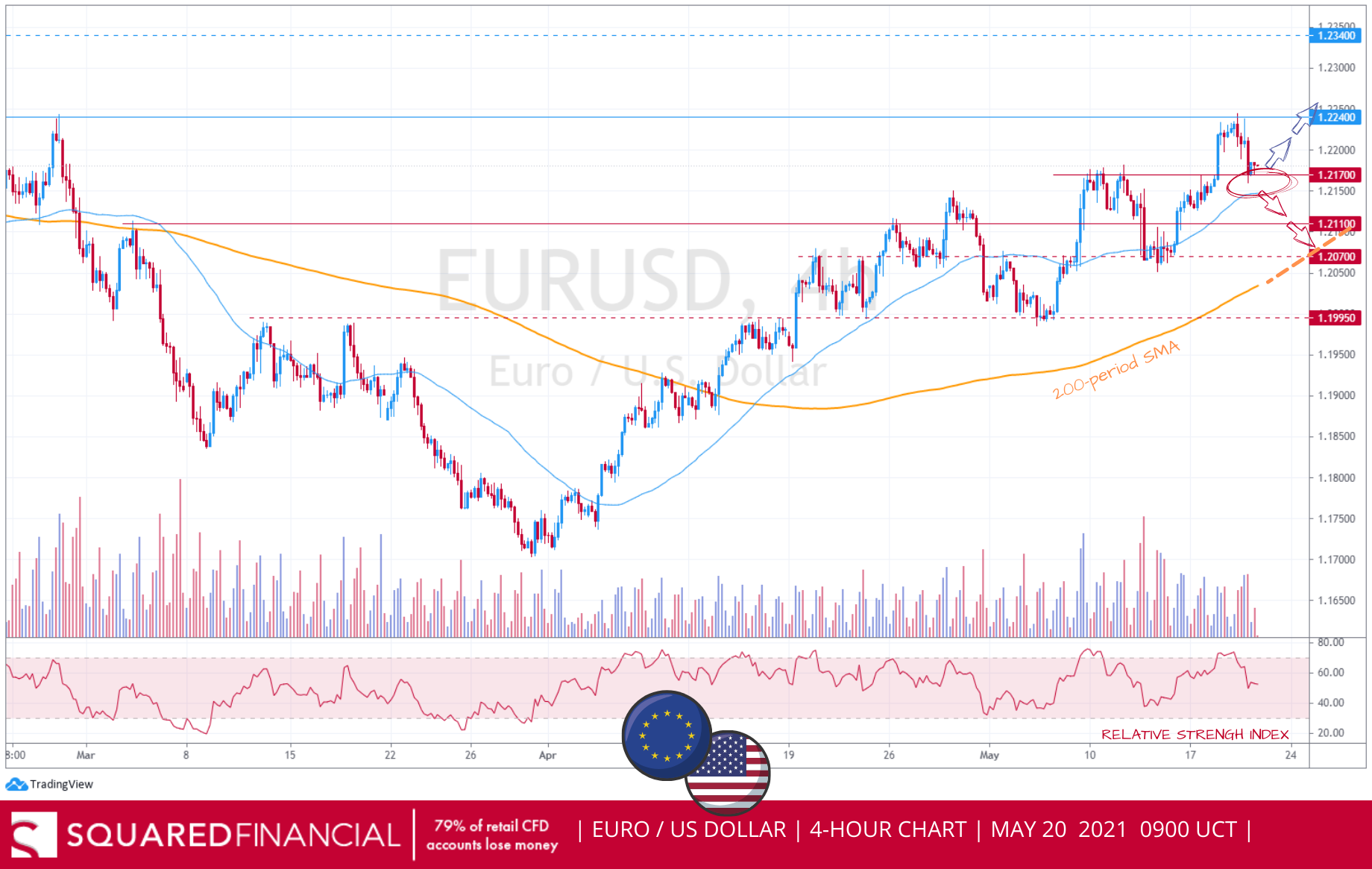

EUR/USD

The Euro hit our support and target at 1.2170 pressured by firming US Treasury yields and by an acceleration in inflation in the eurozone. However, the main trend is still up, and therefore we expect upside price action to resume. Unless the EURUSD moves below the 50-period moving average, triggering further declines to the 200-period moving average as next key support, ahead of US jobless claims figures due out later today.

