Pound Sterling Price News and Forecast: GBP/USD signals caution as BoE takes spotlight

|

GBP/USD signals caution as BoE takes spotlight

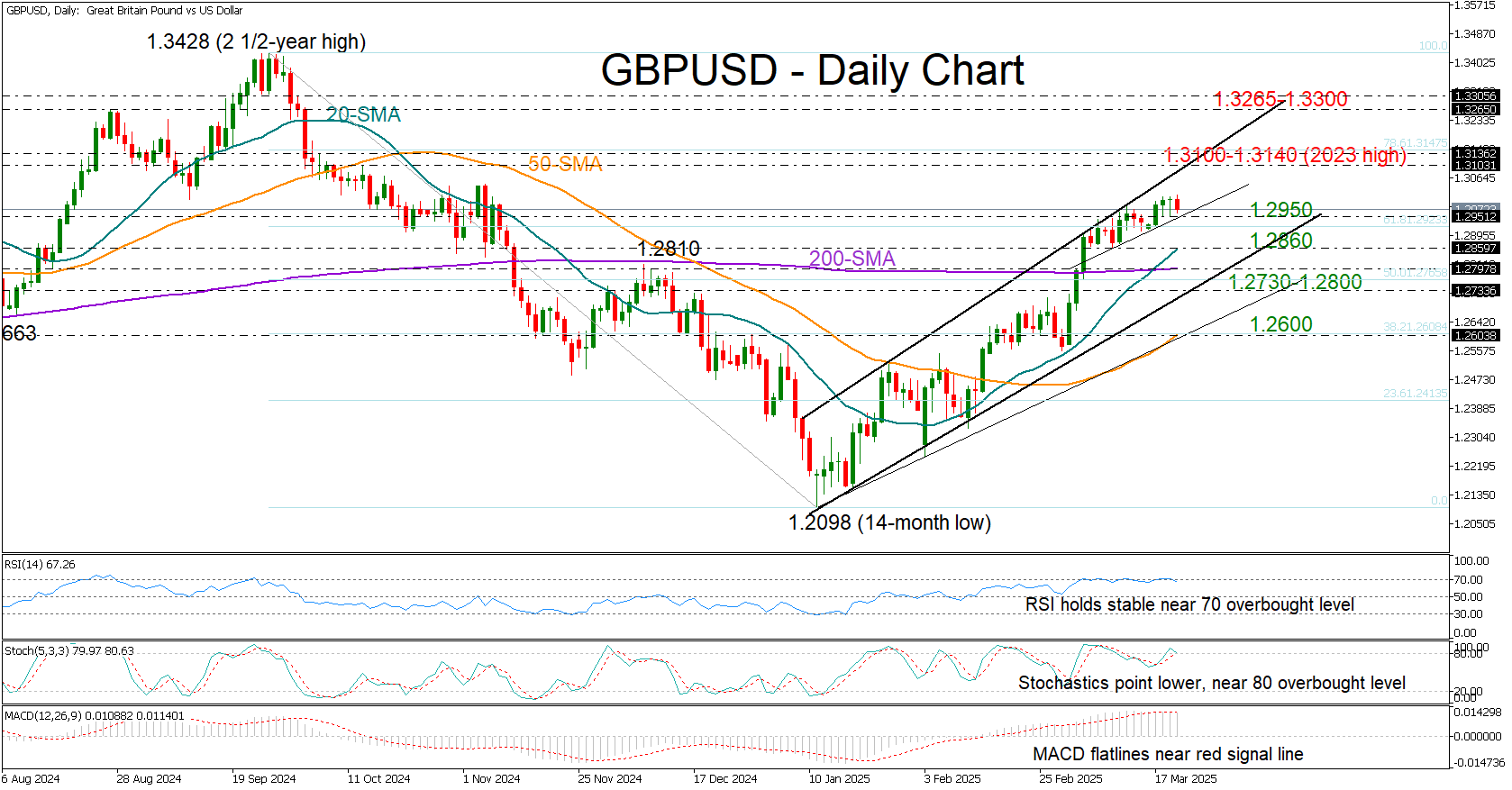

GBPUSD made a modest push into the 1.3000 area following the FOMC policy meeting on Wednesday, which kept the door open for rate cuts amid ongoing uncertainty about the US economic outlook.

The Bank of England is next on the calendar today, and the pair is currently trading moderately lower at 1.2964 after UK claimant counts jumped unexpectedly in February. While the central bank is widely expected to hold rates steady, any shifts in its communication tone in response to trade and geopolitical risks could generate fresh volatility. Read more...

GBP/USD Forecast: Pound Sterling fails to attract buyers ahead of BoE

GBP/USD stays on the back foot and trades in negative territory below 1.3000 in the European morning on Thursday as markets assess the latest data releases from the UK, while waiting for the Bank of England's (BoE) policy announcements.

The Federal Reserve left the policy rate unchanged at 4.25%-4.5% following the March meeting, as expected. The revised Summary of Economic Projections (SEP), also known as the dot plot, showed that policymakers still project a total of 50 basis points (bps) reduction in rates in 2025. Although the US Dollar (USD) struggled to gather strength with the immediate reaction, it managed to find a foothold during Fed Chairman Jerome Powell's press conference. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.