NVAX Stock Price: Novavax Inc.surging 34% after $1.6 billion COVID-19 vaccine candidate grant

|

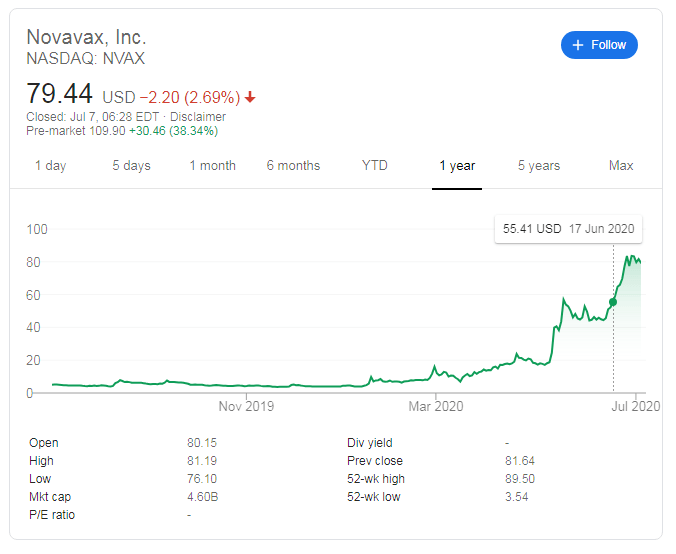

- NASDAQ: NVAX is trading at new record highs following a dramatic announcement.

- The US government has awarded Novavax $1.6 billion toward trialing and producing a coronavirus vaccine.

- Novavax may leapfrog its competition in the race against COVID-19.

Novavax Inc. (NASDAQ: NVAX) is trading at $107 in pre-market trading on Tuesday, up some 34% and above the 52-week high of $89.50. The Gaithersburg, Maryland-based firm that also operates in Sweden focuses on producing immunizations and has seen its stocks up some nearly 20 times from the 52-week low of $3.54 – before the most recent surge.

NVAX news

Novavax has been awarded a whopping $1.6 billion sum from the US federal government to develop and manufacture a COVID-19 vaccine candidate. The race to curb coronavirus continues at full force with Moderna, Oxford University, and other companies racing to find a cure.

The government investment is part of Washington's "Operation Warp Speed" project, intended to accelerate and discovering and distribution of a vaccine that would put COVID-19 to rest.

The funds will serve to fund the candidate coded NVX-CoV2373 including the Phase 3 trial and potentially to distribute them by late 2020 – an ambitious target. Nevertheless, the boost from the government may allow NASDAQ: NVAX to bypass the fierce competition.

Phase 1/2 consists of 130 healthy participants and was launched in Australia in May. Results are due out by late July. The third phase is larger, with 30,000 subjects.

Broader markets are set to open lower on Tuesday after surging on Monday. Cooling down in Asian markets and concerns ahead of new COVID-19 statistics from Florida, Texas, and other states are weighing on sentiment.

The US is recording around 50,000 cases per day, with the positive test rate and hospitalizations also on the rise. On the other hand, the death rate has been decline.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.