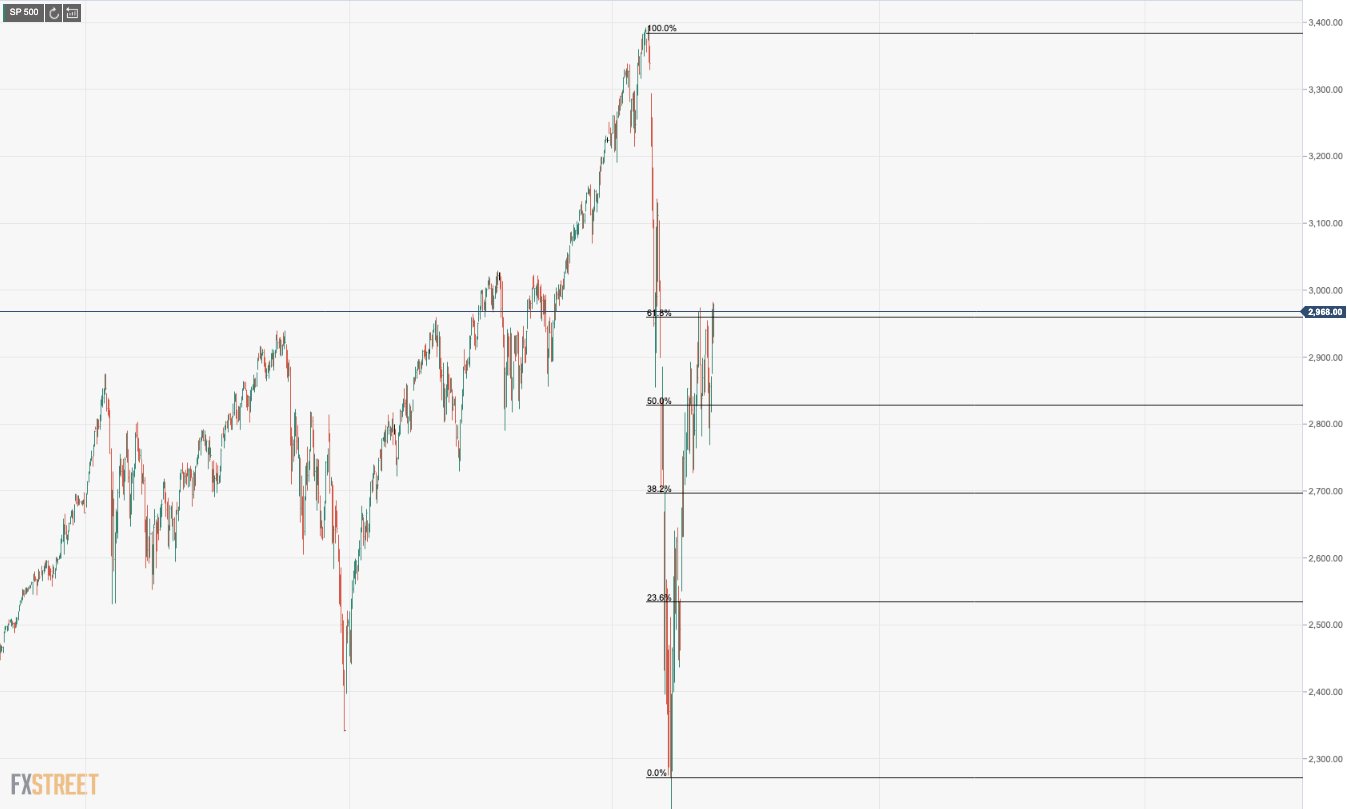

Keeping an eye on US equities and the 61.8% Fibos

"Our sceptical attitude toward this bounce in risk keeps our focus on the AUD. With AUDUSD's persistent correlation to global equities, we think any correction there will also be seen in the FX market," TD Securities argue adds.

At the start of the week, we were looking at the US benchmarks as a guide and the 61.8% Fibonacci retracements:

The market is testing this critical level this week (depending on chart source) and today has been another day where the resistance of the 61.8% is holding up which does not bode well for AUD longs.

AUD/USD levels

Granted, AUD/USD bulls have managed to get above 0.6570 April high and bulls are looking to 0.6665/84 March high and 200-day moving average where a tougher resistance is expected. 0.6910 marks the 2013-2020 resistance line. To the downside, 0.6188 is a key target as being the 38.2% Fibonacci retracement of the latest upside move from the COVID-10 induced 0.55 handle lows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.