QBE Insurance Group Limited Elliott Wave forecast [Video]

|![QBE Insurance Group Limited Elliott Wave forecast [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/stock-market-chart-with-pen-23290418_Small.jpg)

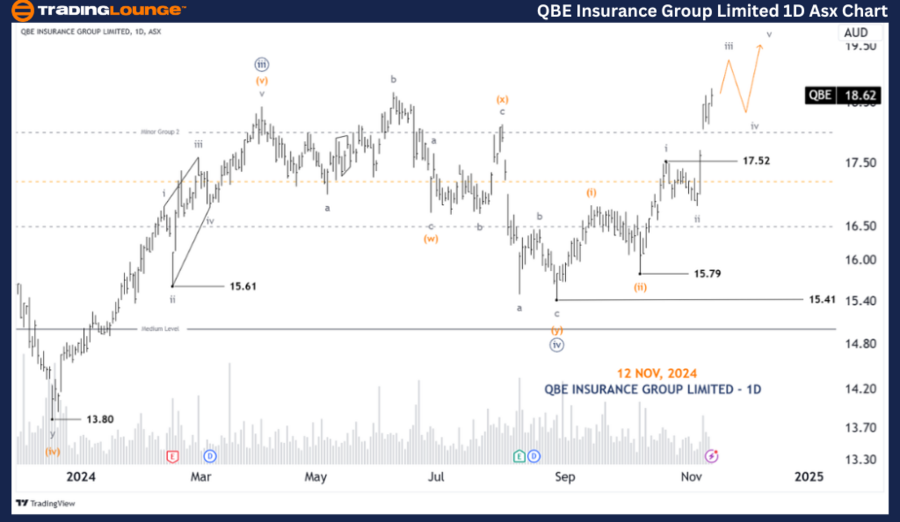

ASX: QBE Insurance Group Limited Elliott Wave technical analysis

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with QBE INSURANCE GROUP LIMITED – QBE. We see QBE continuing to rise with wave (iii)-orange, and then continuing with wave (v)-orange.

ASX: QBE one-day chart (semilog scale) analysis

Function: Major trend (Subminuette degree, gray).

Mode: Motive.

Structure: Impulse.

Position: Wave iii-grey of Wave (iii)-orange of Wave ((v))-navy.

Details: Wave iii-grey of wave (iii)-orange of wave ((v))-navy is unfolding to push much higher. While price must remain above 17.52 to maintain this view, because wave 4 cannot overlap wave 1.

Invalidation point: 17.52.

ASX: QBE four-hour chart analysis

Function: Major trend (Minuette degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave iii-grey of Wave (iii)-orange.

Details: Since the low at 15.79, wave (iii)-orange is extending, it is subdividing into wave i-grey to wave iii-grey. Basically wave iii-grey can still continue to push higher, also be ready for a push back lower than wave iv-grey after that. After wave iv-grey ends, wave v-grey will continue to complete its job of pushing higher. While wave iv-grey cannot move lower than 17.52 to maintain this view.

Invalidation point: 17.52.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: QBE INSURANCE GROUP LIMITED – QBE aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

QBE Insurance Group Limited Elliott Wave forecast [Video]

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.