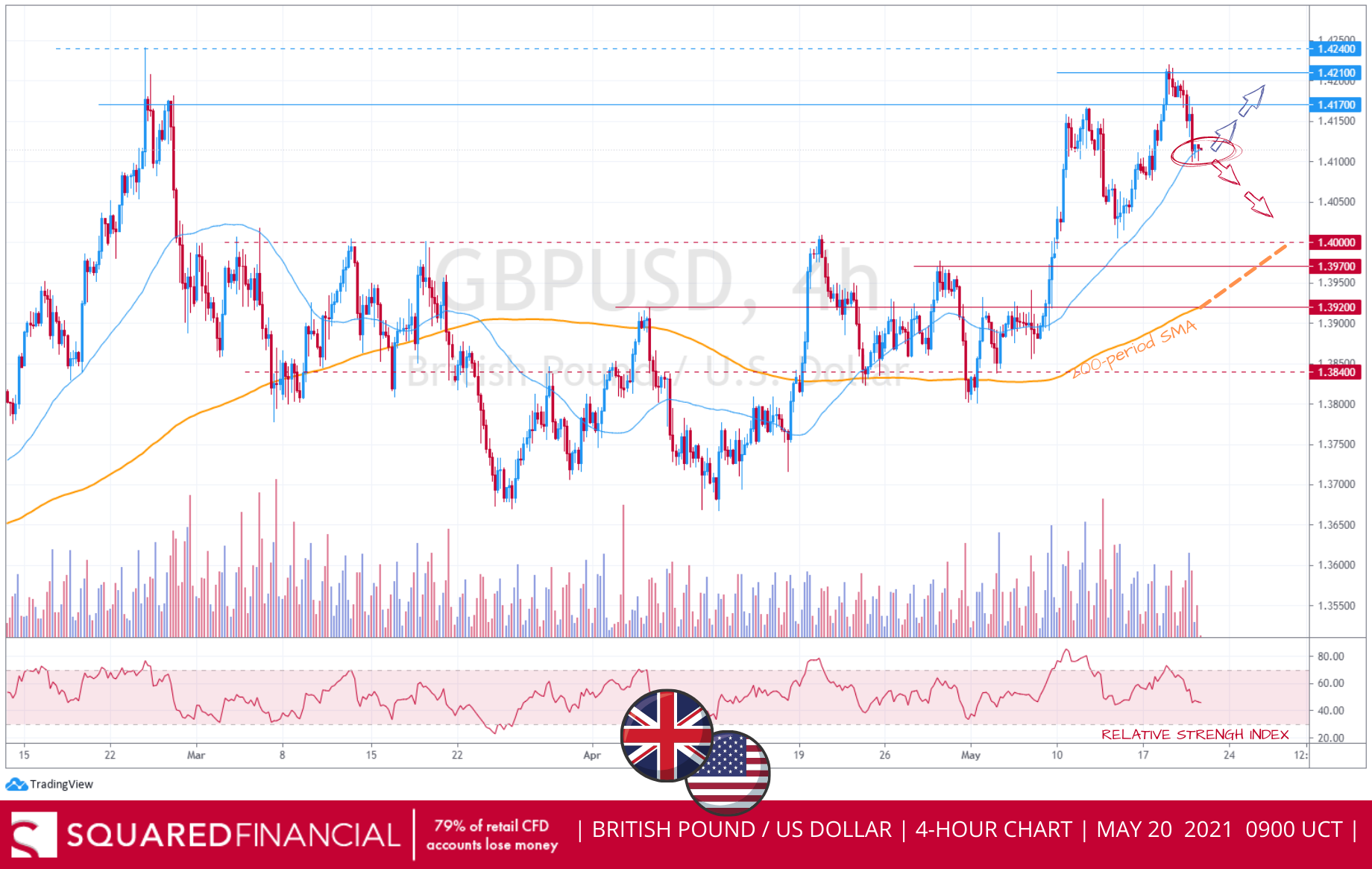

GBP/USD

A hawkish surprise from the FOMC meeting minutes provided modest gains in US bond yields and strengthening of the US dollar which in turn triggered some profit-booking for GBPUSD despite stronger than expected UK inflation figures. However, the downside remains cushioned, at least for the time being, by the 50-period moving average, indicating a positive move for today. Otherwise, a break below the 50-period SMA will trigger another round of selling for Sterling, with the 200-period SMA around 1.40 as next key support level.

