The new week has begun with a neutral mood on the cryptocurrency market as some digital assets are in the red zone, while others are rising.

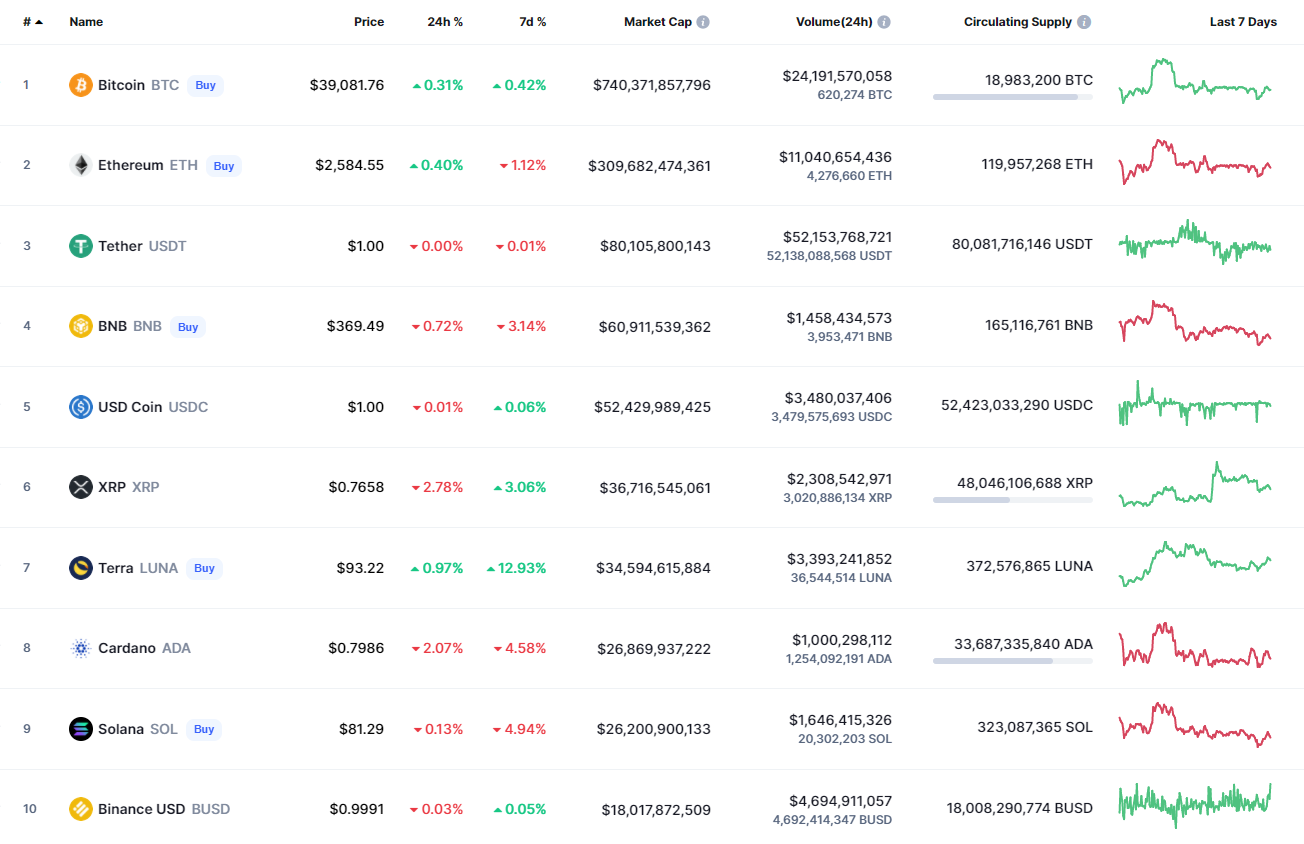

Top coins by CoinMarketCap

BTC/USD

The rate of Bitcoin (BTC) has risen by 0.16% over the last 24 hours.

BTC/USD chart by TradingView

Despite the slight rise, the main crypto is trading in the zone of the most liquidity, accumulating power for a further sharp move. Such a statement is confirmed by the declining trading volume, which means that none of the sides is ready for either growth or decline.

However, if buyers manage to get to the vital level of $40,000, there is a possibility of seeing the test of the resistance shortly.

Bitcoin is trading at $39,092 at press time.

XRP/USD

XRP is the biggest loser from the list today, falling by almost 3% since yesterday.

XRP/USD chart by TradingView

XRP is trading similarly to Bitcoin (BTC) as sideways trading remains the more likely scenario until the end of the month. From another point of view, the buying trading volume has started to grow, which means that bulls are not ready to give up.

If the daily candle closes around the $0.80 mark, the rise may continue to the blue line ($0.91) until the end of the month.

XRP is trading at $0.7645 at press time.

ADA/USD

Cardano (ADA) has followed the decline of XRP, going down by 2.12%.

ADA/USD chart by Trading View

Cardano (ADA) is looking worse than XRP as the rate is approaching the support level at $0.709. Thus, the buying trading volume is also going down, which means that bulls are not willing to buy the altcoin at the current levels. If the bears' pressure continues and the rate closes below the support, one can expect the sharp drop soon.

ADA is trading at $0.797 at press time.

BNB/USD

Binance Coin (BNB) has declined by 0.75% over the last days.

BNB/USD chart by TradingView

Binance Coin (BNB) is located below the zone of the most liquidity at $375. Until it is below it, bears remain more powerful than bulls. If buyers want to seize the initiative and start the short-term rise, the native exchange coin should come back to the area around $400 on the daily chart. If they fail to do that, the decline may lead the rate to the support level within the next few days.

BNB is trading at $368 at press time.

Any financial and market information given on U.Today is written for informational purposes only. Conduct your own research by contacting financial experts before making any investment decisions.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.