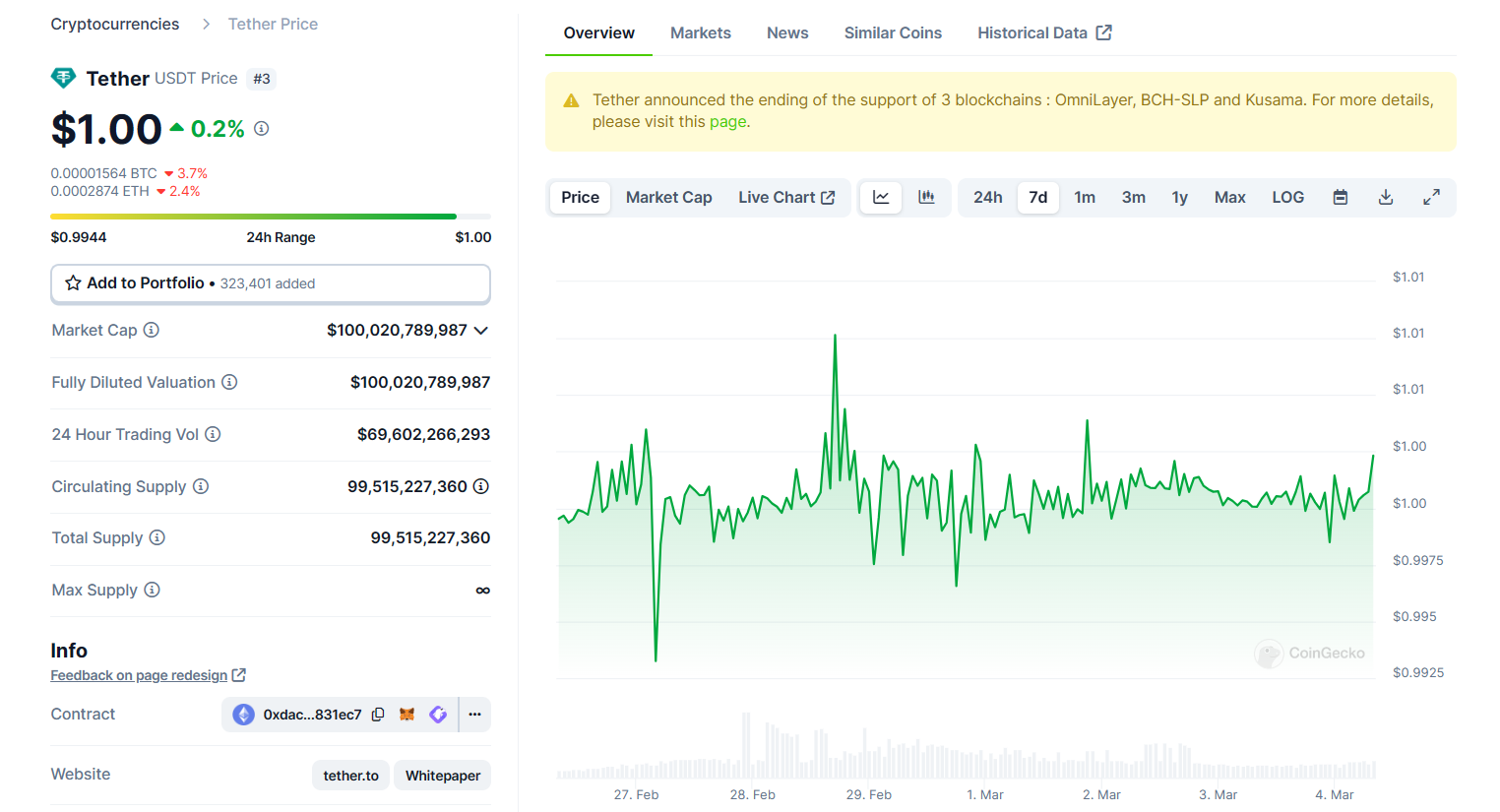

Crypto stablecoin Tether (USDT $1.00) has crossed an all-time high market capitalization of $100 billion, posting a 9% year-to-date growth and furthering the gap between its next-largest rival, USD Coin (USDC $1.00).

