- EUR/USD headed toward fresh yearly lows, 1.1000 on the table.

- Trade tensions exacerbated concerns about a global economic slowdown.

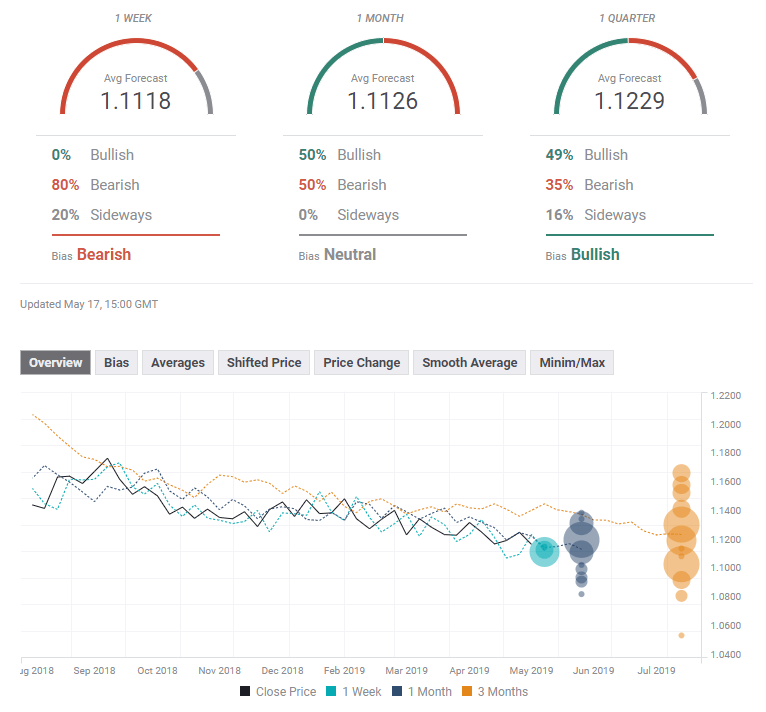

- The FX Poll shows a bearish bias in the short term but a bullish one in the long-term

It was a rough week for the common currency, as persistent tensions between the US and China kept high-yielding currencies away from speculative interest's radar. The EUR/USD pair fell, trimming most of the last two-week gains and losing the 1.1200 figure, also undermined by softer-than-expected Chinese data, which revived concerns about the global economic slowdown, and, as the Union stands at the edge of the cliff, was among the most affected.

The dollar, on the other hand, benefited not only from safe-haven demand but also from encouraging macroeconomic figures that temporarily overshadowed chances of a recession, despite US Treasury yields fell to flirt with yearly lows.

After last week's decision of hitting China with more tariffs, US President Trump this week made a couple of announcements that clearly show he is all about China. The first announcement was risk-positive, as the US administration decided to delay new levies on European cars' imports for six months. Late Wednesday, he also declared a national emergency over threats against American technology, clearly alluding China, as later in the day, the US Department of Commerce added Huawei Technologies and its affiliates to the Bureau of Industry and Security (BIS) Entity List, making it harder for the company to do business with US counterparts.

China didn't stay quiet and retaliate, by announced tariff between 5% and 25% on over $60 billion worth of US goods, but given that it didn't catch the market off-guard, the effect on financial markets was limited.

European data failed to impress, as the preliminary estimates of Q1 GDP for the EU and Germany came in both at 0.4%, matching the market's expectations. The German ZEW Survey showed that Economic sentiment deteriorated in May, with the index down to -2.1 in Germany, and to -1.6 for the whole Union.

US Retail Sales fell by 0.2% in April, while Industrial Production in the country shrank by 0.5%, triggering a short-lived dollar's decline. Thursday data was a bit more encouraging, as Housing Starts and Building Permits were up monthly basis by more than anticipated in April, while unemployment claims for the week ended May 10 decreased to 212K, better than the 220K expected. Also, the Philadelphia Fed Manufacturing Survey came in at 16.6, much better than the previous 8.5 and above the forecasted 9.0.

The greenback found additional support on some big-names presenting above-expectations earnings reports.

