- ETH/USD recovery stalled as the coin failed to stay above $130.00.

- PlusToken team started selling ETH coins.

Fasten your seatbelts, ladies and gentlemen, bit Ethereun dump may be just around the corner.

According to the Wale Alert service (@whale_alert), 789,525 ETH tokens to the tune of about $100 million has been transferred from PlusToken to the unknown wallet.

If history any guide, this transaction may become a trigger for ETH collapse with the first aim at $120.00, followed by the recent low of $116.40, this is the lowest level since February 2019. Once it is cleared, the sell-off may continue towards a psychological $100.00. The broader market will also be affected, but ETH will feel most of the heat.

Earlier, the FXStreet reported that the founders PlusToken, one of the largest cryptocurrency scams, had started to cash out their loot via OTC desks through Huobi. They used mixers to cover-up their tracks, but the experts from Chainalysis managed to trace the transactions.

When the PlusToken team sold 25, 000 BTC, Bitcoin crashed below $7,000. However, the company also received investments in ETH, which means that the second largest coin may suffer the same fate when they start dumping ETH.

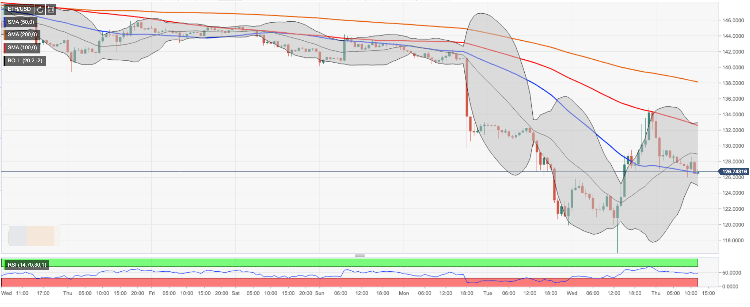

ETH/USD: technical picture

ETH/USD jumped to $134.00 during early Asian hours amid global recovery on the cryptocurrency market. However, the coin hails to hold the ground and retreated to $126.60 by the time of writing. ETH/USD has lost over 5% of its value since the beginning of Thursday.

On the intraday chart, ETH/USD has come close to SMA50 (Simple Moving Average) 1-hour ($126.50). This barrier may slow down the sell-off; however, a sustainable move below this support will push the price towards $125.00 (the lower line of 1-hour Bollinger Band) and $121.00.

On the upside, the initial resistance awaits us on approach to $130.00. An even stronger barrier is created by a combination of SMA100 1-hour and the upper line of 1-hour Bollinger Band at $131.50. Once it is cleared, the recovery may be extended towards the recent high of $134.00/

ETH/USD, the daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

Ethereum could retest $2,707 resistance following increasing ETF inflows and uptrend in funding rates

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and function similarly to a traditional stablecoin.

Crypto Today: Bitcoin, Ethereum and XRP trade in the green as crypto lost to hacks and fraud plunge by 40%

Bitcoin has moved above the $65,000 psychological level after flipping a key resistance, XRP sees a slight 1% gain. Ethereum trades around $2,650, up over 3% in the past 24 hours, as it attempts to tackle the $2,707 key resistance.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.