- Loopring price is trading at $0.221, rising by a little over 6% after hitting a two-month low at the beginning of the month.

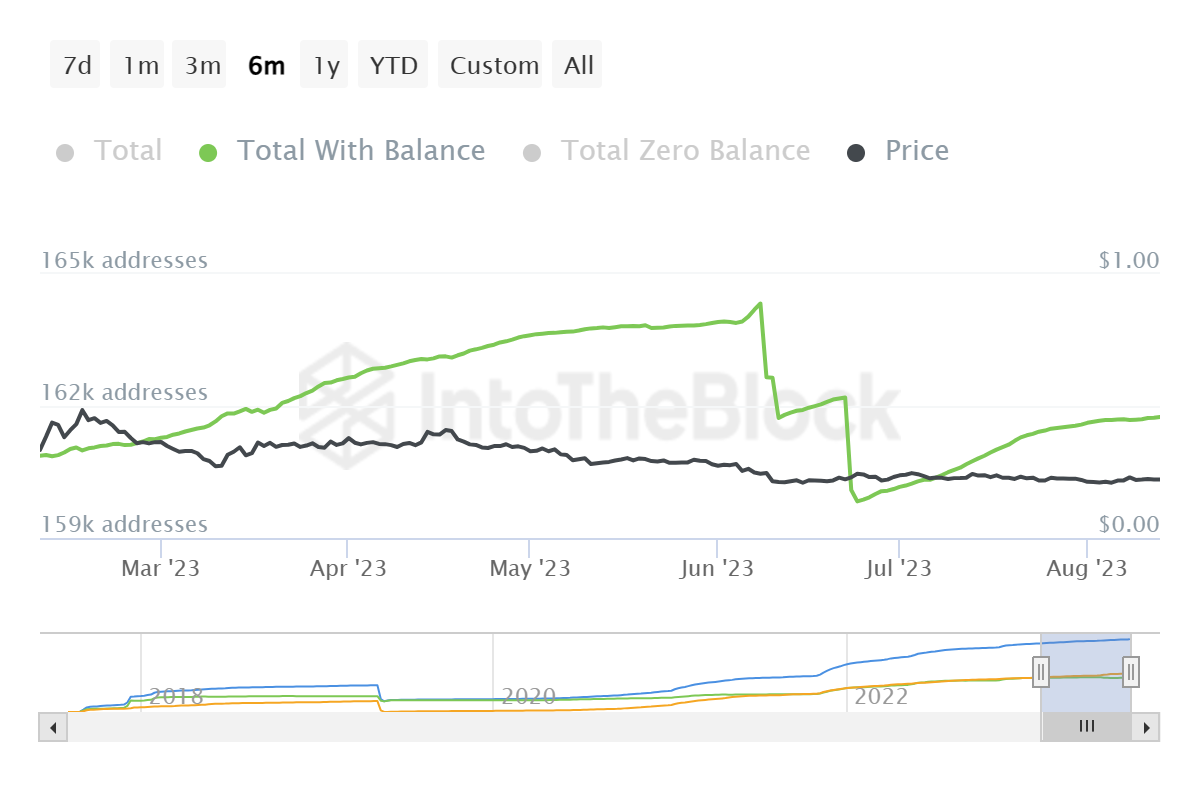

- The network lost over 5k of the total investors in June, of which over 2k have returned since, touching 161k.

- LRC holders have been pulling back on selling as active deposits hit an eight-month low in the past 24 hours, last visiting these levels in December 2022.

Loopring price was saved from observing considerable losses earlier this month as the crypto market’s volatility slowed. The altcoin bounced back from a crucial support level as it also continues to bring back the investors it lost about two months ago.

Loopring price recovery likely

Loopring price trading at $0.221 hit a two-month low of $0.208, bouncing back from the support level at that mark. This critical support line was last tested in May this year and in December 2022 as a resistance level. After recovering from this low at the beginning of this month, LRC has risen by a little over 6% but continues to trade under the 50-, 100- and 200-day Exponential Moving Averages (EMA).

While the momentum indicators - Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) - highlight a potential bullish move, Loopring price needs to stay above the critical support level. A decline below this point would result in the cryptocurrency hitting year-to-date lows of $0.187.

LRC/USD 1-day chart

However, the chances of the latter occurring are faint since LRC holders are acting rather positively. The first sign is that the network has noted a comeback of about 50% of the investors it lost in June. Back then, more than 5k investors exited the network, and since then, over 2.5k have returned, bringing the total to 161k.

Loopring total addresses holding LRC

Not only this, the investors that were present all this while are also holding back on selling their holdings. This is evident from the decline observed in the active deposits, which hit an eight-month low this week.

Loopring active deposits

With selling falling to December 2022 levels, Loopring price has an opportunity to capitalize on the bounce back and breach to flip the EMAs into a support floor. This would support a recovery to June highs of $0.258.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

Ethereum could retest $2,707 resistance following increasing ETF inflows and uptrend in funding rates

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and function similarly to a traditional stablecoin.

Crypto Today: Bitcoin, Ethereum and XRP trade in the green as crypto lost to hacks and fraud plunge by 40%

Bitcoin has moved above the $65,000 psychological level after flipping a key resistance, XRP sees a slight 1% gain. Ethereum trades around $2,650, up over 3% in the past 24 hours, as it attempts to tackle the $2,707 key resistance.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

%20[07.06.08,%2015%20Aug,%202023]-638276639179955336.png)