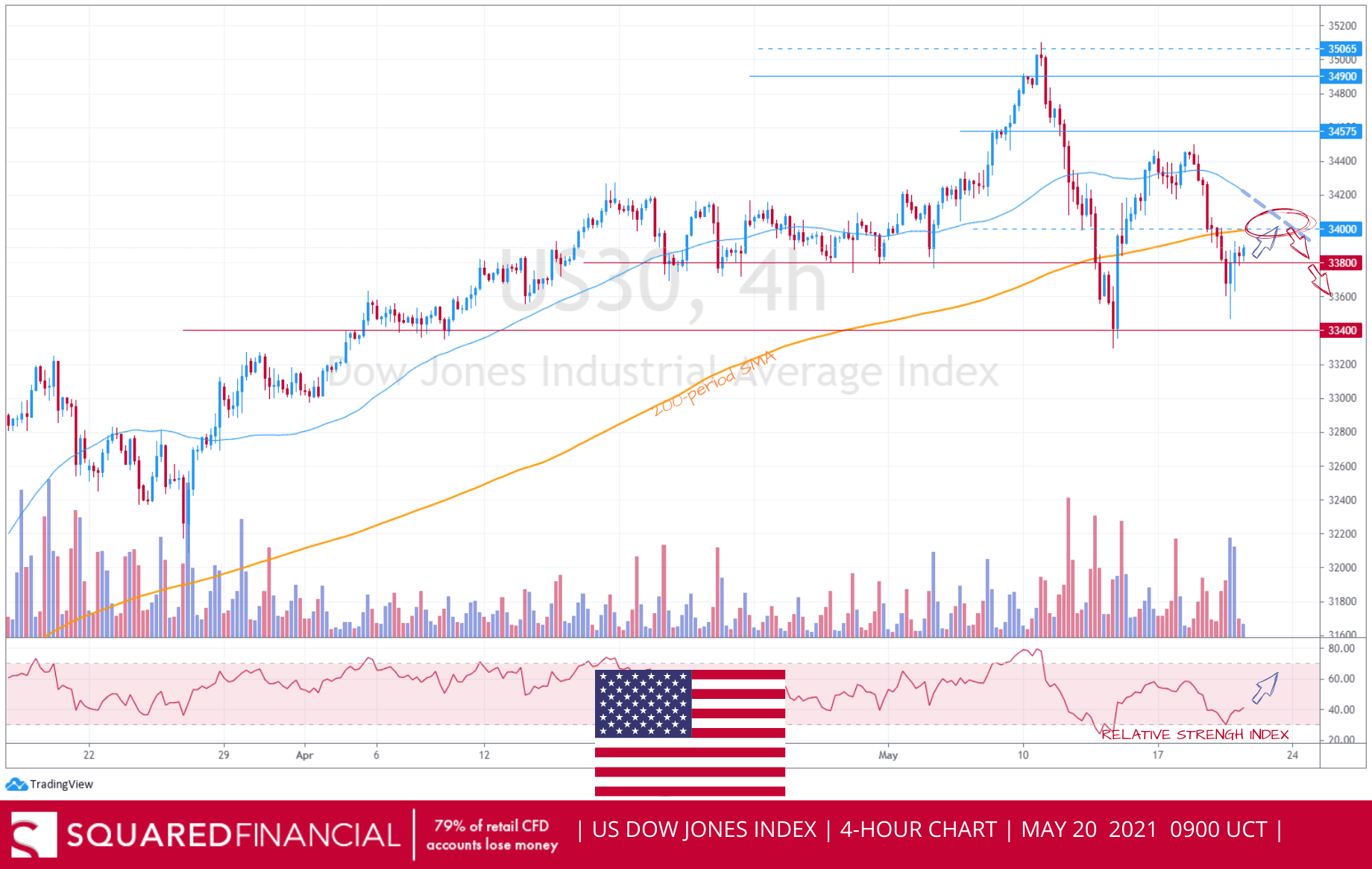

Dow Jones

The recent price volatility that started with the weak NFP number almost 10 days ago coupled with the threat of an “out-of-hand” inflation, has created a lot of uncertainty for the Dow Jones. Will the US stock market break down like Bitcoin? Or should investors keep buying dips? Technically, if we continue to see downward price trending below the 200-period moving average, it is very likely that price will continue to move lower while attempting to find support near 33400.