USDT momentarily hit its $100 billion milestone on March 4 as the market capitalization fluctuates based on the current price and circulating supply, according to data from CoinGecko.

It’s over $71 billion ahead in market cap compared to its closest stablecoin rival, USDC, issued by Circle, which has also seen its market cap grow this year.

Chart showing USDT market cap growth in the last seven days. Source: CoinGecko

On the other hand, Tether has yet to breach the $100 billion milestone on other data sources, such as CoinMarketCap.

Tether’s market cap places it around par with the British oil and gas titan BP and a little above the e-commerce giant Shopify.

Tether is a cryptocurrency pegged to the price of the United States dollar available on 14 blockchains and protocols, according to its website.

It’s the third-largest cryptocurrency by market capitalization behind Ether (ETH $3,503), and it has grown to play a key role as a blockchain-based option for crypto traders needing a stable asset.

Over the past month, the crypto market has sprung back to a market cap above $2 trillion, with Bitcoin (BTC $65,064) seeing a 50% price increase and notching two-year price highs.

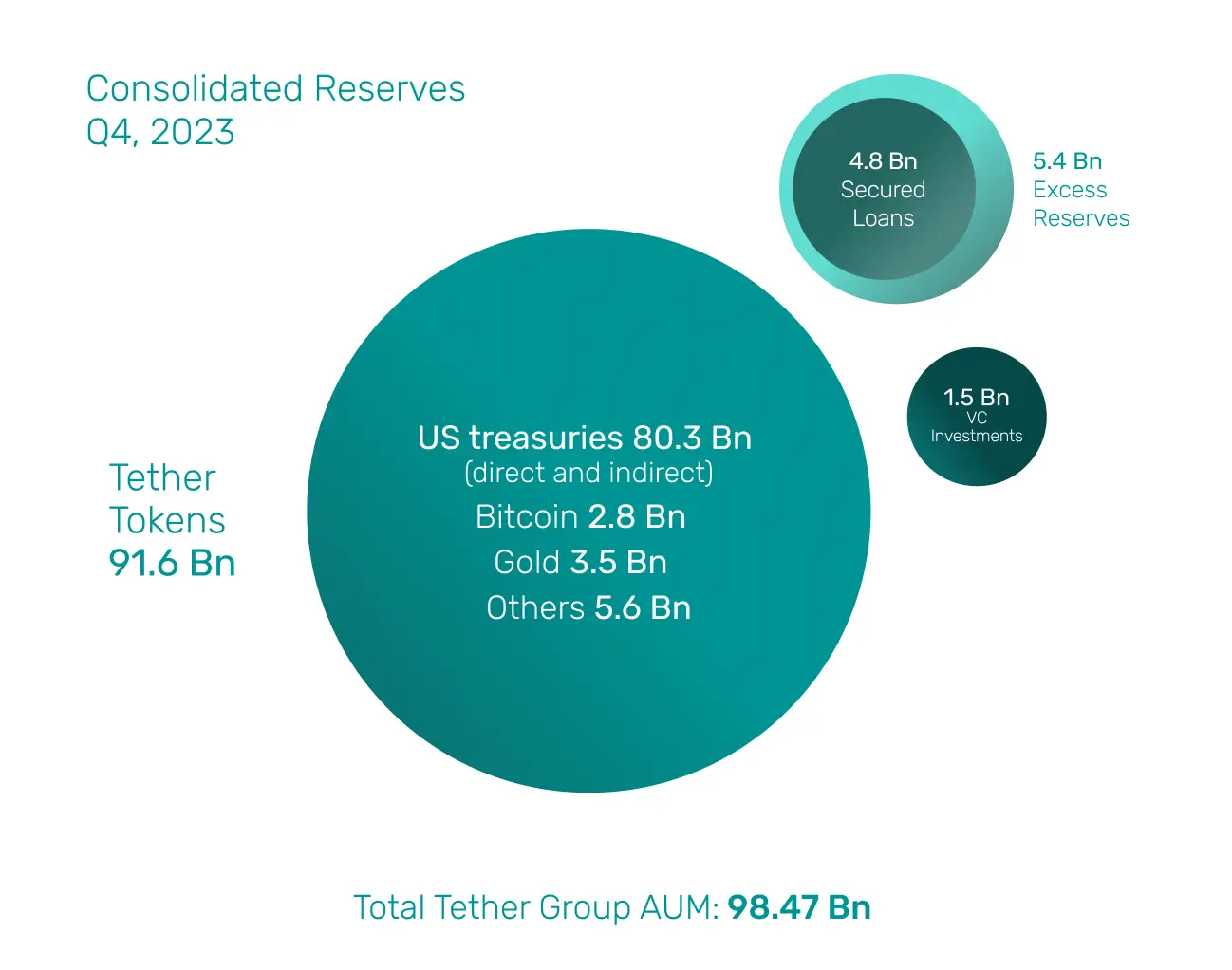

The company that issues the token — also called Tether — claims to back each USDT token 1:1 with its independently audited reserves primarily made up of yield-bearing U.S. Treasury Bills (T-Bills) — a short-term loan given to the U.S. government.

In the fourth quarter of 2023, the company posted a record quarterly profit of $2.85 billion, $1 billion of which came from its T-Bills. Its fourth-quarter report disclosed T-Bills holdings of over $80 billion, and in the past, it claimed to be one of the world’s top buyers of U.S. government debt.

Tether’s Q4 2023 report also said it holds $2.8 billion worth of Bitcoin. Source: Tether

The quality of the assets backing USDT has been a cause of concern in the crypto space, and Tether has made efforts to reduce its exposure to some assets deemed higher risk.

Related: Stablecoins could boost dollar as global reserve currency: Fed governor

In late 2022, Tether pledged that by the end of 2023, it would stop lending out funds from its reserves.

Those plans never eventuated, with Tether having $4.8 billion of loans on its books at the end of 2023, although it’s about $1 billion less than it started the year with. It claims the loans are fully collateralized and promised to cut them to zero in 2024.

