- Coinshares’ weekly report highlights the total amount of money moved around by these institutions has been consistently disappointing.

- Since the beginning of this year, Ethereum as an institutional asset has been generating mostly outflows.

- Trading above $1,300, ETH is still testing the lower lows on the charts.

The overall state of the market has constantly been fluctuating, making it difficult to ascertain whether, going forward, investors should experience another bullish bout or sink into a bearish run. This unsurety has also affected the bigger cohorts, which usually hold a significant influence on the market - the institutional investors.

Keeping it to themselves

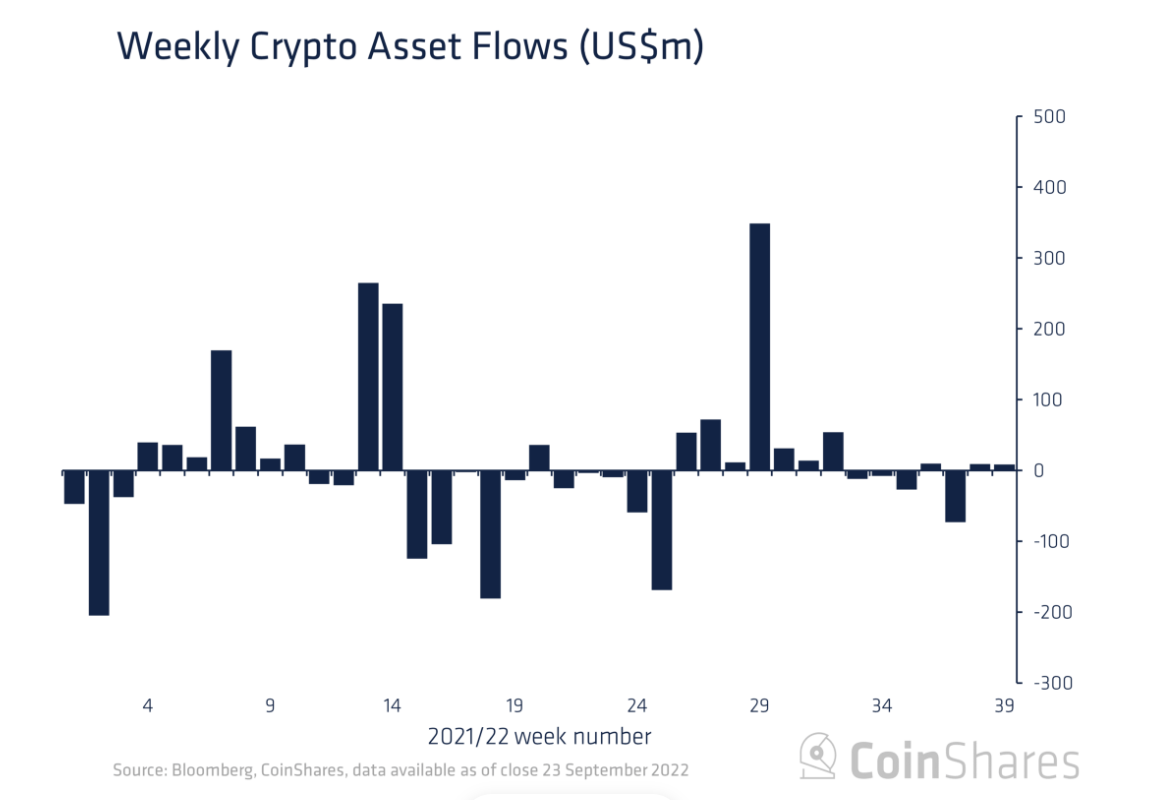

Since the beginning of August this year, institutional investors have been noted to move as little money as possible. In the last seven weeks, pretty much every week has observed minimal inflows and outflows, with the exception of one week.

The beginning of September noted significantly higher outflows, but still remaining within the $100 million mark.

The most recent week ending September 23 witnessed inflows amounting to $8.3 million, evincing lukewarm interest at their end.

Weekly overall flows

Since the market is not providing profits, inflows will remain at a low, and the lack of volatility is keeping this streak active, making it a difficult cycle to escape from.

