The GBP/USD pair remains with a broader trading range set after a dovish BoE rate hike, with dips below the 1.3100 handle being bought into and the bulls struggling to keep it above the 1.3200 mark. Wednesday's better-than-expected headline UK employment figures, coupled with persistent US Dollar selling bias did provide a minor boost to the pair. However, a sharp contraction in the overall employment, worst since 2015, raised concerns that Brexit might now be impacting the labor markets. Adding to this, subdued wage growth is now expected to further squeeze household spending power and dampened prospects of any additional BoE rate hike action in the near future. Moreover, the US Dollar also gained some respite following the release of slightly better-than-expected US economic data and further collaborated towards keeping a lid on the major.

With the US tax bill headlines turning out to be an exclusive driver of the USD price action, investors would remain focused on the key vote on the legislation, due later on Thursday. In the meantime, the UK monthly retail sales data, expected to show a modest rise of 0.1% m-o-m in October as compared to drop of 0.8% in September, will be looked upon for some momentum to assist the pair to break through its near-term trading range. A negative reading would further reduce odds of another interest rate hike by the BoE and deteriorate the outlook for the British pound.

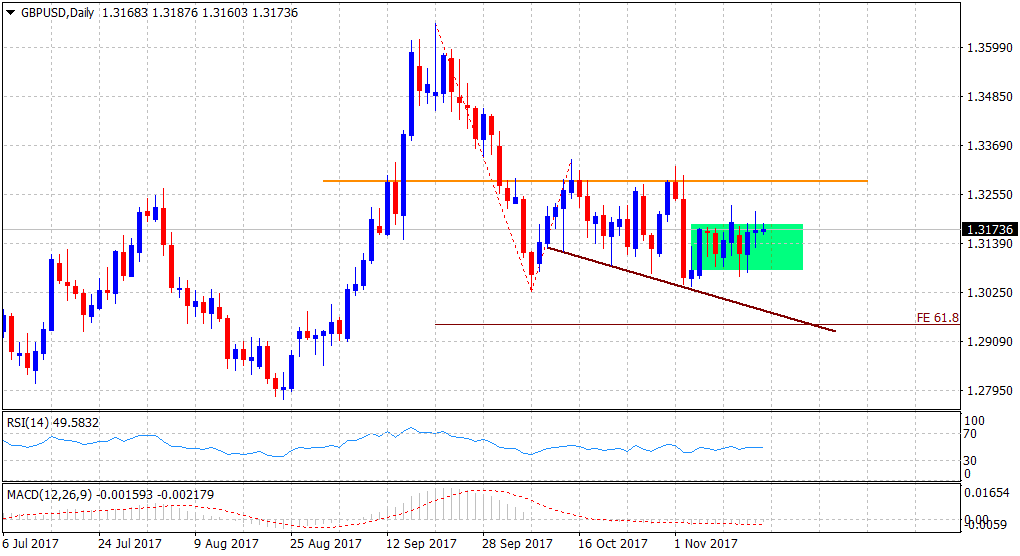

Technically, the pair remains positioned in a neutral territory and traders are likely to wait for a decisive break through the mentioned range before positioning for the next directional move. Below the 1.3100 handle, the pair might continue to find support near the 1.3060-50 region, which if broken is likely to accelerate the slide towards the 1.30 psychological mark. Some follow-through selling pressure might continue dragging the pair further towards the 1.2950 support, marking the 61.8% Fibonacci expansion level of the 1.3657-1.3027 downslide and its subsequent rebound.

On the upside, momentum beyond the 1.3200 handle might continue to confront fresh supply near the 1.3225-30 region, above which a bout of short-covering could lift the pair towards the 1.3300 handle. A convincing move above the mentioned barriers might now negate any near-term bearish bias and pave way for extension of the pair's up-move in the near-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.