- MATIC price did rise to $0.71 during the intra-day trading hours, but broader market cues resulted in a pullback.

- This bullish momentum failing might result in a slowdown in the gradually receding network-wide losses.

- More than 100k investors with 1.3 billion MATIC in losing positions are still waiting for a recovery.

MATIC price has had a rather disappointing day, with the mixed signals from the broader market impacting the altcoin significantly. This most certainly did not sit well with the investors as they were expecting a much larger recovery on the back of Bitcoin breaching a critical barrier.

MATIC price whipsaws

MATIC price failed to hold on to a 6.5% rally due to the broader market cues beating down on the digital asset. Most of the crypto market enjoyed green candlesticks over the past two days owing to the Bitcoin price crossing the $30,000 mark. The same bullishness was expected by Polygon investors, but they would be disappointed as no such gains materialized for them.

The layer-2 token whipsawed and failed to close above the $0.70 mark, trading at $0.66 at the time of writing. The altcoin had only recovered by a little over 13% over the week, and the slowdown in its rise, naturally, will have affected MATIC-holders' profits.

MATIC/USD 1-day chart

Since mid-June, ‘network-wide realized losses’, an on-chain metric, were on a decline giving room for eventual profits. In the past 24 hours, less than a million MATIC tokens faced losses and had the token achieved today’s 6.5% recovery, these losses would have flipped into profits.

MATIC network-wide losses

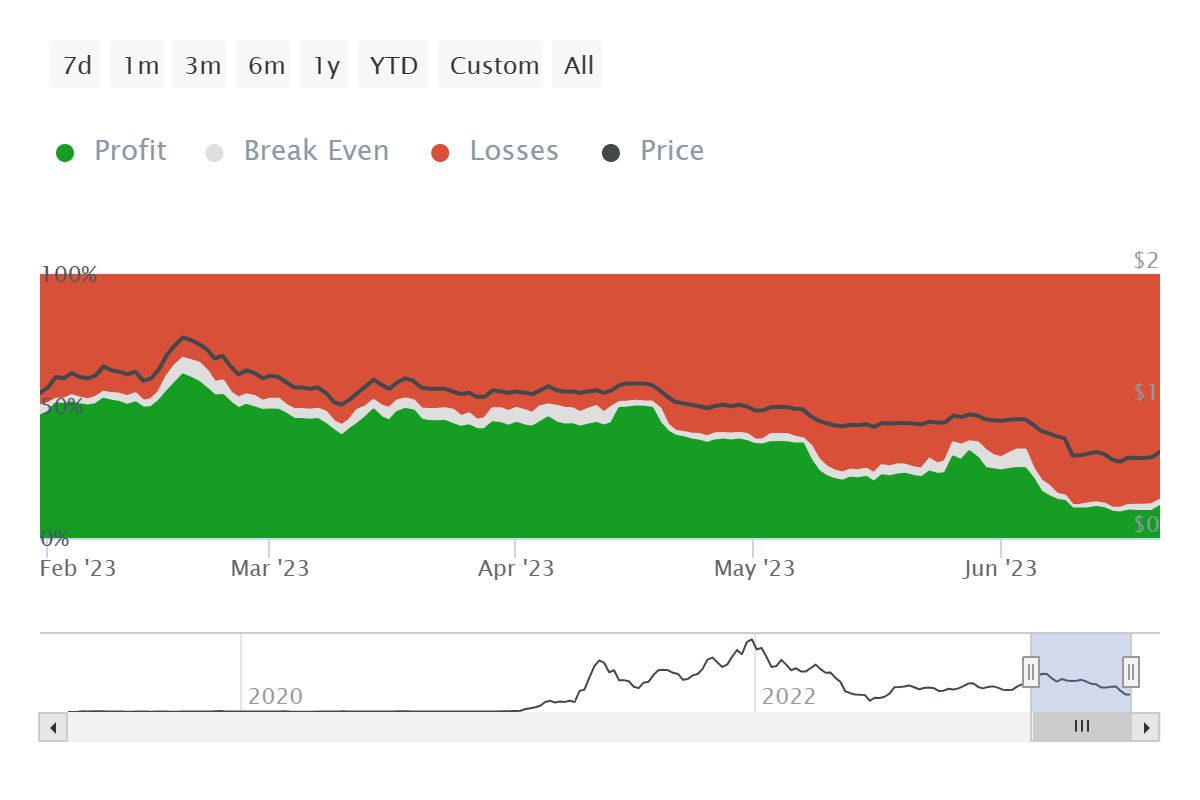

However, the failure to do so has left nearly 100k addresses in anguish since these investors became the victim of the early June crash. Collectively they hold about 1.3 billion MATIC tokens worth $858 million, and their losses increase the concentration of investors that are currently underwater.

Even if MATIC price is not successful in leading the recovery, Polygon is successful in leading the list of most loss-bearing token holders as their concentration has risen to 87%, amounting to nearly half a million addresses.

MATIC investors in loss

If MATIC price does not begin recovering from its recent crash soon, a sell-off can be expected from these addresses. On the other hand, even if the altcoin does recover, MATIC holders could still opt to sell to break even and minimize the potential of future losses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

Ethereum could retest $2,707 resistance following increasing ETF inflows and uptrend in funding rates

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and function similarly to a traditional stablecoin.

Crypto Today: Bitcoin, Ethereum and XRP trade in the green as crypto lost to hacks and fraud plunge by 40%

Bitcoin has moved above the $65,000 psychological level after flipping a key resistance, XRP sees a slight 1% gain. Ethereum trades around $2,650, up over 3% in the past 24 hours, as it attempts to tackle the $2,707 key resistance.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

%20[21.02.39,%2022%20Jun,%202023]-638230514351719794.png)