Over half of the USDT currently issued is on the Tron blockchain, which a January United Nations report said “has become a preferred choice” for Southeast Asia-based cyber fraud and money launders.

Tether has hit back at the report, claiming the UN failed to mention the company’s law enforcement collaboration and the token’s traceability.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum has lost its “ultra” sound money status, faces key rectangle resistance hurdle

Ethereum is up 0.5% on Thursday following a recent analysis showing that the top altcoin lost its "ultra" sound money narrative. Meanwhile, ETH ETFs recorded net inflows for the first time after nine days of consecutive outflows.

Solana bears dominate market as SunPump has potentially led to less demand for SOL

Solana is down 2.5% on Thursday following bearish signals across its funding rate and total fees captured. SOL's weak performance could also be linked to the declining traction seen in its meme coin generation platform Pump.fun.

AI tokens see narrow gains as Wall Street banks raise price targets on NVDA

AI tokens NEAR, ICP, RENDER and TAO briefly traded in the green on Thursday following Wall Street banks' positivity toward Nvidia's earnings report. While a correction followed, these tokens could rally if NVDA meets expectations.

XRP back above $0.57 even as Ripple traders take $8 million in profits

Ripple (XRP) traders have consistently taken profits on their holdings in the last two weeks, per Santiment data. Once again, traders have grabbed $8.36 million in profit so far on Thursday. Typically, profit-taking negatively influences the asset as it increases the selling pressure.

Bitcoin: Will BTC continue its ongoing decline?

Bitcoin (BTC) trades above $59,000 on Friday, but it has lost 7.5% this week so far after being rejected around the daily resistance of $65,000. The decline is supported by lower demand from the US spot Bitcoin ETFs, which registered a net outflow of $103.8 million, falling Bitcoin's Coinbase Premium Index, and a spike in Network Realized Profit/Loss. However, some investors seem to be taking the chance to buy BTC amid this price dip, as shown by the Exchange Netflow data.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.