Rivian Automotive Stock News and Forecast: RIVN keeps rallying, to the moon?

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- Rivian stock is still waiting for its first down day, rally continues on Tuesday.

- RIVN shares surge roughly 30% in the first two trading days of the week.

- Rivian so far the biggest IPO in the world in 2021.

Update November 17: Rivian (RIVN) extended its rally into the fifth straight day on Tuesday, adding 15% on the day to settle at $172.01. In doing so, the stock has more than doubled up its value since last week’s trading debut. The company recorded a 121% gain from the IPO offering price of $78. Investors remained highly optimistic on the Electric Vehicle (EV) sector, awaiting to cash out on a new stock apart from the industry leader Tesla Inc.

Rivian (RIVN) stock news

The valuation of this one is beginning to raise important questions about the long-term viability of this bull market with the EV space especially seeing some high valuations. Tesla popped above a $1 trillion market cap but is back below it now. Lucid Motors (LCID) is worth more than Ford (F), and Rivian (RIVN) is worth more than Ford (F), GM, Honda, BMW, Volkwagen and a few others.

There is no doubt the electric vehicle sector is one of the hottest investment spaces right now and is attracting huge inflows. Witness the surge in demand for Rivian shares as the investor roadshow progressed. The initial IPO price was slated to be $57 to $62. This was then revised up to $72-74 before the IPO eventually listed at $78. Now within three trading sessions, Rivian (RIVN) shares have nearly doubled from what seemed a hefty valuation in the first place. Even Cathie Wood said she would not invest, and she has been a notable investor in some high-growth companies.

Seperately, Tianjin Motors Dies is forced to issue a clarification this morning as its shares surge in Asia. The company, which is involved in research and design of body cover dies, saw its shares surge 9% today. The company said its partnership with Rivian (RIVN) has not yet generated revenue, and it has signed a total of $11.8 million worth of orders from Rivian between 2019 and 2021. Those orders are still in production.