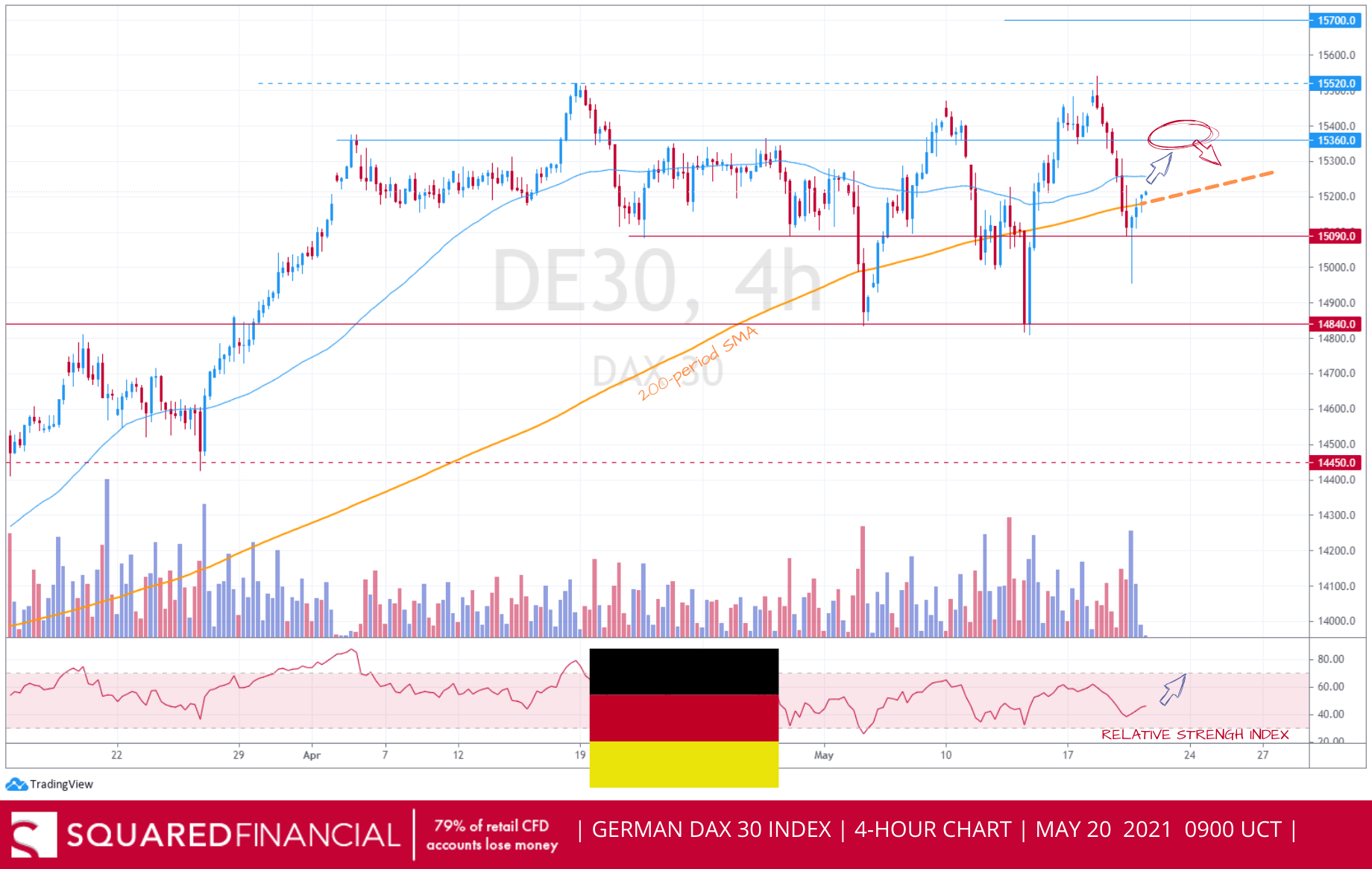

DAX 30

Stocks in Frankfurt fell yesterday as the market's downturn entered its third day, with the DAX30 breaching at one point the key 200-period SMA after FOMC minutes revealed that policymakers discussed QE tapering. The German benchmark however quickly bounced back, preventing a bearish trend reversal signal. The next level of resistance for the Dax on the upside is 15300 but failure to move above it will trigger further decline with the 200-period SMA still acting as support.

