- Financial markets lift bets of a Federal Reserve rate cut in March despite US CPI data.

- European Central Bank has no extra room for rate hikes, unconfirmed pivot here.

- EUR/USD is losing its bullish potential, but a stronger slide is not yet clear.

The EUR/USD pair is ending the week pretty much unchanged in the 1.0950 region, with investors feeling a bit disappointed after assessing the latest economic developments. Throughout the first half of the week, financial markets lacked directional momentum amid a scarce macroeconomic calendar and United States (US) first-tier data scheduled for Thursday.

Economic developments in the United States and the Eurozone

The US Dollar traded with a soft tone ahead of the release of the US Consumer Price Index (CPI) as investors hoped soft figures would keep the Federal Reserve (Fed) on the rate cut’s path. However, the numbers surpassed the market expectations. The December CPI rates printed at 0.3% MoM and 3.4% YoY, higher than November readings. Finally, core annual inflation declined from 4% to 3.9%, still above the 3.8% anticipated.

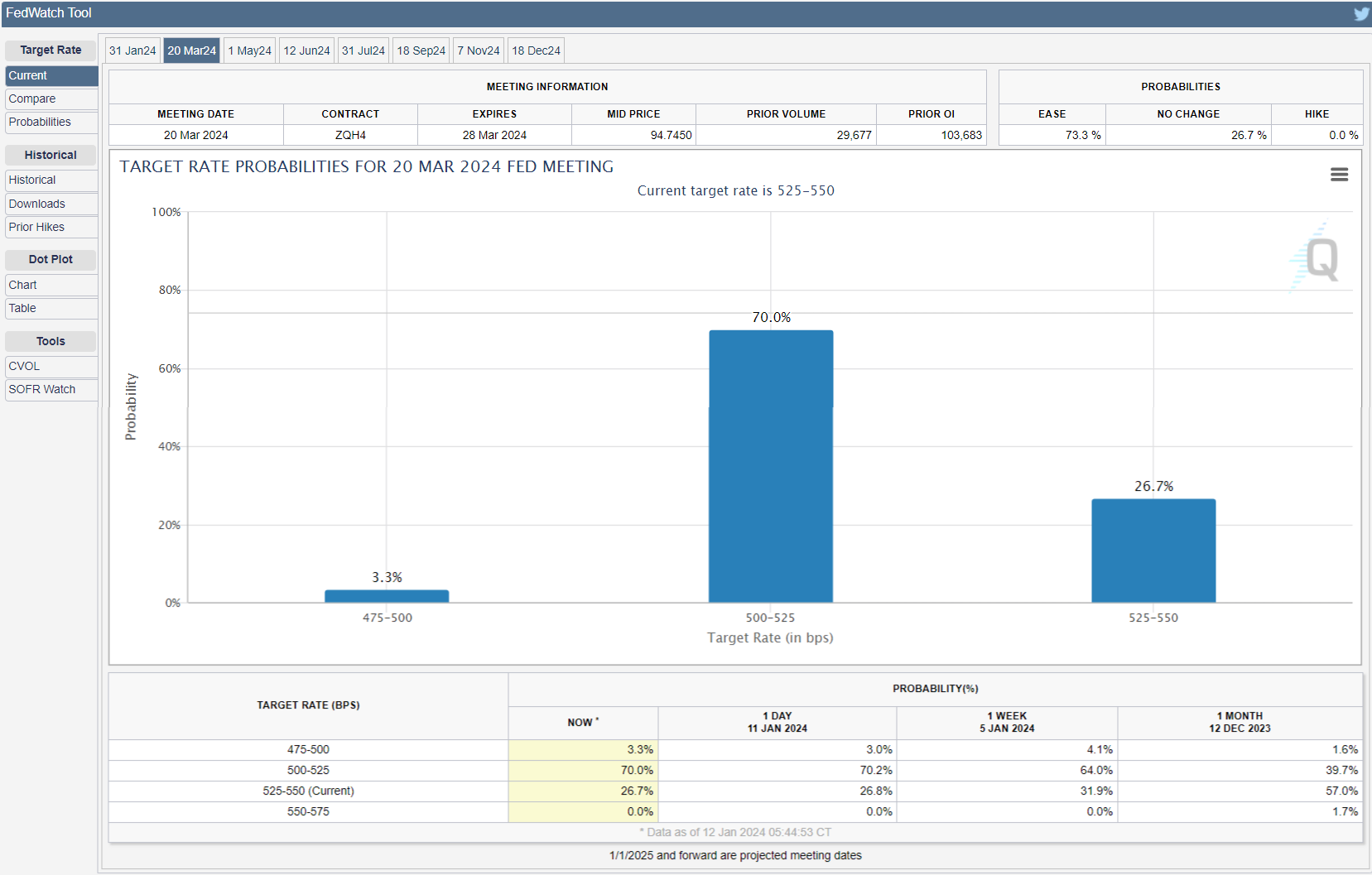

The news initially triggered concerns about the Fed’s potential rate cuts. The US Dollar surged alongside government bond yields as stocks turned negative. Yet after the dust settled, speculative interest reconsidered, and resumed betting on a rate cut as soon as next March. The CME FedWatch Tool shows a 70% chance of a 25 basis points (bps) cut then, against roughly 60% odds ahead of the release.

