Powell speech: Patience stance on policy is still warranted

|

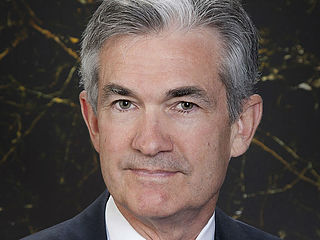

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, is delivering his remarks on the monetary policy outlook with key quotes found below.

"Patient stance on policy is still warranted."

"Risks abroad have eased slightly. Chinese and European data have shown some improvement."

"The U.S. economy is supported by solid fundamentals. A healthy GDP growth is expected for the rest of 2019."

"Job growth has been stronger than expected, inflation has been somewhat weaker."

Related articles

FOMC keeps the target for fed funds rate unchanged in 2.25% - 2.5% range.

Following its 2-day meeting, the Federal Open Market Committee announced that it kept the benchmark interest rate unchanged at the target range of 2.25% - 2.5% in a widely expected decision.

USD/CAD a touch heavier despite benign FOMC, sticking to the script.

Markets were already positioned for a benign outcome and had been exiting dollar longs solely on the basis of recent data that aligns with the dovish stars. A rate cut is expected from the Fed in due course, but the key takeaway from today's statement is one of patience again - Fed is to stay patient on rates as the economy is solid and inflation is muted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.