The EUR/USD pair built on the previous session's modest rebound from 23-month lows and gained some traction at the start of a new trading week, unaffected by the fact that Spain's Prime Minister Pedro Sanchez will require support from smaller parties to maintain power. A modest US Dollar pullback, amid some repositioning trade ahead of this week's FOMC meeting and important macro data later this week, turned out to be one of the key factors driving the pair higher.

The greenback did get a minor lift during the early North-American session following the release of stronger than expected personal spending data, which recorded the strongest growth in nearly a decade and jumped 0.9% in March. Meanwhile, personal income came in weaker than expected, which coupled with steadily cooling core inflation reinforced expectations that the Fed will stick to its cautious stance and eventually kept a lid on any meaningful up-move for the buck.

The pair finally settled near the top end of its daily trading range, around a previous support break-point - near the 1.1185 region, and held steady through the Asian session on Tuesday as market participants now look forward to key Euro-zone/German economic data for fresh impetus. The flash version of the Euro-zone GDP print, scheduled for release at 09:00 GMT, is expected to show that the economic growth stood at 0.3% q/q during the first quarter of 2019. This along with the prelim German CPI figures for April will influence sentiment surrounding the shared currency and produce some meaningful trading opportunities.

The US economic docket highlights the release of Chicago PMI and the Conference Board's Consumer Confidence index, though seems unlikely to be a major game changer ahead of the latest FOMC monetary policy update on Wednesday and Friday's important release of the closely watched US monthly jobs report (NFP).

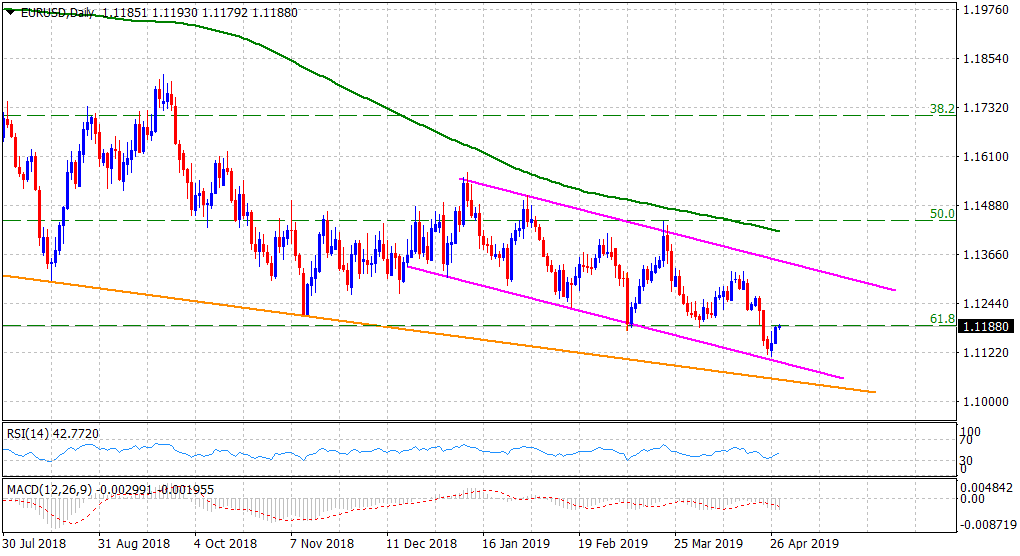

From a technical perspective, the recent bounce might still be categorized as corrective in nature and hence, any subsequent move beyond the 1.1200 handle seems more likely to run into some fresh supply near the 1.1220-25 supply zone. However, a sustained move beyond the mentioned hurdle might prompt some additional short-covering move and lift the pair further towards 1.1255-60 intermediate resistance en-route the 1.1300 round figure mark. The latter marks the top end of a short-term descending trend-channel formation and might now be a tough nut to crack for bullish traders.

On the flip side, immediate support is pegged near mid-1.1100s, below which the pair might head back towards challenging the 1.1100 round figure mark. A follow-through selling might turn the pair vulnerable to accelerate the slide further towards testing a medium-term descending trend-line support, extending from Aug./Nov. 2018 swing lows, currently near the 1.1060-55 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY pares gains toward 145.00 after Tokyo CPI inflation data

USD/JPY is paring back gains to head toward 145.00 in the Asian session on Friday, as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. However, intensifying risk flows on China's policy optimism support the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Avalanche rallies following launch of incentive program for developers

Avalanche announced the launch of Retro9000 on Thursday as part of its larger Avalanche9000 upgrade. Retro9000 is a program designed to support developers with up to $40 million in grants for building on the Avalanche testnet.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.