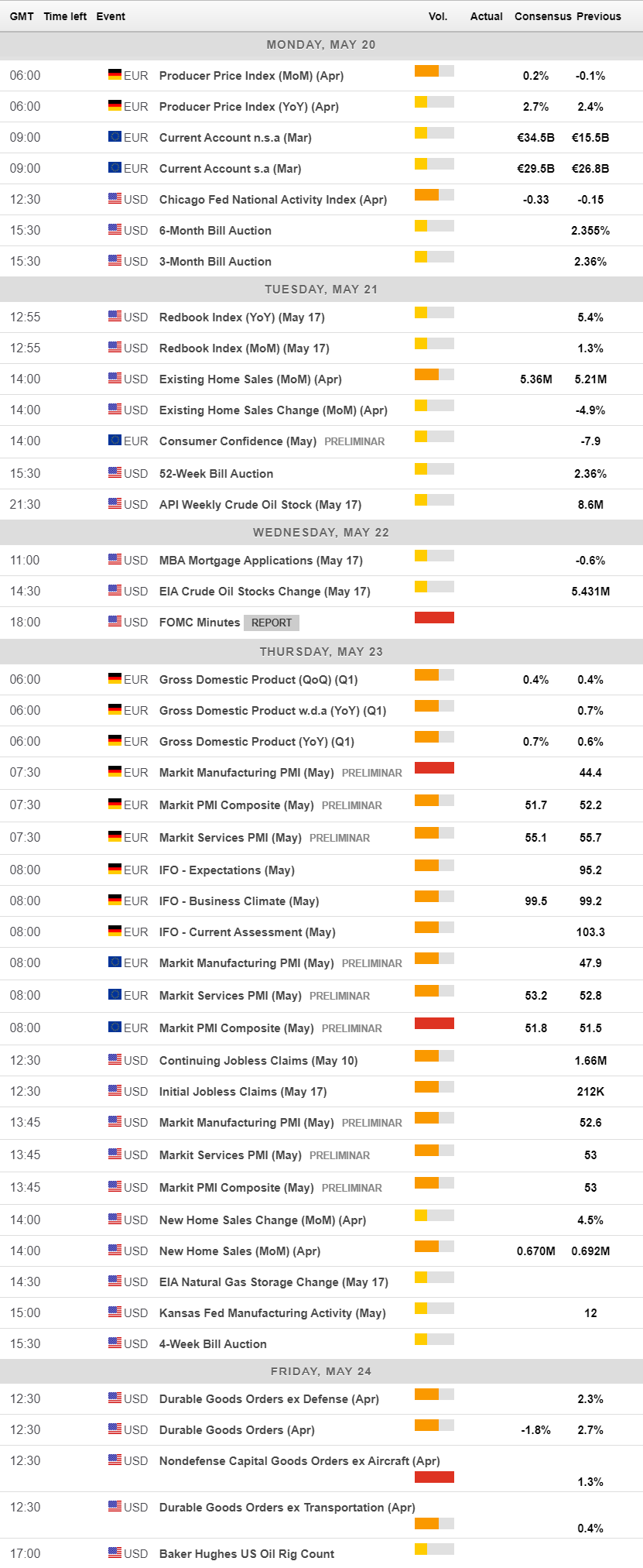

This upcoming week will bring the final version of German's Q1 GDP, foreseen unchanged at 0.4%, alongside preliminary Markit PMI for May, for the Union and the US. This last will unveil April Durable Goods Orders by the end of the week. Also, the FOMC Meetings' Minutes will be out this next week, although no big surprises are expected there.

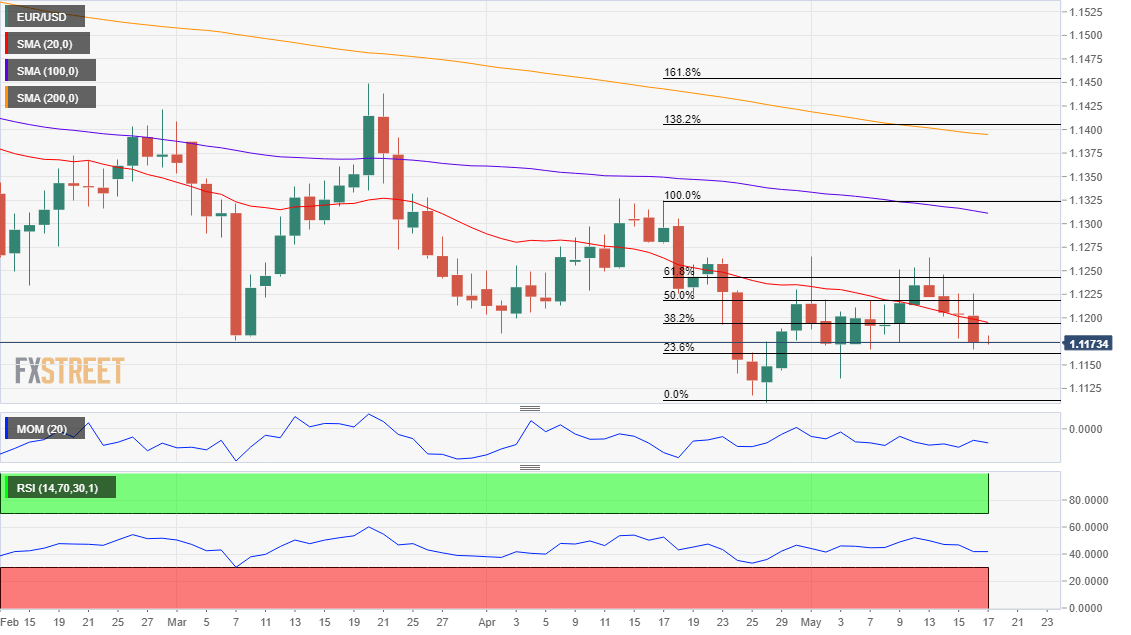

EUR/USD Technical Outlook

The EUR/USD pair, which started the week around the 61.8% retracement of the 1.1323/1.1110, is now below the 38.2% retracement of the same decline at 1.1190, at risk of falling beyond the 1.1110 yearly low.

In the weekly chart, the 20 SMA has extended its slide below the larger ones, all of them far above the current level. Technical indicators in the mentioned chart hold within negative levels, the Momentum lacking directional strength but the RSI turning lower at around 40, all of which maintains the risk skewed to the downside. The mentioned 20 SMA stands at 1.1295, with a weekly close above it being a first warning signal for long-term bears.

In the daily chart, the pair failed to sustain gains above a now bearish 20 MA, which converges with the mentioned Fibonacci resistance at around 1.1190, while the 100 and 200 DMA maintain their bearish slopes far above the current level. The Momentum indicator turned sharply lower and entered negative territory, while the RSI indicator slowly grinds south at around 40, supporting a bearish continuation.

Beyond the yearly low, the pair has room to extend its decline toward 1.1060 initially, to later approach the 1.1000 figure. This last will be a tough level to break, psychological support that if broken, could unwind a panic sell-off. To the upside, the key resistances come at 1.1245, and the 1.1320 area, with gains beyond this last not yet seen.

EUR/USD Sentiment

The FXStreet Poll shows a decidedly bearish bias on EUR/USD in the short term, a neutral stance in the medium term and experts remaining bullish with a long-term target of 1.1229. The average targets have not moved that much in the past week.

Related Forecasts

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.