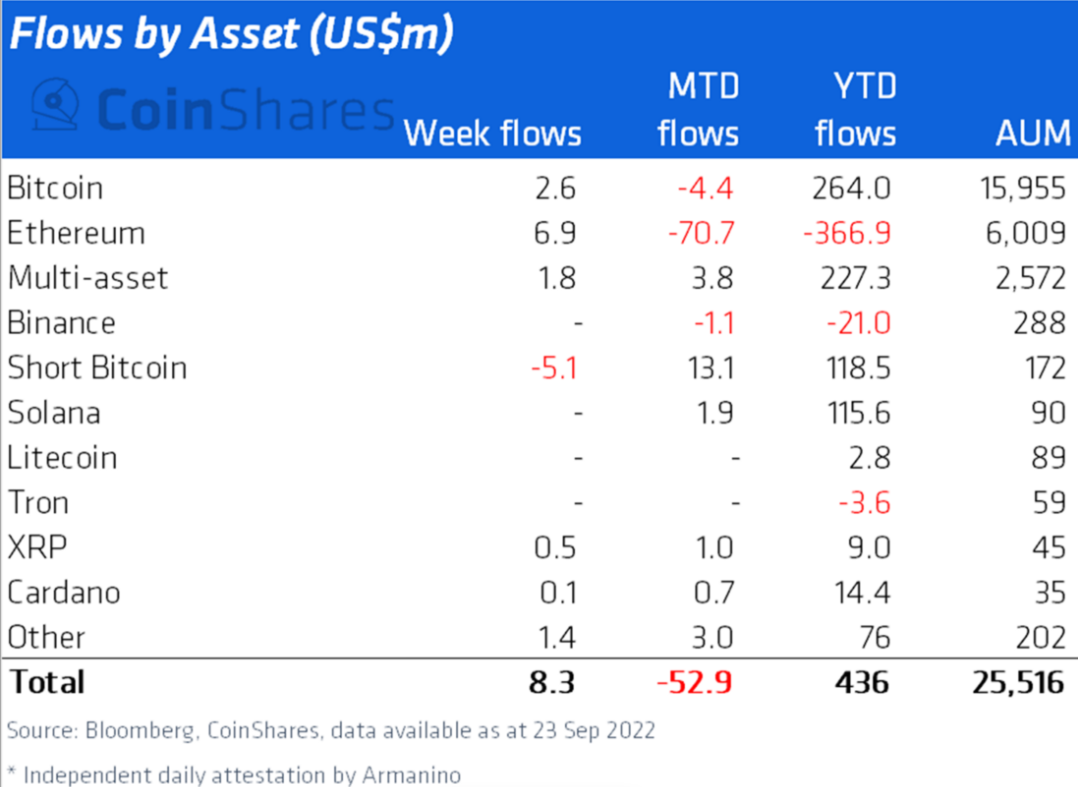

Furthermore, even among the digital asset investment products that are registering inflows or outflows, Ethereum-based products have been the most volatile.

Since the beginning of this year, ETH investment products have noted the highest outflows amounting to a little under $367 million, with $70.7 million of the same coming just from this month.

Money flows by the asset type

Despite recording positive flows worth $7 million last week, ETH still leads the outflows list, followed by Bitcoin at a meager $4.4 million.

However, it isn’t just the inflows or outflows that have been disappointing investors, the price action too has been severely disappointing.

Ethereum falls back down

Following the Merge, the broader market’s bearishness hit ETH’s volatile conditions, resulting in a 30% drop in the span of 10 days. ETH has been in a minor uptrend for the last ten days.

Ethereum 24-hour price chart

Ethereum 24-hour price chart

Historically this period has been known to last anywhere between 20 to 25 days, following which ETH ends up noting a sharp fall and repeating the same price couple of days later.

Thus if ETH can sustain this uptrend, ETH’s price could close above the $1,400 mark, bringing it closer to reclaiming the support of the 100-days SMA (Simple Moving Average) (blue).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum has lost its “ultra” sound money status, faces key rectangle resistance hurdle

Ethereum is up 0.5% on Thursday following a recent analysis showing that the top altcoin lost its "ultra" sound money narrative. Meanwhile, ETH ETFs recorded net inflows for the first time after nine days of consecutive outflows.

Solana bears dominate market as SunPump has potentially led to less demand for SOL

Solana is down 2.5% on Thursday following bearish signals across its funding rate and total fees captured. SOL's weak performance could also be linked to the declining traction seen in its meme coin generation platform Pump.fun.

AI tokens see narrow gains as Wall Street banks raise price targets on NVDA

AI tokens NEAR, ICP, RENDER and TAO briefly traded in the green on Thursday following Wall Street banks' positivity toward Nvidia's earnings report. While a correction followed, these tokens could rally if NVDA meets expectations.

XRP back above $0.57 even as Ripple traders take $8 million in profits

Ripple (XRP) traders have consistently taken profits on their holdings in the last two weeks, per Santiment data. Once again, traders have grabbed $8.36 million in profit so far on Thursday. Typically, profit-taking negatively influences the asset as it increases the selling pressure.

Bitcoin: Will BTC continue its ongoing decline?

Bitcoin (BTC) trades above $59,000 on Friday, but it has lost 7.5% this week so far after being rejected around the daily resistance of $65,000. The decline is supported by lower demand from the US spot Bitcoin ETFs, which registered a net outflow of $103.8 million, falling Bitcoin's Coinbase Premium Index, and a spike in Network Realized Profit/Loss. However, some investors seem to be taking the chance to buy BTC amid this price dip, as shown by the Exchange Netflow data.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.