Introduction

The Nikkei 225 index followed suit after stock indices fell across the board, driven by a decline in European banking equities with heightened talk of the problems in Greece REARING once again. WTI crude oil futures are trading heavily at around the US$30 mark amidst relatively low liquidity and nervous times.

Asian Session

EUR/USD has traded above 1.1200 overnight with the risk-off sentiment driving USD/JPY to a low of 114.21. It also comes as no surprise that gold and CHF were paid up as the scurry for safe-haven assets took place.

In Australia, business confidence data proved largely in line with expectations. Antipodean currencies trade lower against USD with CAD following suit too.

The British Retail Consortium printed a positive retail sales figure overnight. Cable trades right now above the 1.4400 level whilst the US dollar index stands close top lows so far for the year at 96.73.

The day ahead in Europe and NY

A lack of real data and liquidity will inevitably lead to market attitude being the main driving force today. In Switzerland, unemployment data has already been released and proved in line with expectations. Industrial production data and trade balance figures for Germany have recently been published too and pulled EUR lower.

Trade balance info. will print out of London at 09:30 GMT today. EUR/GBP reached a high for the year of .7757 today. Later in the states, a string of data containing only tepid importance will take be released. The weekly crude oil stock data will be a focus when released at 21:30 GMT today.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1182 | -0.10% | 1.1238 | 1.1178 |

| USDJPY | 115.34 | -0.43% | 115.85 | 114.21 |

| GBPUSD | 1.4459 | 0.19% | 1.4462 | 1.4391 |

| AUDUSD | 0.7061 | -0.37% | 0.7088 | 0.7019 |

| NZDUSD | 0.6619 | -0.12% | 0.6629 | 0.6576 |

| EURCHF | 1.102 | 0.25% | 1.1056 | 1.1011 |

| USDCAD | 1.3908 | 0.14% | 1.3961 | 1.3892 |

| USDCNH | 6.5766 | 0.06% | 6.5825 | 6.5699 |

FXO

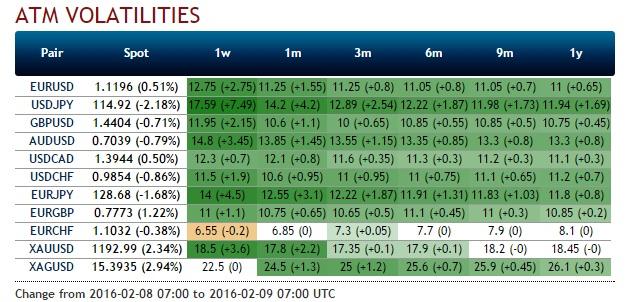

Volatility is higher than may be expected when a look at certain major currencies such as EUR/USD is taken. The one month straddle trades at a volatility of 11.3% which is a high for volatility in this space for the year so far.

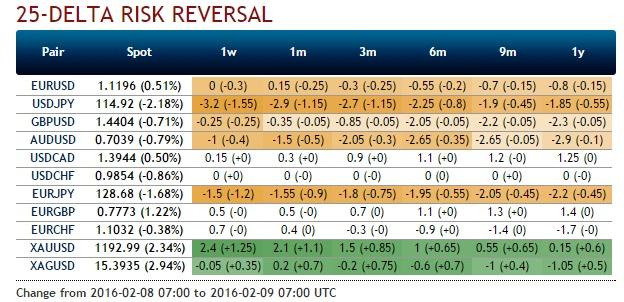

Low liquidity is leading curves to move quite dramatically in the currency options space. The USD/JPY one month 25-delta risk re3versalhas moved from a volatility differential of 1.5% to close to 3.0% today, favouring the downside.

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.