RIVN Stock News: Rivian cools off after bullish start to the week

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

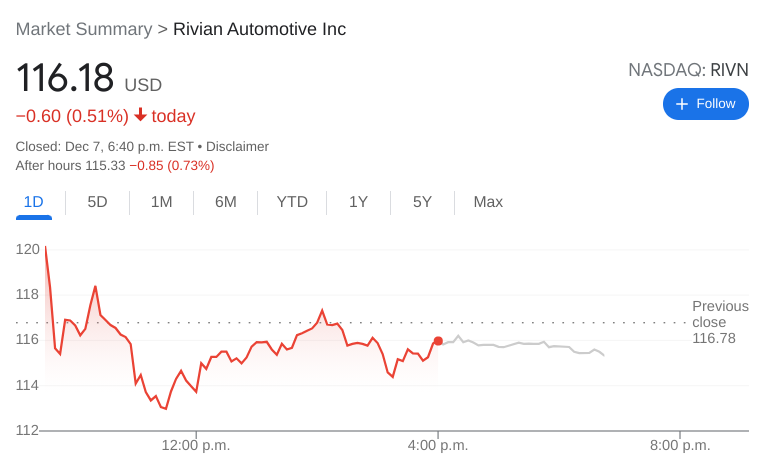

UPGRADE- NASDAQ:RIVN fell by 0.51% during Tuesday’s trading session.

- Tesla CEO Elon Musk is critical of the recent infrastructure bill.

- A new Rivian prototype is spotted at a supercharger station in San Diego.

NASDAQ:RIVN saw its stock cool off on Tuesday after receiving several bullish upgrades from Wall Street analysts on Monday. Shares of Rivian fell by 0.51% and closed the trading day at $116.18. The move lower came despite a broader market rally that saw the NASDAQ surge higher by 3.03% as the tech-heavy index recorded its best session since March. The rebound is notable after a long list of tech stocks were feeling pressure as of late, with high flying valuations being slashed down within a matter of days. The S&P 500 also gained 2.07% which was also a nine-month high for the benchmark index.

Stay up to speed with hot stocks' news!

Despite the electric vehicle industry remaining red-hot amongst investors, Tesla (NASDAQ:TSLA) CEO Elon Musk has spoken out about the recent infrastructure bill from the Biden administration. While Musk didn’t specifically have an issue with improving infrastructure in the country, he does take issue with the government spending so much money on improvements that will lead to exacerbated levels of traffic and congestion. Musk has suggested other forms of improvements that can be made such as tunnels and double decker highways.

Rivian stock forecast

Some exciting news surfaced for Rivian shareholders on Tuesday as well. The EV-related site InsideEVs.com posted a user submitted video of a brand new Rivian prototype called the R1S that was spotted charging in San Diego. The electric truck model appeared to be as large as some of its rivals including a Dodge Ram pickup truck that was parked nearby. Rivian is developing electric trucks for consumers, but much of the excitement around the company has to do with its last-mile delivery fleet it is producing for Amazon (NASDAQ:AMZN).

Like this article? Help us with some feedback by answering this survey:

- NASDAQ:RIVN fell by 0.51% during Tuesday’s trading session.

- Tesla CEO Elon Musk is critical of the recent infrastructure bill.

- A new Rivian prototype is spotted at a supercharger station in San Diego.

NASDAQ:RIVN saw its stock cool off on Tuesday after receiving several bullish upgrades from Wall Street analysts on Monday. Shares of Rivian fell by 0.51% and closed the trading day at $116.18. The move lower came despite a broader market rally that saw the NASDAQ surge higher by 3.03% as the tech-heavy index recorded its best session since March. The rebound is notable after a long list of tech stocks were feeling pressure as of late, with high flying valuations being slashed down within a matter of days. The S&P 500 also gained 2.07% which was also a nine-month high for the benchmark index.

Stay up to speed with hot stocks' news!

Despite the electric vehicle industry remaining red-hot amongst investors, Tesla (NASDAQ:TSLA) CEO Elon Musk has spoken out about the recent infrastructure bill from the Biden administration. While Musk didn’t specifically have an issue with improving infrastructure in the country, he does take issue with the government spending so much money on improvements that will lead to exacerbated levels of traffic and congestion. Musk has suggested other forms of improvements that can be made such as tunnels and double decker highways.

Rivian stock forecast

Some exciting news surfaced for Rivian shareholders on Tuesday as well. The EV-related site InsideEVs.com posted a user submitted video of a brand new Rivian prototype called the R1S that was spotted charging in San Diego. The electric truck model appeared to be as large as some of its rivals including a Dodge Ram pickup truck that was parked nearby. Rivian is developing electric trucks for consumers, but much of the excitement around the company has to do with its last-mile delivery fleet it is producing for Amazon (NASDAQ:AMZN).

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.