Nasdaq futures lose ground as Fed's Brainard turns from dove to hawk and spikes yields

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- Nasdaq futures close sharply lower on Tuesday, down 2.2%.

- NASDAQ 100 hit by rising bond yields and hawkish central bankers.

- The main tech index futures losing more ground on Wednesday.

The Nasdaq futures contract was once again the laggard on Tuesday, closing down over 2%. The S&P 500 was down 1.2% while the Dow Jones futures were down 0.8%.

Also read: GGPI fails to hold gains from Hertz partnership

Nasdaq futures news: Brainard hits high-growth sectors

The hawkish comments from Fed speaker Lael Brainard sent bond yields sharply higher on Tuesday and that had obvious knock-on effects for equities. The Nasdaq futures always have the most to lose in the face of rising yields and so it proved. In particular, Brainard said “It is of paramount importance to get inflation down. We will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” She said the Fed balance sheet is expected “to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017-19.” That last comment was the real kicker for equities as bond yields spiked.

Another Fed speaker, this time Mary Daly took to the airwaves later and added to the hawkish stance. Both Brainard and Daly would usually be associated with dovish outlooks (lower, less aggressive interest rates). That led yields higher and put further likelihood of a nailed-on 50bps rate hike in May.

Nasdaq futures forecast: Weakening momentum

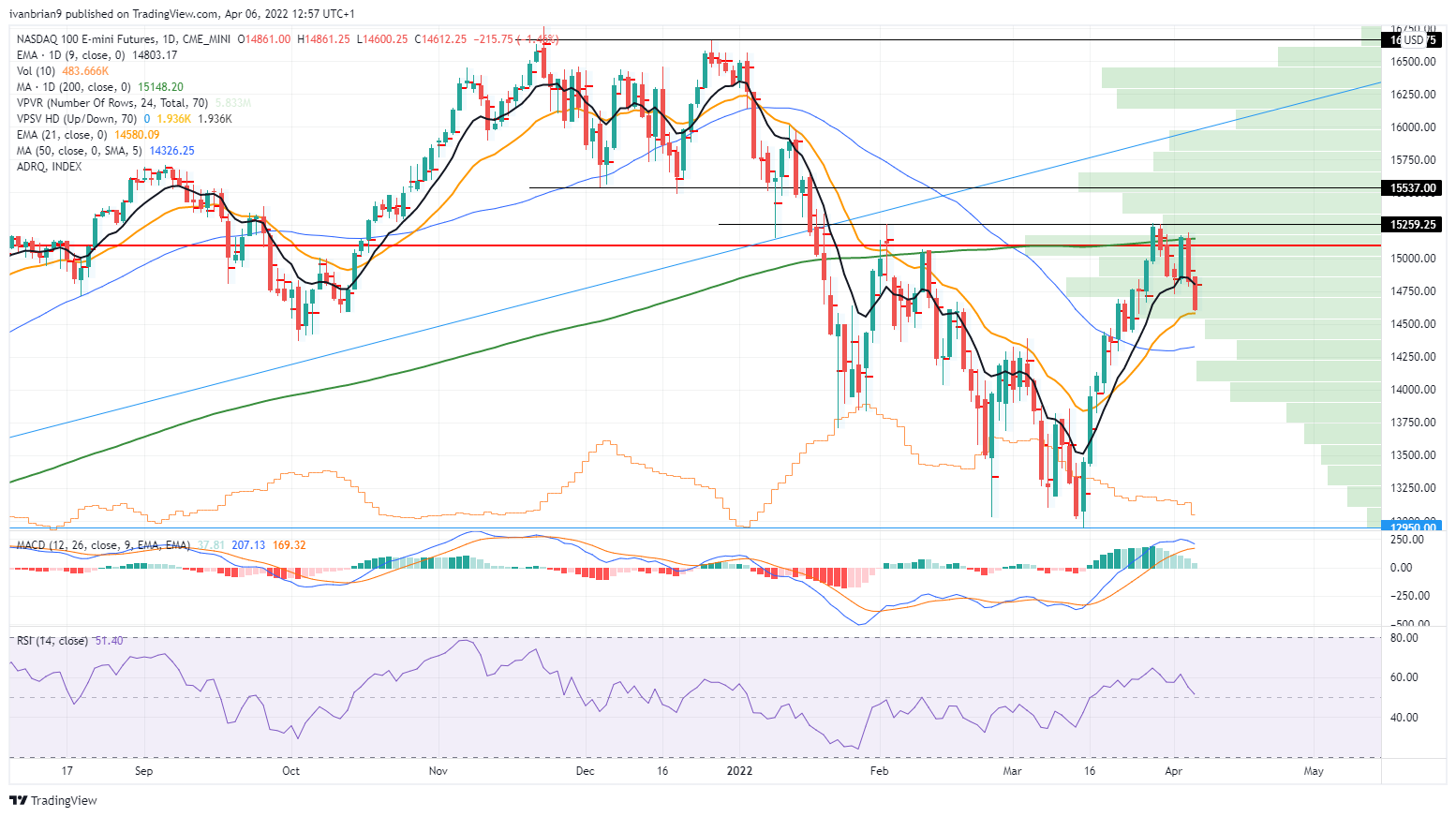

We continue to see a worsening flow-related outlook for the NASDAQ 100. We identified weakening momentum across corporate buybacks entering blackout and weakening demand from trend-following funds as well as fund managers now being slightly overweight equities. The repeated failure to break 15,259 showed the slowing momentum. This was a strong resistance area in terms of volume and the 200-day moving average. Failure has led to the current declines with macro factors backing up the move.

Nasdaq futures chart, daily

Taking a closer look at the hourly level we see 14,600 as support for Nasdaq futures. A break will target 14,447. The 15,259 mark is also the key short-term pivot. Remaining below this level keeps the Nasdaq futures bearish in the short term.

