Bitcoin jumped to a fresh five-month high early Monday, extending the two-week price rally even though Friday’s weak U.S. jobs report failed to dampen expectations for Federal Reserve (Fed) tapering in November. The market also turned a blind eye toward the data showing supposedly bearish positioning by leveraged funds in the futures market.

The cryptocurrency rose to $57,000 during the early European hours, hitting the highest since mid-May, according to CoinDesk 20 data. Prices rose 13% in the week ended Oct. 10, registering its second straight double-digit weekly gain.

Bitcoin’s continued resilience to usually bearish macro factors could be attributed to improved prospects of the U.S. approving a futures-based bitcoin exchange-traded fund (ETF) this month.

“The positive sentiment in BTC has been partially driven by the expectations of a potential approval for a futures-based Bitcoin ETF in the near future. Other factors contributing to the rise include continued inflows from institutional investors and SEC chairman Gary Gensler telling Congress that the agency has no plans to ban crypto,” Coinbase Institutional said in its weekly email.

The U.S. jobs data, which released on Friday, showed Nonfarm payrolls increased by 194,000 in September, compared to the Dow Jones estimate of 500,000. However, the jobless rate dropped to an 18-month low of 4.9%, keeping the Fed on track to begin unwinding the crisis-era stimulus from November and lift interest rates by mid-2022.

“Friday’s headline NFP jobs miss has done little to dampen Fed tapering/tightening expectations. For example, Dec 2023 Euro-dollar futures continue to break lower, consistent with the recent trend of the market re-pricing the U.S. interest rate curve towards Fed projections in the September Dot Plots. This is dollar bullish,” ING analysts noted in the daily market analysis.

Recent reports of Soros Foundation gaining exposure to bitcoin and U.S. Senator Cynthia Lummis’s disclosure of bitcoin purchases may have also added to the bullish sentiment.

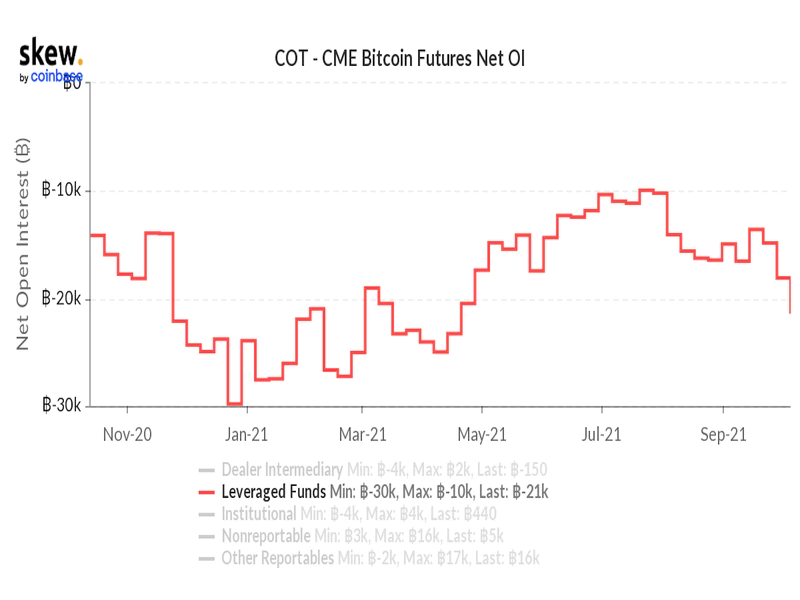

The Commitments of Traders (COT) report published by the U.S. Commodity Futures Trading Commission (CFTC) on Friday revealed that hedge funds and various types of money managers that, in effect, borrow money to trade – increased their short positions from 18,000 to 22,000 in the week ended Oct. 5.

The uptick does not necessarily represent outright short positioning and could have stemmed from renewed interest in cash and carry arbitrage strategy. The method involves buying the asset on the spot market and taking a sell position in the futures market when the latter is trading at a significant premium to the spot price. Futures prices converge with spot prices on the expiry day, giving a risk-free return to a carry trader.

The premium on the CME-based front-month futures rose from an annualized 1.5% to nearly 12% in the seven days to Oct. 5, according to data provided by Skew.

While bitcoin appears to be on a strong footing, some investors anticipate a temporary price pullback. The one-week put-call skew has turned positive, reflecting demand for short-term downside protection or put options.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

Ethereum could retest $2,707 resistance following increasing ETF inflows and uptrend in funding rates

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) and function similarly to a traditional stablecoin.

Crypto Today: Bitcoin, Ethereum and XRP trade in the green as crypto lost to hacks and fraud plunge by 40%

Bitcoin has moved above the $65,000 psychological level after flipping a key resistance, XRP sees a slight 1% gain. Ethereum trades around $2,650, up over 3% in the past 24 hours, as it attempts to tackle the $2,707 key resistance.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.