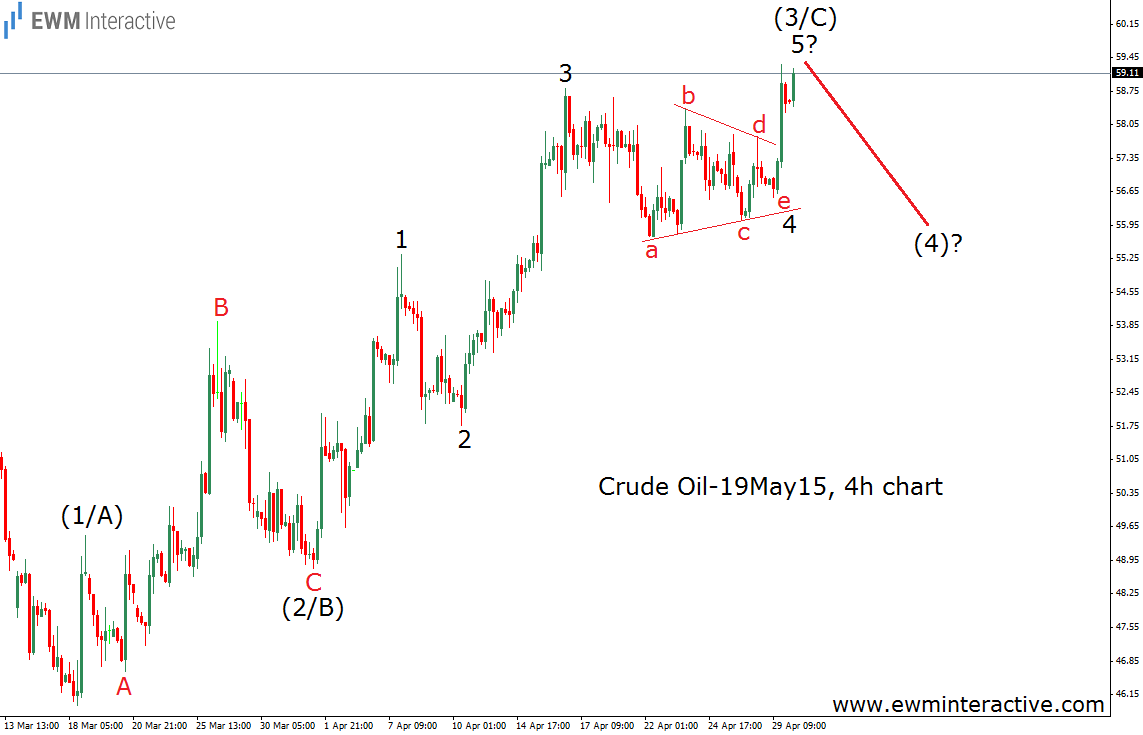

In our previous post about crude oil we thought the “black gold” is in a post-triangle wave 5. That is why we said it was not a good time to go long on crude oil. Once that fifth wave was over, there was likely to be a reversal to the downside. The next chart shows how the forecast looked like less than a month ago, on April 30th.

