USD/ZAR Price Analysis: Rises 0.30%, gains could be short-lived

|

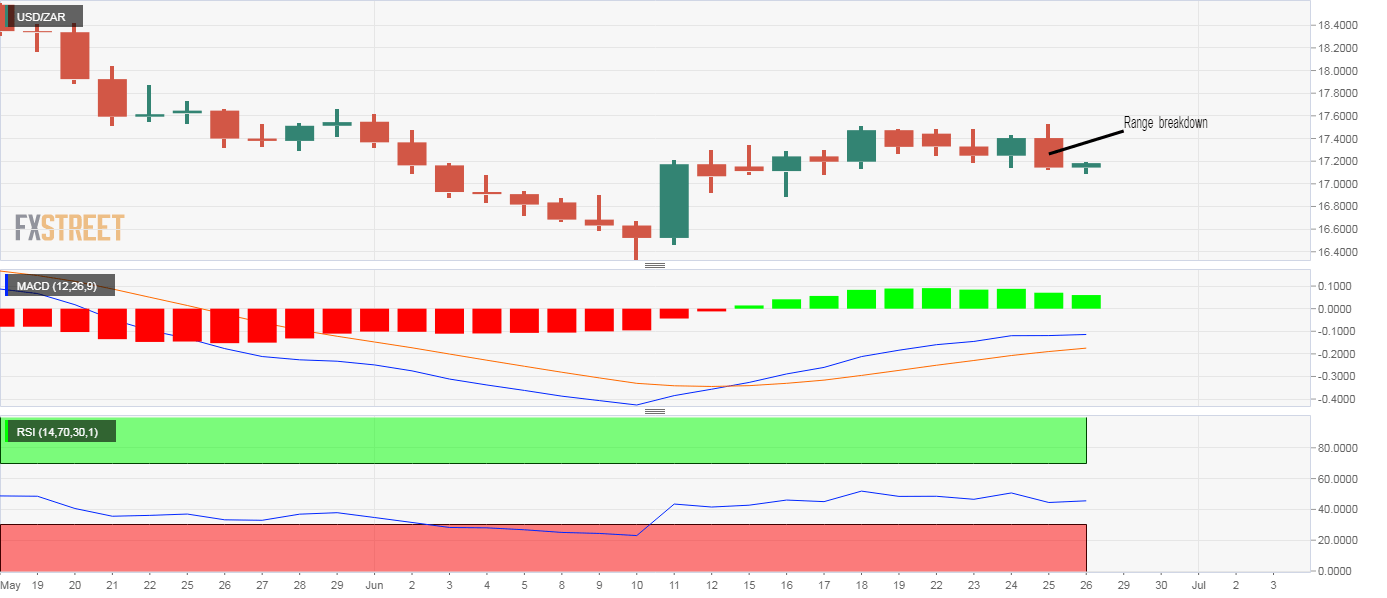

- USD/ZAR looks south with a range breakdown on the daily chart.

- Key indicators favor a test of deeper support levels.

USD/ZAR is trading at 17.1773 at press time, representing a 0.30% gain on the day.

The bounce could be short-lived, as the daily chart studies are reporting bearish conditions. To start with, Thursday's 1.34% decline, the biggest single-day decline since May 21, confirmed a downside break of the narrow trading range of 17.1670-17.50.

The range breakdown suggests the bounce from the June 10 low of 16.3204 has ended and the bears have regained control. In addition, the 14-day relative strength index is hovering in bearish territory below 50 and the MACD histogram is beginning to chart lower bars above the zero line, a sign of weakening of upward momentum.

The pair risks falling to the psychological support of 17.00, which, if breached, would shift the focus to 16.3204. A close above Thursday's high of 17.5303 is needed to restore the bullish view.

Daily chart

Trend: Bearish

Technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.