Nasdaq futures chart, hourly

- Nasdaq futures close sharply lower on Tuesday, down 2.2%.

- NASDAQ 100 hit by rising bond yields and hawkish central bankers.

- The main tech index futures losing more ground on Wednesday.

The Nasdaq futures contract was once again the laggard on Tuesday, closing down over 2%. The S&P 500 was down 1.2% while the Dow Jones futures were down 0.8%.

Also read: GGPI fails to hold gains from Hertz partnership

Nasdaq futures news: Brainard hits high-growth sectors

The hawkish comments from Fed speaker Lael Brainard sent bond yields sharply higher on Tuesday and that had obvious knock-on effects for equities. The Nasdaq futures always have the most to lose in the face of rising yields and so it proved. In particular, Brainard said “It is of paramount importance to get inflation down. We will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” She said the Fed balance sheet is expected “to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017-19.” That last comment was the real kicker for equities as bond yields spiked.

Another Fed speaker, this time Mary Daly took to the airwaves later and added to the hawkish stance. Both Brainard and Daly would usually be associated with dovish outlooks (lower, less aggressive interest rates). That led yields higher and put further likelihood of a nailed-on 50bps rate hike in May.

Nasdaq futures forecast: Weakening momentum

We continue to see a worsening flow-related outlook for the NASDAQ 100. We identified weakening momentum across corporate buybacks entering blackout and weakening demand from trend-following funds as well as fund managers now being slightly overweight equities. The repeated failure to break 15,259 showed the slowing momentum. This was a strong resistance area in terms of volume and the 200-day moving average. Failure has led to the current declines with macro factors backing up the move.

Nasdaq futures chart, daily

Taking a closer look at the hourly level we see 14,600 as support for Nasdaq futures. A break will target 14,447. The 15,259 mark is also the key short-term pivot. Remaining below this level keeps the Nasdaq futures bearish in the short term.

Nasdaq futures chart, hourly

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.