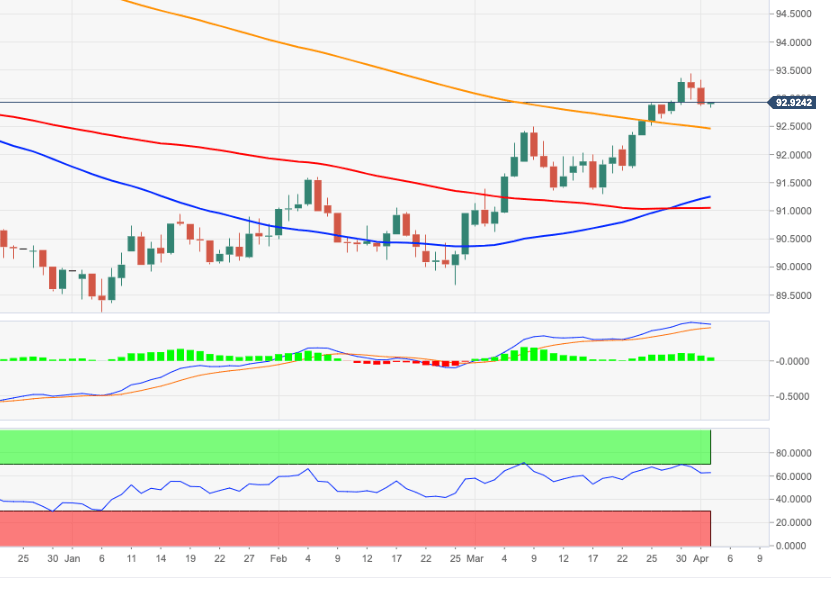

US Dollar Index Price Analysis: Further south comes in the 200-day SMA

|

- DXY extends the corrective downside to 92.85/80 band.

- Immediate contention is located at the 200-day SMA at 92.45.

The dollar extends the rejection from recent yearly highs near 93.50 and re-visits the 92.80 zone on Friday.

If the selling impulse gains further traction, then DXY could re-visit the key 200-day SMA in the mid-92.00s.

A convincing return to the area below the 200-day SMA should negate the ongoing near-term constructive stance.

DXY daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.