Unusually high liquidations on some altcoin futures led by Big Time’s BIGTIME and Ordi Protocol’s ORDI tokens created over $250 million in total altcoin liquidations in the past 24 hours, showcasing the inherent and sudden volatility of the sector.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

These figures were without the liquidations of futures trading bitcoin (BTC) and ether (ETH), which topped the charts at a cumulative $85 million in evaporated bets.

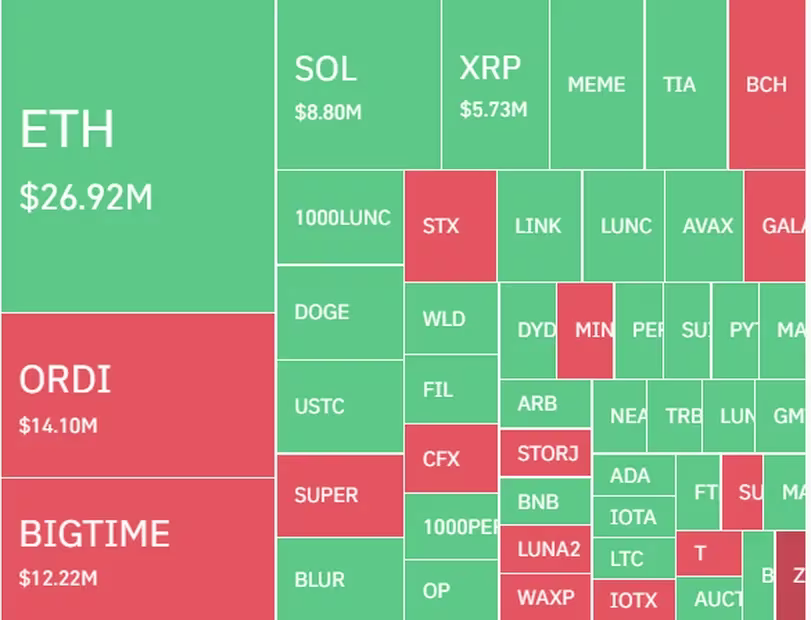

Some $15 million in ORDI bets were liquidated, followed by $12 million on BIGTIME. These consisted of both longs, or bets on higher prices, and shorts, or bets against. Prices of both these tokens whipsawed in the past 24 hours, impacting traders on either side.

(Coinglass)

Demand for Bitcoin-linked tokens has created hype for ORDI, which is tied to Bitcoin’s ecosystem – with the tokens gaining 580% in the past month. Meanwhile, an ongoing narrative for crypto gaming platforms has benefited BIGTIME holders, who have gained nearly 400% since the start of November.

Traders of Celestia’s TIA and Memeland’s MEME – both tokens were issued last month – lost some $10 million.

Elsewhere, bets on tokens tied to Terra’s once-titan ecosystem soured, with traders of LUNC, USTC and LUNA losing some $11 million. Prices of these tokens surged up to 70% on Monday on various catalysts, as CoinDesk reported.

Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Ethereum has lost its “ultra” sound money status, faces key rectangle resistance hurdle

Ethereum is up 0.5% on Thursday following a recent analysis showing that the top altcoin lost its "ultra" sound money narrative. Meanwhile, ETH ETFs recorded net inflows for the first time after nine days of consecutive outflows.

Solana bears dominate market as SunPump has potentially led to less demand for SOL

Solana is down 2.5% on Thursday following bearish signals across its funding rate and total fees captured. SOL's weak performance could also be linked to the declining traction seen in its meme coin generation platform Pump.fun.

AI tokens see narrow gains as Wall Street banks raise price targets on NVDA

AI tokens NEAR, ICP, RENDER and TAO briefly traded in the green on Thursday following Wall Street banks' positivity toward Nvidia's earnings report. While a correction followed, these tokens could rally if NVDA meets expectations.

XRP back above $0.57 even as Ripple traders take $8 million in profits

Ripple (XRP) traders have consistently taken profits on their holdings in the last two weeks, per Santiment data. Once again, traders have grabbed $8.36 million in profit so far on Thursday. Typically, profit-taking negatively influences the asset as it increases the selling pressure.

Bitcoin: Will BTC continue its ongoing decline?

Bitcoin (BTC) trades above $59,000 on Friday, but it has lost 7.5% this week so far after being rejected around the daily resistance of $65,000. The decline is supported by lower demand from the US spot Bitcoin ETFs, which registered a net outflow of $103.8 million, falling Bitcoin's Coinbase Premium Index, and a spike in Network Realized Profit/Loss. However, some investors seem to be taking the chance to buy BTC amid this price dip, as shown by the Exchange Netflow data.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.