Caption: Walking the tightrope: BoJ's strategy amid inflation and global challenges

The Bank of Japan kept interest rates unchanged on 20 September, with Governor Kazuo Ueda signalling no immediate need to raise them due to global economic uncertainty. Ueda said Japan's economy is performing as expected, with wage growth boosting consumption and inflation approaching the 2% goal.

Source: adopted from Reuters

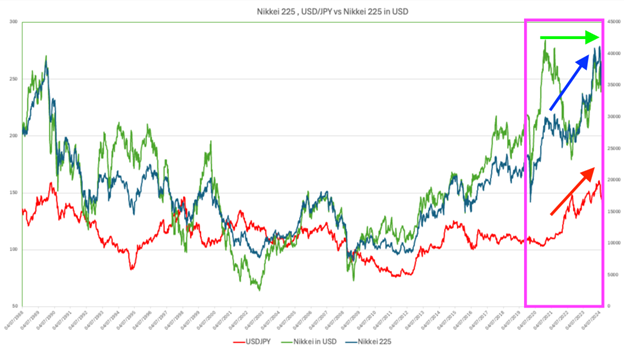

A closer look: The weaker Yen and rising Nikkei 225

The rise in the Nikkei 225 to a new high by 2024 can be attributed to the weak yen, driven by the large interest rate gap between the US and Japan. With the Federal Reserve planning further rate cuts, the Bank of Japan must weigh the potential impact of tightening too aggressively, as seen in July when a rate hike to 0.25% led to an equity market drop. Since then, the BoJ has been cautious with rate increases, despite CPI now at 2.8%.

Before assessing the impact of a stronger yen, we must first examine how a weaker yen affects the economy.

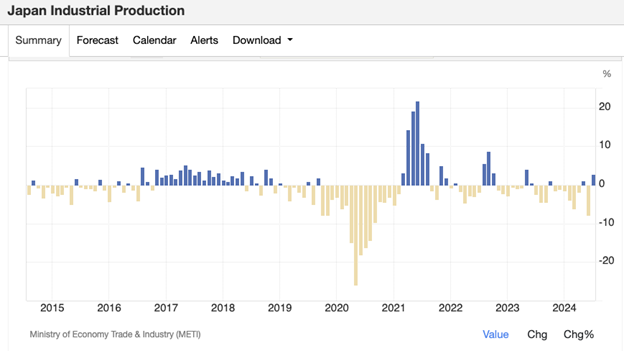

Weak Yen’s impact on growth and production

Source: tradingeconomics

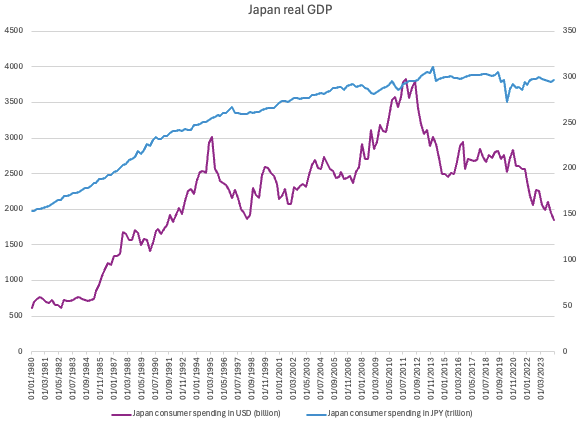

The yen has weakened due to the interest rate gap between the US and Japan in recent years. Even since 2020, the Japanese government has encouraged companies in China to relocate back to Japan and Southeast Asia, but industrial production has not picked up. While Japan's real GDP in yen has increased, its GDP in USD has declined, indicating that growth is primarily driven by the weaker yen.

Source: adopted from Reuters

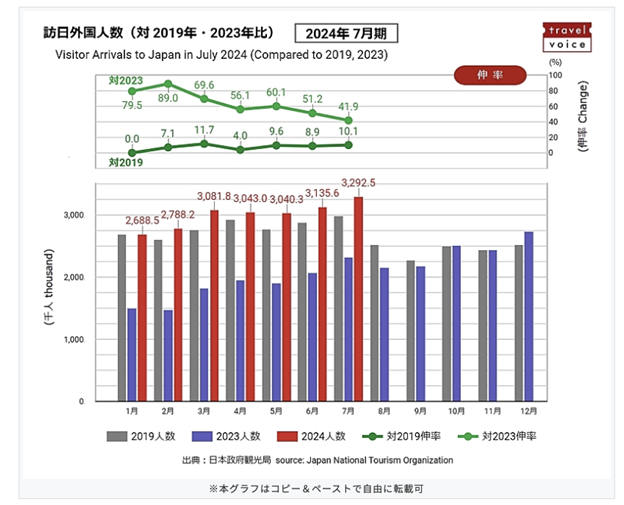

Tourism boom: An unexpected benefit of a weaker Yen

In July 2024, the number of international visitors to Japan reached a record 3,292,500, up 10.1% compared to July 2019, driven by the weak yen.

Source: travel voice

For further discussion of the Bank of Japan's interest rate strategy, refer to the article Monetary maneuvers: How Japan's decisions affect global markets. With rising interest payments, the BoJ has limited room for manoeuvre. The Fed’s rate policy and the strength of the US dollar will largely determine the USD/JPY exchange rate.

