Netflix Stock (NFLX) Elliott Wave farecasting the path after the wave

|

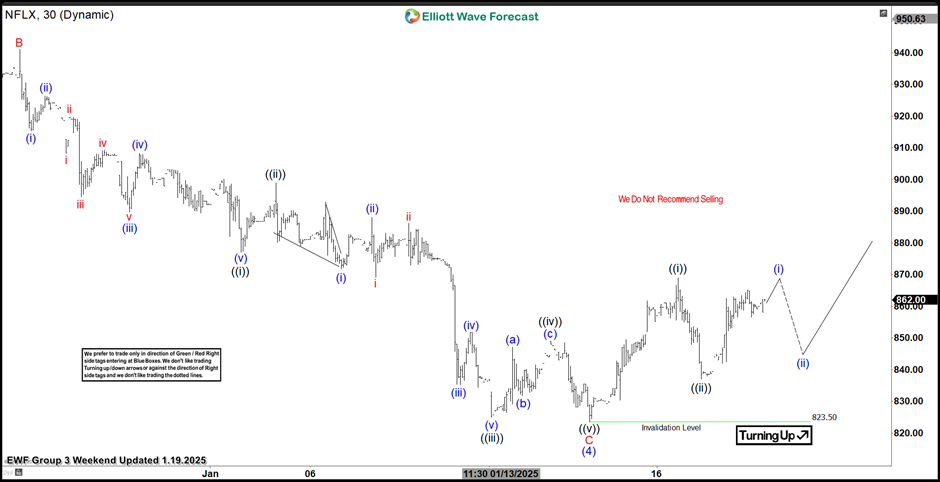

In this technical article we’re going to take a quick look at the Elliott Wave charts of Netflix Stock (NFLX), published in members area of the website. As our members are aware, NFLX recently completed a correction against the 583.7 low. We saw a clear 3-wave pullback, wave (4), followed by the expected rally. In this post, we will explain the Elliott Wave count in detail.

NFLX H1 weekend 01.19.2025

The current view suggests that Netflix stock completed a 3-wave pullback from the peak to the low, labeled as wave (4) blue. A rally followed from this low, appearing impulsive. We have labeled this short-term cycle as wave ((i)) black, marking the start of a new bullish cycle. We expect Netflix stock to continue attracting intraday buyers in 3, 7, and 11 swings, as long as the price stays above ((ii)), and more importantly, above the (4) blue low of 823.5.

NFLX H1 post-market 01.21.2025

Netflix held above the 823.5 low as expected and made a sharp rally toward new highs. The structure from the 823.5 low looks impulsive. We believe this rally is wave ((iii)) of 3, known among Elliott Wave practitioners as the strongest wave. At some point, we expect a 3-wave pullback in wave 4 (red), which should present new buying opportunities.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.