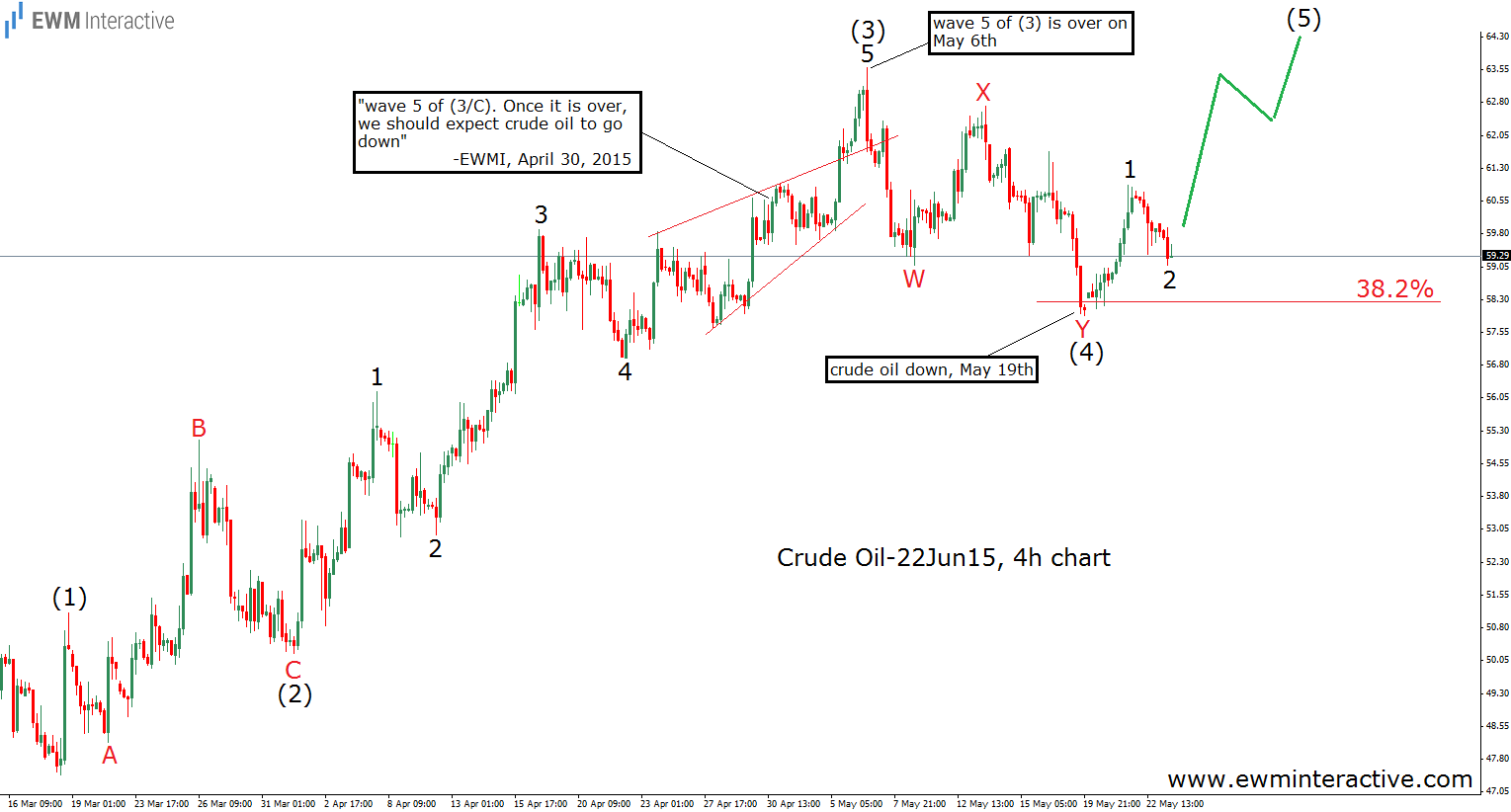

Now we could say that wave 4 was not a triangle. Instead, some of the price swings we thought were part of a triangle, turned out to be part of an ending diagonal in wave 5. Nevertheless, the count did not change much. We were still expecting a bearish reversal. The chart below demonstrates how crude oil has been developing ever since.

The price of crude oil topped on May 6th. Less than two weeks later, it stood more than $5 lower. The three-wave decline we were waiting for developed as a W-X-Y double zig-zag. Fourth waves usually retrace the third wave to the 38.2% Fibonacci level. This is precisely the area, where crude oil prices found support on May 19th. So, if this count is correct, wave (5) to the upside could already be in progress. Unless it becomes truncated, it has the potential to take crude oil prices above $64 per barrel

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.