USDJPY rose to three-week high (146.49) and subsequently fell over three full figures on Friday, on speculations about new prime minister’s support to BOJ’s further policy tightening, which was seen as a violation of central bank’s independence, initially weakening yen and then sparking strong rally after news proved false.

Yen strengthened more after US data showed moderate increase in consumer spending in August, while inflation continued to slow, adding to expectations for another Fed outsized rate cut (bets are currently 50-50).

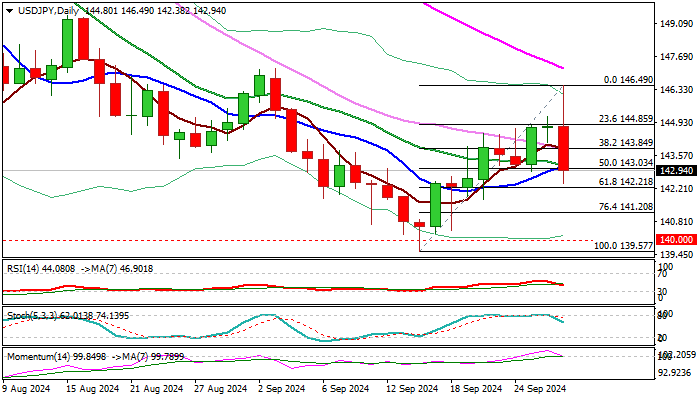

Technical structure is weakening on daily chart as falling 14-d momentum is cracking the centreline and about to break into negative territory, MA’s returned to full bearish setup, and a double bull-trap above 144.82 (Fibo 23.6% of 161.80/139.57).

Friday’s large bearish daily candle with long upper wick, to weigh on near-term action, along with falling and thickening daily cloud, which stays above the price.

Daily close below 143.00 zone (broken 50% of 139.57/146.49 /10DMA) to boost bearish signal and keep fresh bears firmly in play for extension through 142.21 (Fibo 61.8%) and 141.68 (Aug 5 spike low).

Res: 143.16; 143.84; 144.02; 144.85

Sup: 142.21; 142.00; 141.68; 141.20

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD nears 1.1200 after US PCE inflation data

EUR/USD approaches 1.1200 following generally softer-than-anticipated US inflation-related figures. The pair lacks momentum amid tepid European data undermining demand for the Euro. Still, optimism weighs on the USD.

GBP/USD battles the 1.3400 level for a definitive bullish breakout

GBP/USD advances modestly beyond the 1.3400 level after US PCE inflation data showed price pressures continued to recede in August. Sterling Pound aims for fresh yearly highs beyond the 1.3433 peak posted earlier this week.

Gold hovers around $2,670 as US Dollar resumes decline

Gold price retains its bullish bias near fresh record highs, as demand for the US Dollar remains subdued following US PCE inflation figures. The strong momentum around stocks limits demand for the safe-haven metal.

Week ahead – NFP on tap amid bets of another bold Fed rate cut

Investors see decent chance of another 50bps cut in November. Fed speakers, ISM PMIs and NFP to shape rate cut bets. Eurozone CPI data awaited amid bets for more ECB cuts. China PMIs and BoJ Summary of Opinions also on tap.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.