- EUR/USD has kicked off the week on the back foot on ECB Lagarde's dovish comments.

- The rapid spread of the Delta covid variant is a lose-lose for the currency pair.

- Monday's four-hour chart is painting a mixed picture.

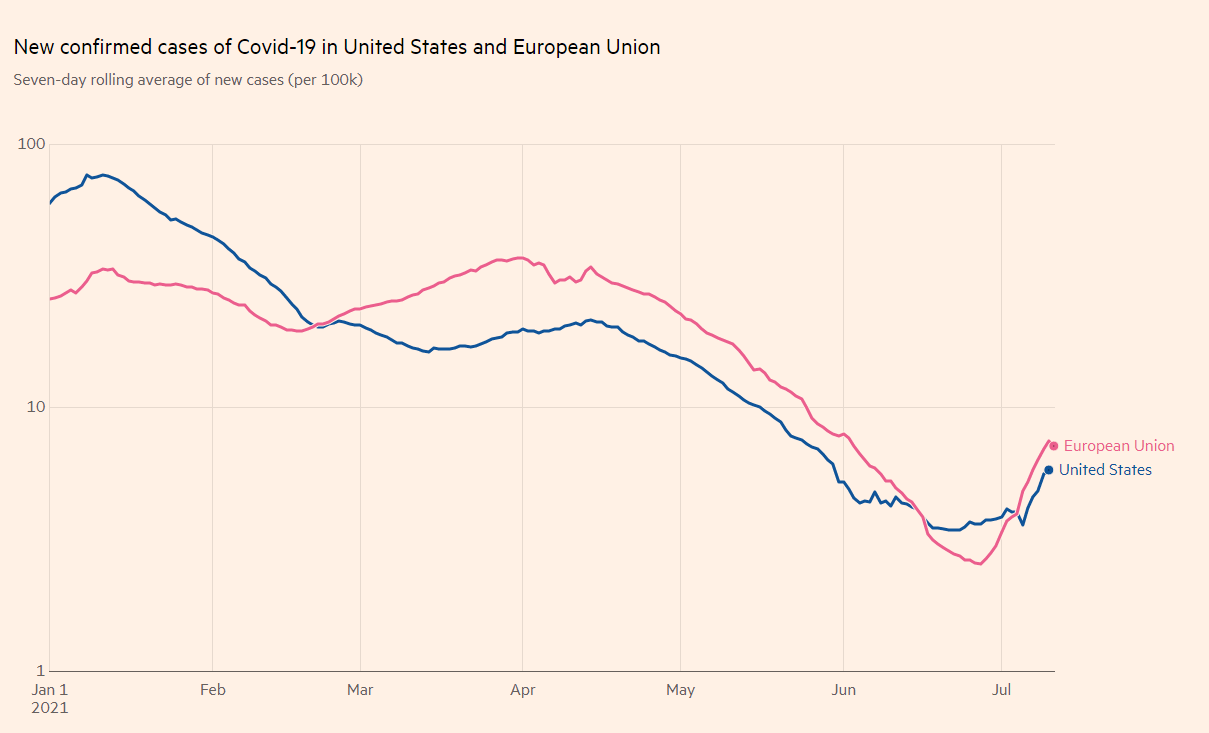

Heads bears win, tails bulls lose – the highly transmissible Delta coronavirus variant is spreading on both sides of the Atlantic, but it for EUR/USD, it clearly means a downside move. Why?

The euro had been benefiting from the pickup in Europe's vaccination scheme and the gradual reopening ahead of the summer. Catching up on immunization meant an increase in the common currency's value. However, the recent outbreak poses a risk and threatens to ruin holidays at the beach.

After Spain and Portugal led the upswing, the Netherlands reported a leap of 800% in coronavirus cases, and French President Emmanual Macron is set to address the nation. With most of the vulnerable population already vaccinated – and jabbing moving fast – this wave will likely have a more limited impact on hospitals and may be short-lived. Nevertheless, it is a setback.

On the other side of the pond, infections are up against some 60% in America. As it comes from a low base and is limited to specific parts of smaller states, for now, markets are not paying full attention. That may change and support the dollar. Why? The greenback is a safe haven sought in times of trouble. Overall, Delta is a win-win for the dollar.

See Delta Doom is set to storm America, the dollar could emerge as top dog

Source: FT

At least on Monday, EUR/USD may also suffer from the divergence in monetary policy. European Central Bank President Christine Lagarde gave an interview over the weekend, saying that forward guidance will change in the upcoming July 22 meeting, as part of the ECB's new framework. More importantly, Lagarde hinted that the bank's bond-buying scheme could be extended beyond March 2022, albeit in a new format.

These are far clearer words than her message on Thursday when she presented the ECB's new policy and point to more support for longer – euro negative. She also dismissed any words about withdrawing stimulus.

Lagarde's US counterpart Jerome Powell, Chair of the Federal Reserve, will testify on Wednesday amid growing uncertainty about the US economy. Recent figures such as jobless claims and business surveys have been somewhat weaker than expected.

Ahead of his public appearance, inflation data for June is awaited on Tuesday. The economic calendar is pointing to softer price rises, potentially allowing the dollar to fall. However, that may wait for Tuesday, while the greenback potentially gains ground on Monday.

US Consumer Price Index June Preview: Has inflation peaked?

Overall., EUR/USD has room to extend its falls at the beginning of the new week.

EUR/USD Technical Analysis

Momentum on the four-hour chart has turned positive, but euro/dollar remains has failed to top the 100 Simple Moving Average. It is sliding toward the 50 SMA, which hits that price at 1.1848 at the time of writing.

Further support awaits at 1.1825, a support line from last week, followed by 1.1808, a cushion from early in the month. The multi-month trough of 1.1781 is next.

Some resistance is at 1.1880, the daily high, followed by 1.1890, which was a swing high last week. Further above, 1.19 awaits EUR/USD bulls.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.1100, looks to post weekly losses

EUR/USD continues to trade in a narrow range below 1.1100 and remains on track to end the week in negative territory. Earlier in the day, monthly PCE inflation data from the US came in line with the market expectation, failing to trigger a reaction.

GBP/USD struggles to find a foothold, trades near 1.3150

GBP/USD stays on the back foot and trades in negative territory at around 1.3150 on Friday. The US Dollar holds its ground following the July PCE inflation data and doesn't allow the pair to stage a rebound heading into the weekend.

Gold retreats toward $2,500 ahead of the weekend

Gold stays under modest bearish pressure and declines toward $2,500 in the American session on Friday. The 10-year US Treasury bond yield edges higher toward 3.9% after US PCE inflation data, causing XAU/USD to stretch lower.

Week ahead – Investors brace for NFP amid Fed rate cut speculation

Here comes another NFP week, with investors eagerly awaiting the results as they try to discern the size and pace of the Fed’s forthcoming rate cuts. The weaker than expected July numbers triggered market turbulence, instilling fears about a potential recession in the US.

Easing Eurozone inflation to back an ECB rate cut in September Premium

Eurostat will publish the preliminary estimate of the August Eurozone Harmonized Index of Consumer Prices on Friday, and the anticipated outcome will back up the case for another European Central Bank interest rate cut when policymakers meet in September.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.