Rivian (RIVN) stock forecast

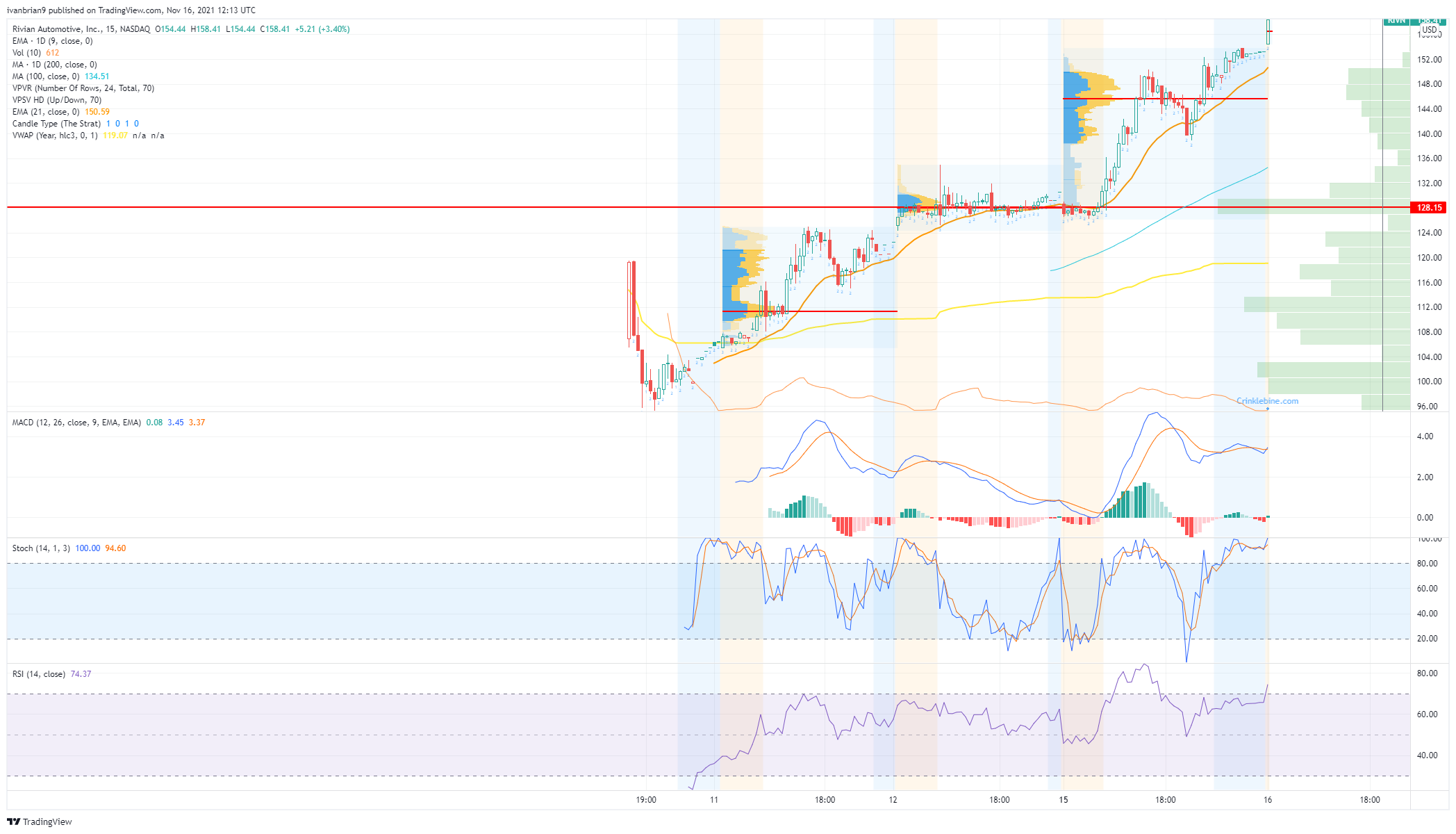

The only way is up with more gains in Tuesday's premarket. Demand for this one still has not been sated from retail and possibly some laggard institutional investors. Given the social media commentary, we suspect most of this late surge is retail based. Eventually, interest will start to slow. For now, strong support is at $127.86, which is the point of control since the IPO. This is the price with the highest amount of volume. Volume always equals stability. Breaking below $144 sees volume thin out until the point of control, so a move could accelerate through this vaccum. Below $128 there is a second volume gap to $112.

RIVN 1-day chart

Previous updates

Update: Rivian (RIVN) is up over 15% ahead of Wall Street's close, trading above $172.00 per share. Less than a week after the IPO, Rivian is up roughly 65%, from its initial price of $106.75. Investors' enthusiasm for the American electric vehicle automaker remains intact. The better performance of Wall Street further supported the share, after a soft start to the week. At the time being, the Nasdaq Composite is up 122 points or 0.77%.

Update: Rivian (RIVN) stock surged another 14 % on Monday as the US electric vehicle manufacturer sees its stock nearly up 100% from the IPO price after just four full days of trading. While many are questioning the valuation of a company in its infancy (including ourselves), this one is pure momentum. Eventually, the music will stop or slow, so just be prepared for when it does. Right now though, momentum is there to be used for speculation, and the retail crowd is loving this one.

- Rivian stock is still waiting for its first down day, rally continues on Tuesday.

- RIVN shares surge roughly 30% in the first two trading days of the week.

- Rivian so far the biggest IPO in the world in 2021.

Update November 17: Rivian (RIVN) extended its rally into the fifth straight day on Tuesday, adding 15% on the day to settle at $172.01. In doing so, the stock has more than doubled up its value since last week’s trading debut. The company recorded a 121% gain from the IPO offering price of $78. Investors remained highly optimistic on the Electric Vehicle (EV) sector, awaiting to cash out on a new stock apart from the industry leader Tesla Inc.

Rivian (RIVN) stock news

The valuation of this one is beginning to raise important questions about the long-term viability of this bull market with the EV space especially seeing some high valuations. Tesla popped above a $1 trillion market cap but is back below it now. Lucid Motors (LCID) is worth more than Ford (F), and Rivian (RIVN) is worth more than Ford (F), GM, Honda, BMW, Volkwagen and a few others.

There is no doubt the electric vehicle sector is one of the hottest investment spaces right now and is attracting huge inflows. Witness the surge in demand for Rivian shares as the investor roadshow progressed. The initial IPO price was slated to be $57 to $62. This was then revised up to $72-74 before the IPO eventually listed at $78. Now within three trading sessions, Rivian (RIVN) shares have nearly doubled from what seemed a hefty valuation in the first place. Even Cathie Wood said she would not invest, and she has been a notable investor in some high-growth companies.

Seperately, Tianjin Motors Dies is forced to issue a clarification this morning as its shares surge in Asia. The company, which is involved in research and design of body cover dies, saw its shares surge 9% today. The company said its partnership with Rivian (RIVN) has not yet generated revenue, and it has signed a total of $11.8 million worth of orders from Rivian between 2019 and 2021. Those orders are still in production.

Rivian (RIVN) stock forecast

The only way is up with more gains in Tuesday's premarket. Demand for this one still has not been sated from retail and possibly some laggard institutional investors. Given the social media commentary, we suspect most of this late surge is retail based. Eventually, interest will start to slow. For now, strong support is at $127.86, which is the point of control since the IPO. This is the price with the highest amount of volume. Volume always equals stability. Breaking below $144 sees volume thin out until the point of control, so a move could accelerate through this vaccum. Below $128 there is a second volume gap to $112.

RIVN 1-day chart

Previous updates

Update: Rivian (RIVN) is up over 15% ahead of Wall Street's close, trading above $172.00 per share. Less than a week after the IPO, Rivian is up roughly 65%, from its initial price of $106.75. Investors' enthusiasm for the American electric vehicle automaker remains intact. The better performance of Wall Street further supported the share, after a soft start to the week. At the time being, the Nasdaq Composite is up 122 points or 0.77%.

Update: Rivian (RIVN) stock surged another 14 % on Monday as the US electric vehicle manufacturer sees its stock nearly up 100% from the IPO price after just four full days of trading. While many are questioning the valuation of a company in its infancy (including ourselves), this one is pure momentum. Eventually, the music will stop or slow, so just be prepared for when it does. Right now though, momentum is there to be used for speculation, and the retail crowd is loving this one.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.