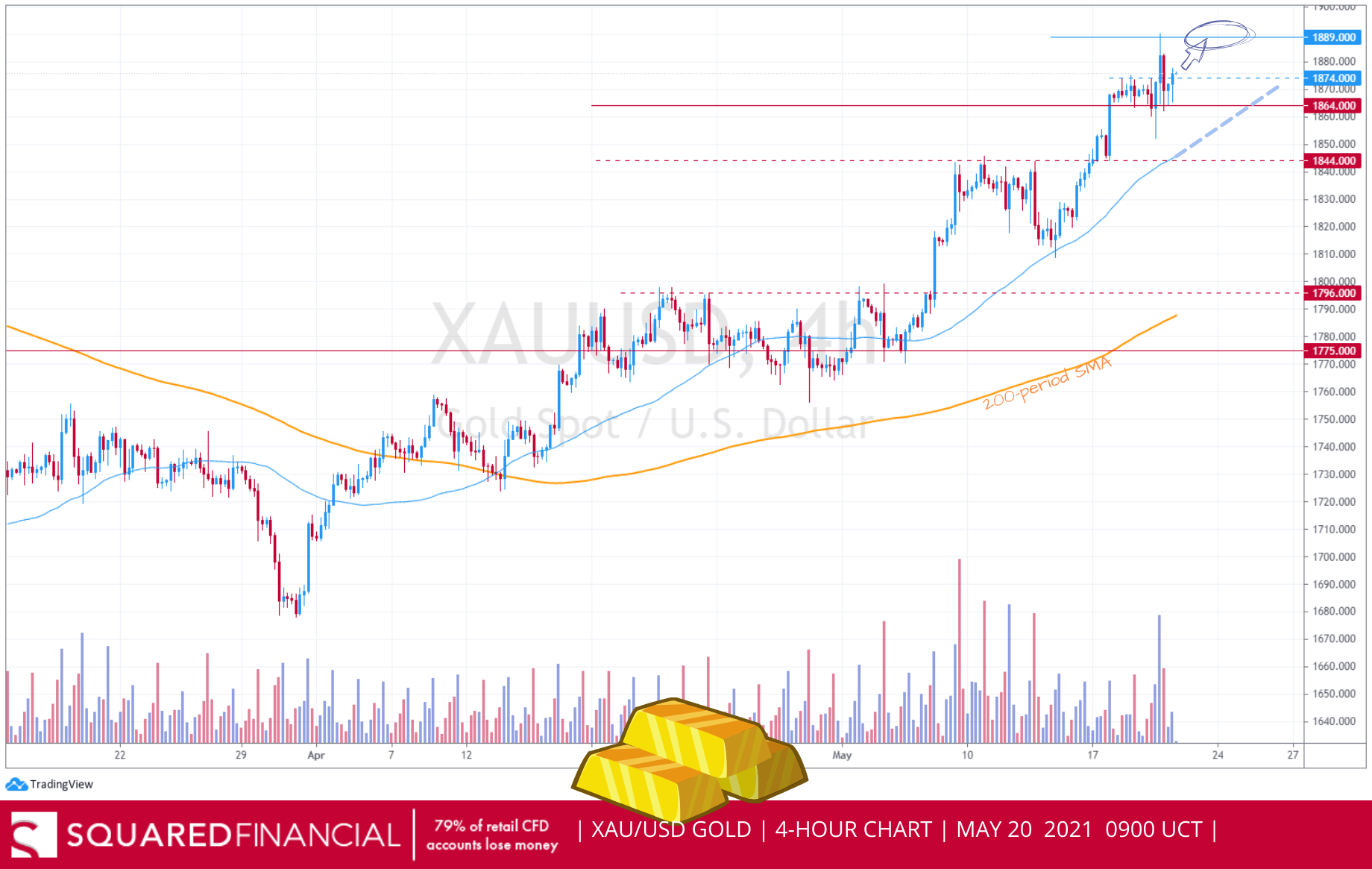

Gold

FOMC minutes that hinted at the possibility of a sooner than expected debate on scaling back asset purchases, dragged down the yellow metal after hitting our resistance target at $1889, with technicals favoring another retest of yesterday’s session highs. Inflation concerns along with resurging virus cases in Asia, is keeping the bullion supported, with an hourly close above $1880 to favor further upside.

US oil

WTI Crude shed almost 3% in yesterday’s session, weighed down by rising coronavirus cases in Asia, a buildup in EIA inventories (1.321Mb vs. previous -0.427Mb), progress on the US-Iranian nuclear talks, and FOMC minutes that hinted at the possibility of a taper talk coming sooner than expected. Technically, an hourly close above $63.85 will favor further upside with $64.40 as the next resistance target.

This information is only for educational purposes and is not an investment recommendation. The information here has been created by SquaredFinancial. All examples and analysis used herein are of the personal opinions of SquaredFinancial. All examples and analysis are intended for these purposes and should not be considered as specific investment advice. The risk of loss in trading securities, options, futures, and forex can be substantial. Customers must consider all relevant risk factors including their own personal financial situation before trading.

Recommended Content

Editors’ Picks

AUD/USD consolidates near 19-month peak as traders await US PCE Price Index

AUD/USD oscillates in a range below the 0.6900 mark, as traders opt to move to the sidelines ahead of the US PCE Price Index. In the meantime, the RBA's hawkish stance, the optimism led by additional monetary stimulus from China, the prevalent risk-on mood, and a bearish USD continue to act as a tailwind for the pair.

USD/JPY holds above 145.00 after the Tokyo CPI inflation data

The USD/JPY pair attracts some buyers to near 145.20 on Friday during the early Asian session. The pair gains ground near three-week highs after the Tokyo Consumer Price Index. The attention will shift to the US Personal Consumption Expenditures Price Index for August, which is due later on Friday.

Gold price holds steady near record peak; looks to US PCE data from fresh impetus

Gold price consolidates below the all-time high set on Thursday amid overbought conditions on the daily chart and the risk-on mood, though dovish Fed expectations continue to act as a tailwind. Bulls, meanwhile, prefer to wait for the release of the US PCE Price Index before placing fresh bets.

Ethereum could retest $2,707 resistance following increasing ETF inflows and uptrend in funding rates

Ethereum traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates. However, investors may be wary of a potential correction from ETH's rising exchange reserve.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.