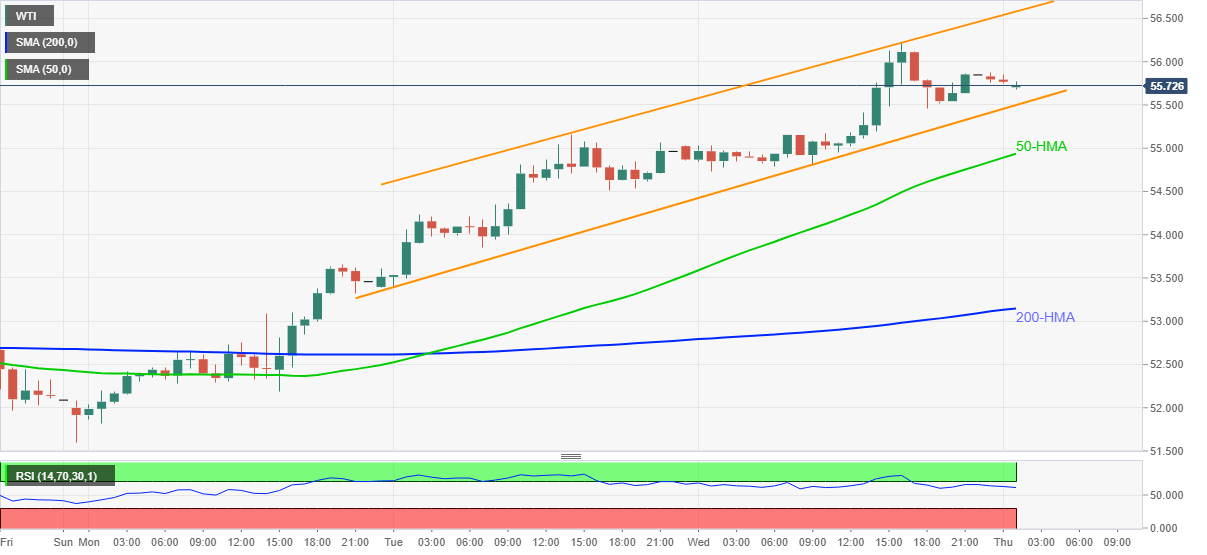

WTI Price Analysis: Eases below $56.00 inside short-term rising channel

|

- WTI recedes from intraday high while keeping mild gains.

- Bullish chart pattern, sustained trading above key HMAs and strong RSI favor buyers.

- Mid-January 2020 low lures the bulls beyond trend channel resistance.

WTI drops to $55.72 while trimming the initial Asian session gains to +0.17% on a day during early Thursday. Even so, the black gold stays positive for the fourth consecutive day while taking rounds to the highest since late January 2020 levels.

Also portraying the strength of the energy benchmark is the three-day-old rising channel and the quote’s successful trading above the key Hourly Moving Averages (HMAs) amid strong RSI conditions.

As a result, the latest pullback is likely to stop around the stated channel’s support line near $55.50. Though, any further downside will not hesitate to probe the 50-HMA level of $54.93.

It should, however, be noted that any further weakness below $54.93 should drag WTI towards 200-HMA, currently around $53.15.

Meanwhile, the recent multi-month high of around $56.25 and the upper line of the channel near $56.60 can entertain intraday buyers of the oil benchmark.

During further upside past-$56.60, January 15, 2020 low near $57.42 will be the key to watch.

WTI hourly chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.