USD/JPY Price Analysis: Strong resistance at 108.00

|

- USD/JPY rebound from 106.60 area has stalled below 108.00

- The dollar faces resistance at the 50-day SMA and previous tops in the 108.00/05 area

US dollar’s mild rebound from the mid-range of 106.00 last week has been halted at 108.00, where the pair seems to be facing an important resistance area.

The USD/JPY picked up earlier this week, with the yen somewhat weaker amid a moderate recovery on risk appetite. Initial plans to ease coronavirus restrictions in the major economies have boosted hopes of an economic recovery which fuelled riskier assets against the safe-haven yen. The pair, however, has been unable to extend past 108.00, and it has remained practically flat over the last sessions.

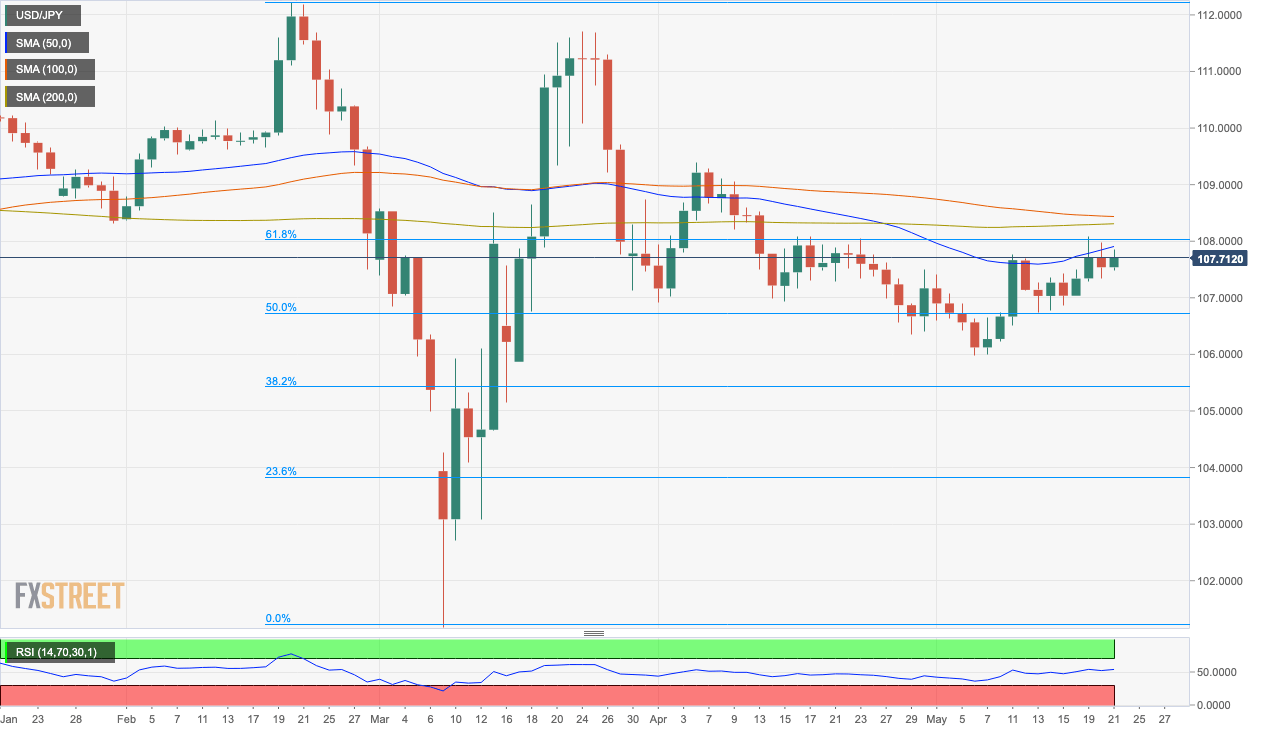

The daily chart shows the USD/JPY limited below an important resistance hurdle around 108.00. The 50-day SMA, which capped the pair on May 11 and 12, lies now at 107.95 and right above it, there is the 61.8% retracement of the February-March decline concurring with mid and late-April tops at 108.00/05.

The dollar should break above that area to increase bullish momentum. In that case, the next targets would be the 100 and 200-days SMA’s around 108.30/40 on its way towards 109.38 (April 4 high). On the downside, immediate support lies at 107.30 (May 19 low) and below there, 106.60 (May 13 low) and 106 (May 6 and 7 lows).

USD/JPY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.