Further helping sentiment to recover, the US Producer Price Index (PPI) released on Friday came in softer than anticipated. The PPI contracted 0.1% MoM and rose 1.0% from a year earlier in December. The core annual rate posted 1.8%, below the 2% previous and the expected 1.9%.

Meanwhile, the Euro was unable to capitalize on early USD weakness. Mixed European data suggested the recovery path is still long. Comments from European Central Bank (ECB) representatives were mostly hawkish but failed to provide a boost to the shared currency. Among the most notorious comments, ECB policymaker and head of the Bank of France Francois Villeroy de Galhau said a rate cut is on the table in 2024 “as long as underlying fundamentals don't deliver any unforeseen surprises.” Also, he clarified the ECB will stand pat until inflation expectations are "solidly anchored" at 2%.

The ECB has reached its monetary policy pivot despite no official confirmation on the matter. President Christine Lagarde may likely keep the door open to additional hikes and reaffirm the data-dependent stance. Still, given the poor macroeconomic conditions and persistent price pressures, a rate cut in the EU may be closer than what the market believes.

Policymakers in the spotlight

With monetary policy meetings still far away, comments from officials will be highly watched in the upcoming days in search of fresh clues on whatever central banks may do next.

In the meantime, the upcoming week will be light in terms of macroeconomic releases. The US will publish December Retail Sales and the preliminary estimate of the January Michigan Consumer Sentiment Index. Across the pond, the Eurozone will offer the final estimates of the December German and the EU Harmonized Index of Consumer Prices (HICP).

EUR/USD technical outlook

The EUR/USD pair seems to be losing the bullish strength witnessed in December. It stands at the lower end of the previous week’s range, and not far from the January low set at 1.0876. Technical readings in the weekly chart reflect the lack of directional conviction. EUR/USD stands below a flat 200 Simple Moving Average (SMA), providing dynamic resistance at around 1.1150. Meanwhile, the 20 and 100 SMAs also lack directional strength, with the shorter one at 1.0766, a potential bearish target should the pair break the aforementioned monthly low. Finally, technical indicators head nowhere, although holding within positive levels. The bearish case should be firmer on a slide below the 1.0800 figure.

The daily chart suggests that EUR/USD could come under fresh selling pressure in the upcoming sessions. The pair has met sellers around its 20 SMA throughout the week, with the indicator losing its former upward strength, now flat around 1.0980. At the same time, the 100 and 200 SMAs remain directionless, far below the current level. The Momentum indicator gains modest downward strength within negative levels, while the Relative Strength Index indicator remains directionless around 53, suggesting bearish interest is not yet enough.

EUR/USD peaked at 1.1000 earlier in January, the level to beat to shrug off the sour tone. Still, the pair would need to extend its recovery beyond 1.1120 to turn bullish. In the middle, intraday resistance lies around 1.1060.

Euro price this week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.38% | -0.52% | -0.04% | -0.10% | -0.24% | -0.43% | -0.18% | |

| EUR | 0.38% | -0.13% | 0.35% | 0.28% | 0.17% | -0.04% | 0.21% | |

| GBP | 0.52% | 0.13% | 0.48% | 0.41% | 0.31% | 0.08% | 0.35% | |

| CAD | 0.04% | -0.34% | -0.47% | -0.07% | -0.16% | -0.39% | -0.13% | |

| AUD | 0.11% | -0.27% | -0.41% | 0.07% | -0.08% | -0.32% | -0.06% | |

| JPY | 0.22% | -0.13% | -0.28% | 0.22% | 0.15% | -0.17% | 0.06% | |

| NZD | 0.43% | 0.04% | -0.09% | 0.38% | 0.32% | 0.22% | 0.25% | |

| CHF | 0.19% | -0.21% | -0.34% | 0.14% | 0.07% | -0.04% | -0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0550, looks to post weekly gains

EUR/USD continues to fluctuate in a tight channel at around 1.0550 in the American session on Friday as trading action remains subdued with US financial markets heading into the weekend early. The pair looks to end the week in positive territory.

GBP/USD loses traction, retreats below 1.2700

After climbing to its highest level in over two weeks at 1.2750, GBP/USD reverses direction and declines to the 1.2700 area on Friday. In the absence of fundamental drivers, investors refrain from taking large positions. Nevertheless, the pair looks to snap an eight-week losing streak.

Gold pulls away from daily highs, holds near $2,650

Gold retreats from the daily high it set above $2,660 but manages to stay afloat in positive territory at around $2,650, with the benchmark 10-year US Treasury bond yield losing more than 1% on the day. Despite Friday's rebound, XAU/USD is set to register losses for the week.

Bitcoin attempts for the $100K mark

Bitcoin (BTC) price extends its recovery and nears the $100K mark on Friday after facing a healthy correction this week. Ethereum (ETH) and Ripple (XRP) closed above their key resistance levels, indicating a rally in the upcoming days.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.