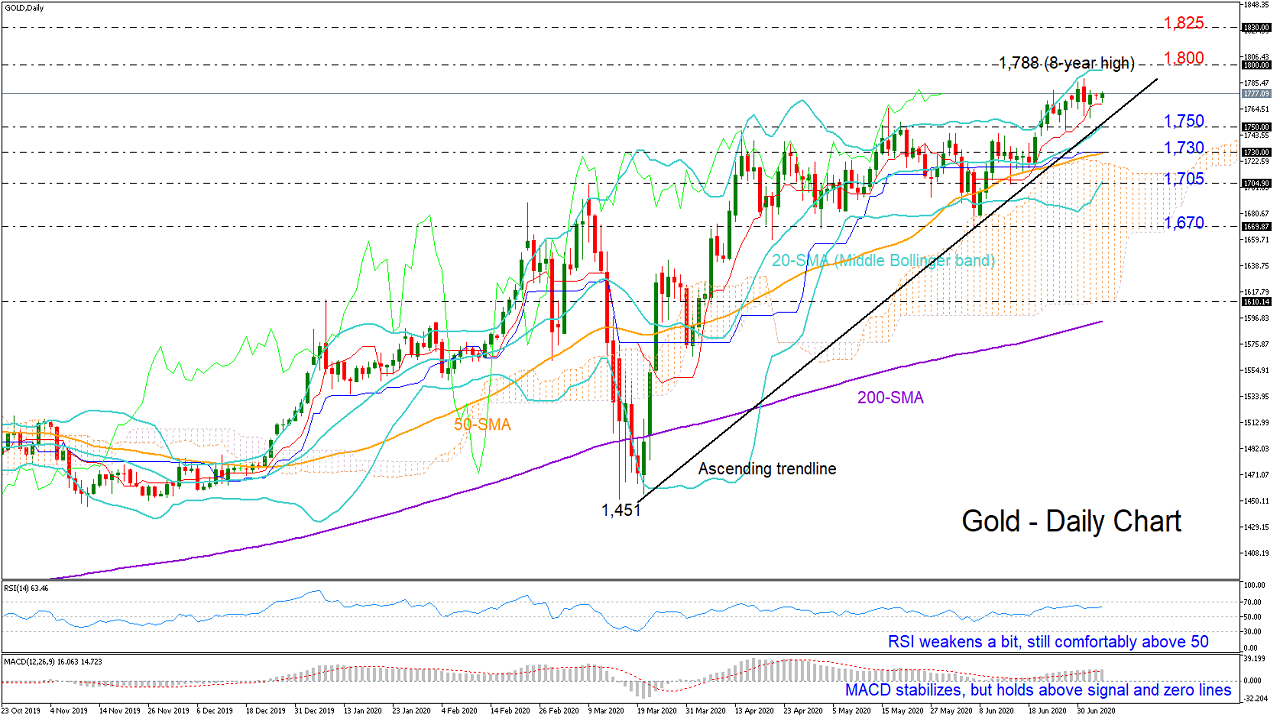

Gold opened with weak momentum on Monday in the daily chart, hovering slightly below the new almost eight-year peak registered last week.

Nevertheless, the short-term bias is still skewed to the upside. Although frail, the RSI is holding comfortably above its 50 neutral level, while the MACD, despite stabilizing, remains within the positive area and marginally above its red signal line. Meanwhile, the price itself continues to trade above the upward-sloping 20-day simple moving average (SMA) and within the upper bullish Bollinger band area, keeping hopes of further improvement in the market alive for now.

A decisive close above 1,800 is what buyers are currently looking for to fly towards the 1,920 record high. But in a short distance, the 1,825 resistance, which the bulls failed to successfully lift in 2011, could block the way.

Alternatively, the middle Bollinger band (20-SMA) and the tentative ascending trendline both around 1,750 could be the threshold for a more aggressive downside correction that may initially stall around the 50-day SMA (1,730) and then around the lower Bollinger band at 1,705. Lower, the door would open for the 1,670 barrier, a break of which would switch the medium-term picture to a bearish one, signalling the start of a downtrend as well.

Summarising, the precious yellow metal is in neutral mode at the moment. A break above 1,800 or a drop below 1,750 could trigger some volatility accordingly.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD extends losses toward 1.1100 on increased dovish ECB bets

EUR/USD accelerates decline toward 1.1100 in European trading on Friday. Softer French and Spanish inflation data ramped up Oct ECB rate cut bets, weighing on the Euro. However, the downside could be cushioned by a wobbly US Dollar, as US PCE inflation looms.

USD/JPY slides 1% toward 143.00 as Ishiba wins LDP leadership race

USD/JPY is seeing a fresh sell-off toward 143.00 in the European session on Friday. The pair loses over 300 pips, as the Japanese Yen rebounds on Shigeru Ishiba's win in the LDP leadership run-off. Sanae Takaichi, who favored keeping interest rates lower, was expected to win the race.

Gold price pulls back from record high ahead of US PCE Price Index, bullish bias remains

Gold price attracts some sellers on the last day of the week and retreats further from the all-time peak, around the $2,685-2,686 region touched on Thursday. The downtick is sponsored by the emergence of some US Dollar buying, which tends to undermine demand for the commodity.

US core PCE set to show continued disinflation trend, reinforcing Federal Reserve easing cycle

The core Personal Consumption Expenditures Price Index is seen rising 0.2% MoM and 2.7% YoY in August. Markets have already priced in near 50 bps of easing in the next two Federal Reserve meetings. A firm PCE result is unlikely to move the Fed’s stance on policy.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.