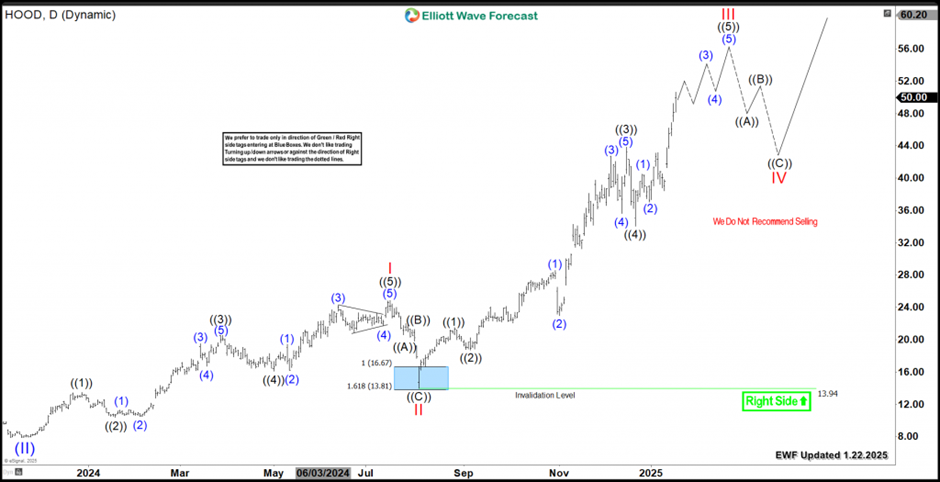

Robinhood (NASDAQ: HOOD) extension in Wave III above $50

|

Since our previous blog about Robinhood stock HOOD, the price tripled during a strong bullish upside move. Therefore, we’ll be looking at the daily Elliott Wave Structure and explain the current structure within the cycle.

The recent daily rally started in August 2024, HOOD established an impulsive 5 waves structure to the upside within wave III. In addition, it exceeded the 1.618 Fibonacci extension level $41 which confirmed the strong momentum within the 3rd wave. The current advance from 12/20/2024 low is proposed to be wave ((5)) of III as long as it’s holding the divergence in RSI. Consequently, the stock will be looking for more upside to finish a series of 3rd & 4th waves toward $52 – $56 before ending that cycle.

HOOD still has the potential of opening more upside above if the structure turns out to be a nest. In that case, the current move will be wave ((3)) of III and it will reach equal legs area at $63 – $82. In conclusion, we don’t recommend selling the stock as the overall structure for remains bullish and we only favor buying the daily pullbacks in 3 , 7 or 11 swings.

HOOD daily chart 1.22.2025

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.