Outlook: We are undergoing a crisis of confidence in the reflation trade now that the Fed is acknowledging that supply constraints and labor shortages may last longer than we thought. A possible rescue comes in the form of unemployment claims this morning, forecast at only 350,000 after 364,000 the week before.

Trading Economics reports “That would be a new pandemic low figure, although initial claims remain almost the double of the 200K levels before the coronavirus pandemic. Also, employers across the country have been complaining about the struggle to fill open positions, citing ongoing labor shortages due to enhanced benefits, concerns about contracting COVID-19, and finding childcare. Continuing claims are expected to fall to 3.335 million from 3.469 million.”

Note that Trading Economics’ own forecast is for a lesser 320,000 new initial claims. That raises the question of how good the claims number has to be to offset the new gloom. An offset may not be possible at all. Yesterday’s job openings may have been a record high (9.209 million in May but fell short of the forecast (9.388 million). Worse, “the number of hires fell by 85 thousand to 5.927 million, while total separations including quits, layoffs and discharges, and other separations declined by 485 thousand to 5.318 million.”

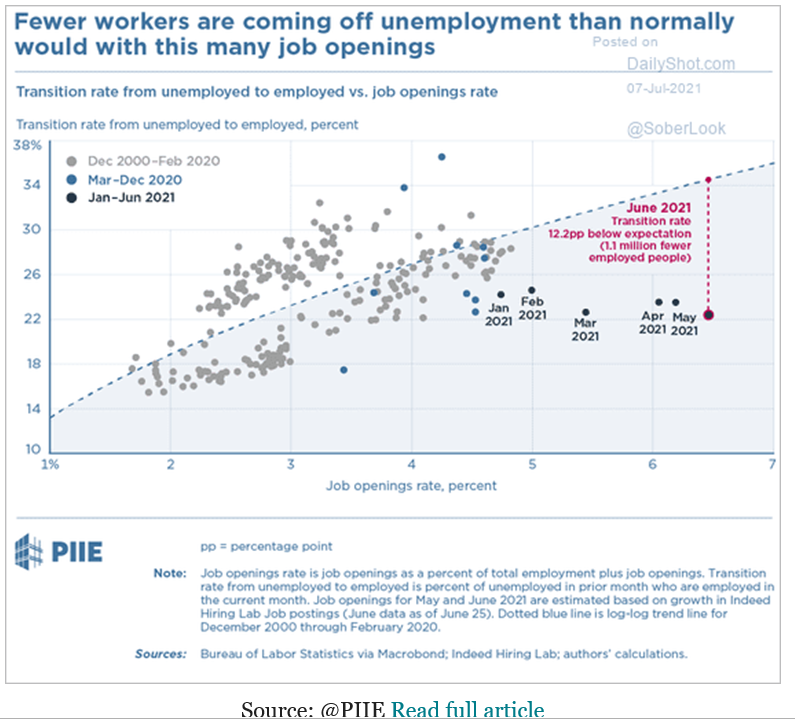

The US labor market is messed up in ways we do not understand. See this chart from the Peterson Institute. It shows that one of the things we have been wondering and complaining about—the mismatch between unemployment and job openings—is not an illusion. As of June, about 1.1 million persons who would have gone from jobless to employed in previous periods did not. They stayed unemployed. The article sedately notes that “The Labor Market Remains Well Short of Normal.”

The Fed no doubt has its own version of this chart. The minutes validated the idea that the Fed is mightily worried about the weird labor market. Wolf Street notes that the term “labor shortages” was mentioned five times in the minutes, along with material shortages, supply disruptions, and production bottlenecks, all of which “constrain” economic activity. “Supply disruptions and labor shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed.”

The Fed is also more worried about the recent inflation surge, which may not be so transitory after all. The causes include that labor shortage and its consequent wage increases, supply blockages, and high demand. Still, tapering might begin earlier than thought at the last meeting. And given that low rates are contributing to elevated house prices and thus a financial stability risk, tapering purchases of mortgage-backed securities “more quickly or earlier than Treasury purchases” is officially on the table “in light of valuation pressures in housing markets.”

We have a disconnect between central bank tendencies and currency outcomes. If the Fed is more hawkish (accelerated tapering) and the ECB is more dovish (low for longer with inflation overshooting allowed), why is it the euro that is on the upswing this morning? We are back again to growth. The Fed is worried about growth being under the cosh from supply issues and labor shortages. The ECB sees a lesser cooling and the policy shift is taking steps to offset that cooling. Note that the Fed utterly rejects a negative base rate, while the ECB is willing to keep a negative rate for as long as it takes.

Most financial analysts give it short shrift, but it’s hard to miss that even heavily vaccinated populations are getting the delta variant of covid at lightning speed, while at the same time, Europe is allowing tourism, and Japan is declaring a state of emergency while continuing to host the Olympics in just a few weeks. Talk about a disconnect! Pres Biden was careful to say yesterday that the federal government will not be recommending any lockdowns even if the US gets a delta wave and it’s up to the states. Fear of a Delta Wave contributes to the new uncertainty about the pace of recovery.

The risk-off sentiment should favor the dollar except against the yen and perhaps the Swiss franc. A complete lack of coherence in thinking about EM’s can be seen in the wildly whipsawing Mexican peso.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.