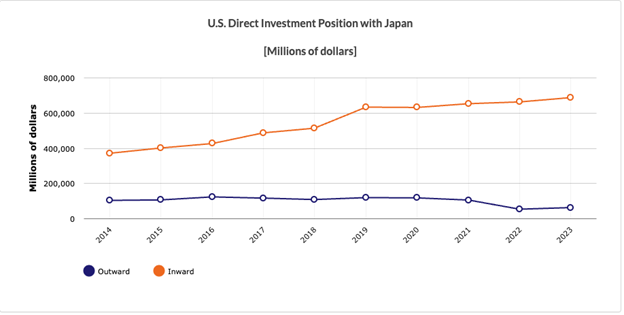

Source: BEA

A weaker yen makes Japanese assets cheaper, attracting more funds and increasing foreign direct investment (FDI) into Japan.

Navigating the fragile banking sector

Japan’s regional banks are particularly vulnerable to interest rate increases due to the BoJ’s long history of negative and zero rates. A rapid rate hike could affect their investments.

According to Moody’s, regional banks may face higher valuation losses on bond investments, threatening profitability and capitalisation, similar to the Silicon Valley Bank situation. As a result, the BoJ is likely to raise rates cautiously.

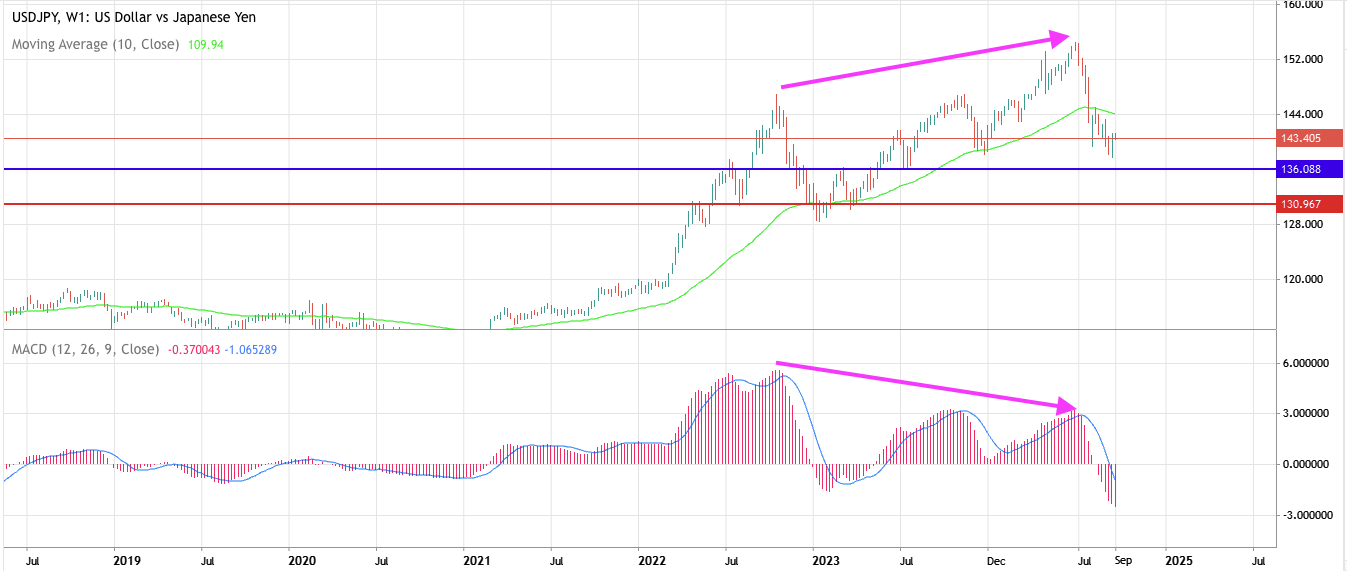

Technical analysis

A bearish divergence between the MACD and USD/JPY has formed, with the pair below the 60-week moving average. Support levels are expected at 136 and 131. Unless USD/JPY closes above the 60-week moving average, it remains in a potential consolidation phase.

Conclusion

As global markets keep an eye on the BoJ's next moves, the central bank must juggle economic growth, inflation control, and financial sector stability. Its cautious rate strategy remains essential to avoid destabilising both Japan's banking system and broader economy.

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. It is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information. The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. No representation or warranty is given as to the accuracy or completeness of this information. Do your own research before making any trading decisions.

Recommended Content

Editors’ Picks

EUR/USD extends losses toward 1.1100 on increased dovish ECB bets

EUR/USD accelerates decline toward 1.1100 in European trading on Friday. Softer French and Spanish inflation data ramped up Oct ECB rate cut bets, weighing on the Euro. However, the downside could be cushioned by a wobbly US Dollar, as US PCE inflation looms.

USD/JPY slides 1% toward 143.00 as Ishiba wins LDP leadership race

USD/JPY is seeing a fresh sell-off toward 143.00 in the European session on Friday. The pair loses over 300 pips, as the Japanese Yen rebounds on Shigeru Ishiba's win in the LDP leadership run-off. Sanae Takaichi, who favored keeping interest rates lower, was expected to win the race.

Gold price pulls back from record high ahead of US PCE Price Index, bullish bias remains

Gold price attracts some sellers on the last day of the week and retreats further from the all-time peak, around the $2,685-2,686 region touched on Thursday. The downtick is sponsored by the emergence of some US Dollar buying, which tends to undermine demand for the commodity.

US core PCE set to show continued disinflation trend, reinforcing Federal Reserve easing cycle

The core Personal Consumption Expenditures Price Index is seen rising 0.2% MoM and 2.7% YoY in August. Markets have already priced in near 50 bps of easing in the next two Federal Reserve meetings. A firm PCE result is unlikely to move the Fed’s stance on policy.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.