US Dollar Index Price Analysis: Trims intraday losses but buyers are less hopeful below 91.00

|

- DXY recovers from the day’s low after the week-start gap-down.

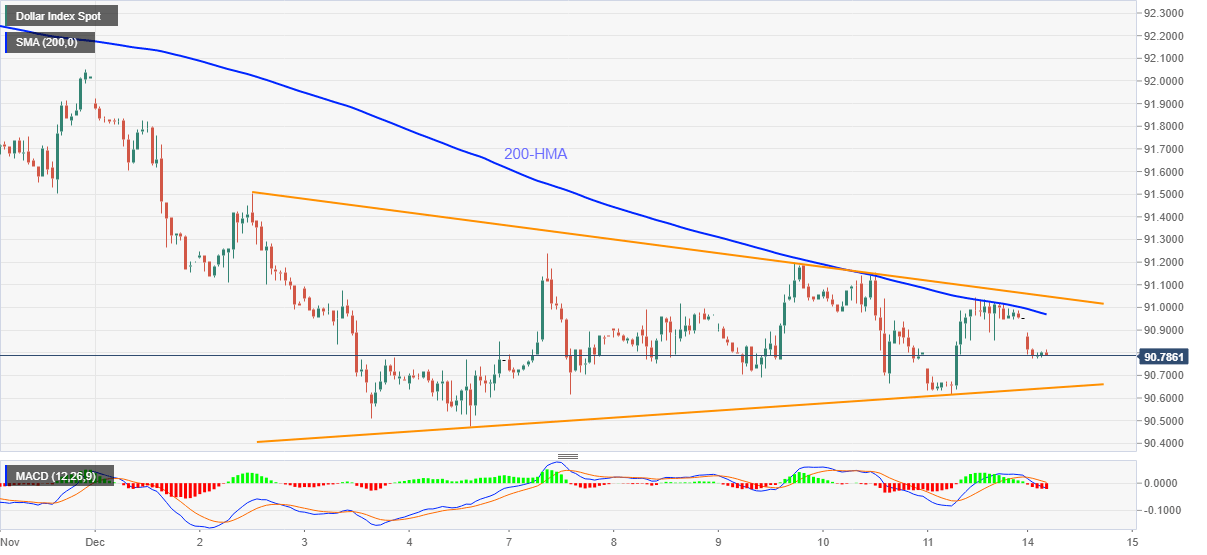

- Short-term symmetrical triangle restricts immediate moves.

- Bearish MACD, sustained trading below 200-HMA favor sellers.

US dollar index (DXY) marks a corrective pullback from 90.77 while taking rounds to 90.80 during the pre-European session on Monday. Even so, the greenback gauge prints 0.16% intraday losses while keeping the early-Asian gap to the south.

Not only the failure to fill the downside gap but sustained trading below 200-HMA amid bearish MACD also favor the sellers. However, the support line of an immediate triangle pattern, established from December 02, around 90.64, can challenge the US dollar bears.

In a case where the DXY sellers dominate past-90.64, the monthly bottom around 90.47 and the 90.00 psychological magnet can grab the market’s attention.

On the upside, the 200-HMA level of 90.96, followed by the stated triangle’s resistance, at 91.05 now, will keep the DXY bulls chained.

Though, a clear break to the north of 91.05 will not hesitate to challenge 91.50 before eyeing the monthly top near 91.90.

DXY hourly chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.