EUR/USD spot clocked a high of 1.1583 on Tuesday before falling back to 1.1514 on Wednesday. The pullback looks like a chart driven move… courtesy of the overbought RSI.

The stellar rally in the EUR/USD faces the moment of truth as Draghi will take centre stage today. The major part of the rally has been fueled by expectations that the ECB will announce the QE taper this year. A Bloomberg survey released earlier this month showed the ECB will hold fire this month and announce Taper in September. Investors also believe Draghi would remain non-committal today and avoid further appreciation in the EUR exchange rate.

Their fears are evident from the big improvement in the open interest (OI) in the out-of-the-money (OTM) put options.

| Call Summary vs 1.1555 (Source: CME) | |||||

| Total | ITM | OTM | |||

| OI | Chg | OI | Chg | OI | Chg |

| 33,851 | -28 | 21,597 | -122 | 12,254 | 94 |

| Put Summary vs 1.1555 (Source: CME) | |||||

| Total | ITM | OTM | |||

| OI | Chg | OI | Chg | OI | Chg |

| 34,604 | 1,057 | 738 | -386 | 33,866 | 1,443 |

The table above shows a big jump in the OI in the OTM put options. This, coupled with a drop in the OI in the call options suggests the investors are buying insurance against the long EUR/USD spot positions.

A similar jump in the OTM Puts OI was witnessed on 18th July as well.

EUR futures activity

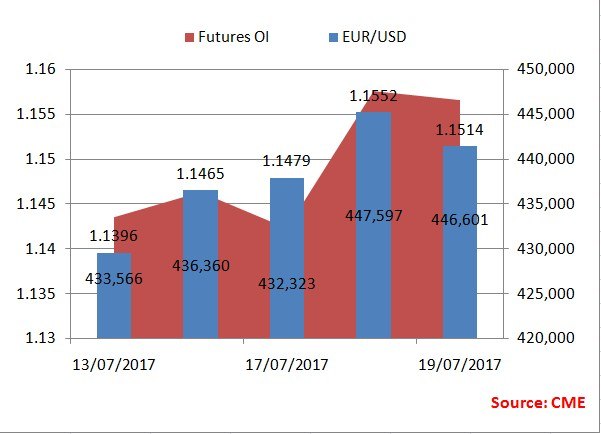

The preliminary data published by the CME show the open interest in the EUR futures dropped by 996 contracts. However, the OI has risen by 13K contracts if we take into account the fact that the total OI stood at 433,566 last Thursday.

Clearly the traders/investors are bullish on the EUR, but are opting for downside protection ahead of the ECB rate decision.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD corrects toward 0.6850, awaits US PCE Price Index

AUD/USD is falling back toward 0.6850 in Friday's Asian trading, reversing from near 19-month peak. A tepid US Dollar bounce drags the pair lower but the downside appears called by the latest Chinese stimulus measures, which boost risk sentiment ahead of US PCE data.

USD/JPY rebounds toward 146.00, as focus shifts to US PCE data

USD/JPY is bouncing back toward 146.00 in the Asian session on Friday even as Tokyo CPI inflation data keep hopes of BoJ rate hikes alive. Intensifying risk flows on China's policy optimism underpin the pair's renewed upside. The focus shifts to the US PCE inflation data.

Gold price consolidates below record high as traders await US PCE Price Index

Gold price climbed to a fresh all-time peak on Thursday amid dovish Fed expectations. The USD languished near the YTD low and shrugged off Thursday’s upbeat US data. The upbeat market mood caps the XAU/USD ahead of the key US PCE Price Index.

Bitcoin surges past $65,000, sets sights on $70,000

Bitcoin broke above its consolidation zone, signaling a potential bullish move ahead. At the same time, Ethereum is finding support at a key level, hinting at an upcoming rally. In contrast, Ripple consolidates between its crucial levels, indicating a period of indecision among traders.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.