GBP/CHF, H4 and Daily

The Pound has settled off lows after printing new low points against the US Dollar, Euro while it faced the biggest decline against Swiss Franc. Cable hit a 19-day low at 1.2953 in what is now the 6th trading day of declines. EURGBP posted a fresh 7-week high at 0.8595.

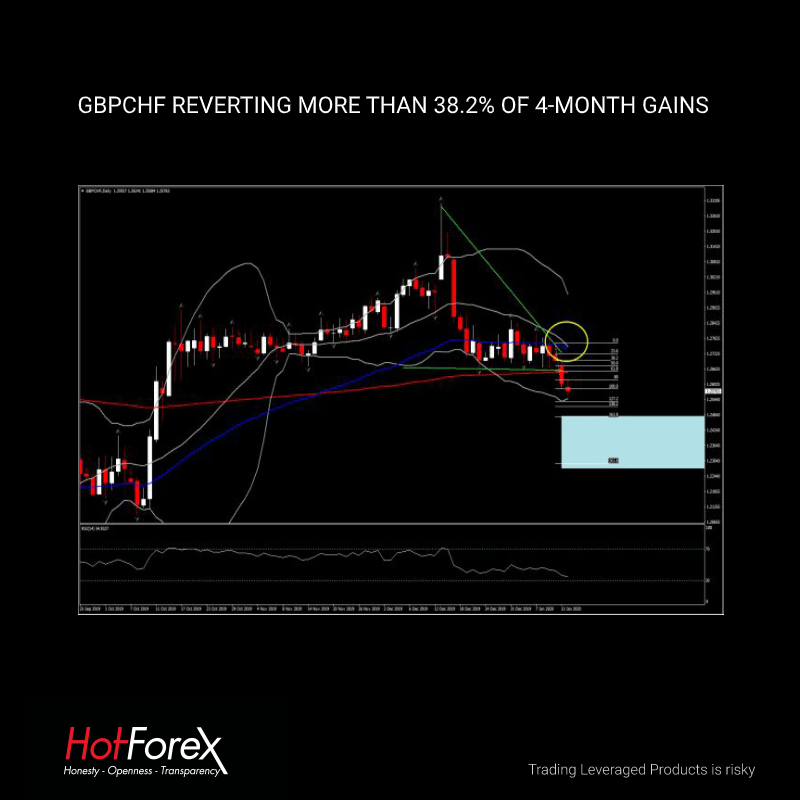

GBPCHF, meanwhile, has seen a 1.12% decline so far this week, with the asset posting a decisive negative candle yesterday which had taken the asset below the 1.2600 level and below the descending triangle formation since the mid of December. The latter along with the move below the 200-day SMA today, has turn the medium term outlook from neutral to negative. The UK currency turned heavy in the wake of yesterday’s UK November production and GDP data misses, and dovish BoE-speak. This correction on the 4-month uptrend seen since December, has now started looking like a reversal. However we need to see a decisive close below the midpoint of August -November trend in order to confirm this bearish scenario.

Momentum indicators are negatively configured are well, with RSI at 33 looking to extend further to the downside, whilst MACD lines forming a bearish cross within the negative territory. The indicators along with the latest price action suggest that negative bias could sustained in the medium term. Subsequent next Support is at 1.2480 (161.8 FE and 50% retracement since August, pleases check figure below), 1.2385 and 1.2300. Immediate Resistance is at triangle’s lower line which coincides with December’s Support at 1.2660.

Ultimately, on a fundamental basis, the UK economy is unlikely to see a significant post-election boost, despite the fog of Brexit-related uncertainty and the grip of political gridlock having been replaced by a government with a clear mandate. One issue is that a no-deal Brexit remains a theoretical possibility, with the government having legislated for leaving the EU at the end of 2020, which limits the post-Brexit transition period to just 11 months.An increasing body of EU officials and others have been saying is insufficient time for the UK to negotiate a comprehensive new trade agreement with the EU, let alone other global economies and trading blocs.

Another issue is the simple realisation of how low it will take for the UK — most likely years — to get close to matching the trading benefits of being a member of the European Union (unfettered access to the world’s biggest free-trade area plus access to the 40 trade deals the EU has with 70 global economies and trading blocs).

The UK’s Institute for Government also warned that it will be impossible to deliver the computer systems for the special Brexit arrangements for Northern Ireland’s border by the end of the year. An implementation failure like this would break the terms of the Withdrawal Agreement. Such considerations have lead the Confederation of British Industry to forecast UK growth of only between 1% and 1.5% over the next few years. BoE members Carney and Vlieghe have in recent days also signalled a rise in dovishness the the Monetary Policy Committee, and some analysts, such as those at RBS, are now forecasting a 25 bp rate cut at the January-30 policy meeting. The UK’s OIS market is implying about 50-50 odds for such as rate cute this month, and is fully discounting such a move by September.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.