-

NYSE: AMC dropped by 4.7% on Friday as meme stocks took a breather.

-

AMC CEO Adam Aron reminds investors that further dilution is coming for AMC’s stock.

-

Meme stocks fall ahead of a key day, according to WallStreetBets users.

Update: AMC missed out on inclusion into the Russell 1000 Index, while its meme rival Gamestop (GME) made the cut. However, both ended Friday in negative territory as the meme stocks took a well earned breather. AMC still remains elevated at $54.06.

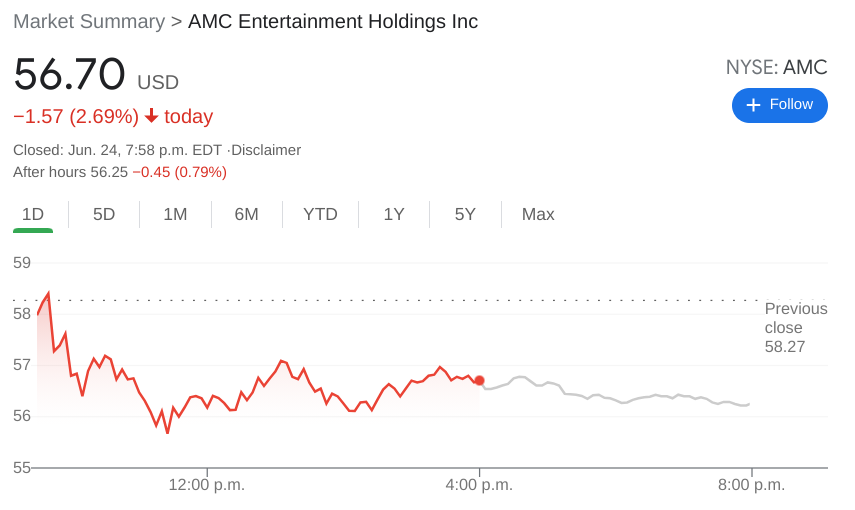

NYSE:AMC is showing more signs that its recent short squeeze is cooling off, especially on Thursday when its daily trading volume was cut in half with only 79 million shares being traded. Shares of AMC fell by 2.7% to close the trading session at $56.70, which is still well above both its 50-day and 200-day moving averages. AMC has seen more red days than green as of late, although retail investors are insisting that they are holding strong, even as other meme stocks with high short interest continue to pop up.

Stay up to speed with hot stocks' news!

CEO Adam Aron was on the wrong end of a message that investors did not want to hear on Thursday. Aron had to remind investors that AMC would be raising more capital by further diluting its stock, a move that the company has already carried out numerous times. Incredibly, AMC now has over 500 million shares outstanding. For reference, GameStop has just over 70 million shares outstanding, which is more of a reasonable number of shares for a small to mid-cap company.

AMC stock forecast

On Friday, there is some expected higher volatility for the markets as GameStop is added to the Russell 1000 index, although AMC did not make the cut this time around. June 25 also marks a +T21 date for GameStop, which has recently been a date where the price spikes for the stock. The +T21 refers to days after settlement transactions, and the pattern has been quite predictable for GameStop. With all that is happening on Friday, GameStop, AMC and other meme stocks could see some higher volume and volatility than normal.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD consolidates near 19-month peak as traders await US PCE Price Index

AUD/USD oscillates in a range below the 0.6900 mark, as traders opt to move to the sidelines ahead of the US PCE Price Index. In the meantime, the RBA's hawkish stance, the optimism led by additional monetary stimulus from China, the prevalent risk-on mood, and a bearish USD continue to act as a tailwind for the pair.

USD/JPY holds above 145.00 after the Tokyo CPI inflation data

The USD/JPY pair attracts some buyers to near 145.20 on Friday during the early Asian session. The pair gains ground near three-week highs after the Tokyo Consumer Price Index. The attention will shift to the US Personal Consumption Expenditures Price Index for August, which is due later on Friday.

Gold price holds steady near record peak; looks to US PCE data from fresh impetus

Gold price consolidates below the all-time high set on Thursday amid overbought conditions on the daily chart and the risk-on mood, though dovish Fed expectations continue to act as a tailwind. Bulls, meanwhile, prefer to wait for the release of the US PCE Price Index before placing fresh bets.

Ethereum investors show bullish bias amid ETF inflows and positive funding rates, exchange reserves pose risk

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates. However, investors may be wary of a potential correction from ETH's rising exchange reserve.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.