MercadoLibre Inc. (MELI) Elliott Wave technical analysis [Video]

|![MercadoLibre Inc. (MELI) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/HangSeng/stock-market-38974104_Small.jpg)

MELI Elliott Wave Analysis Trading Lounge.

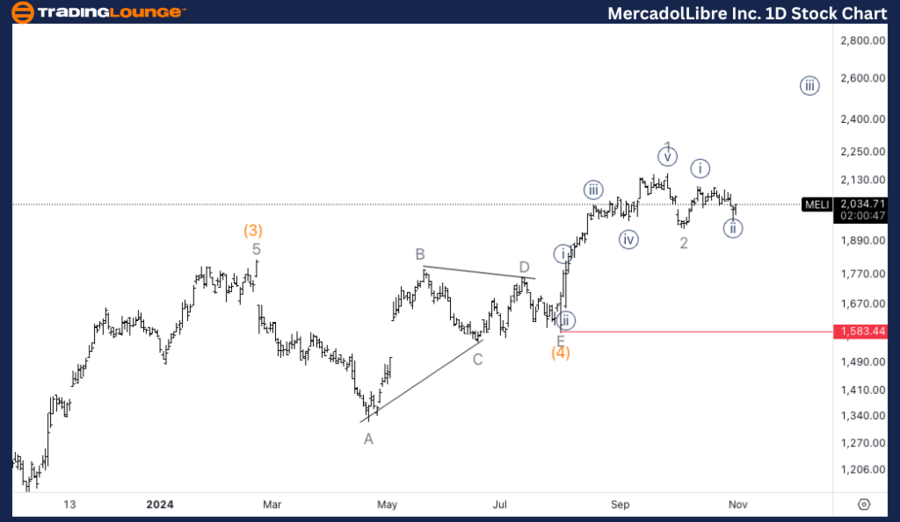

MercadoLibre Inc., (MELI) Daily Chart.

MELI Elliott Wave Technical Analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 3 of (5).

Direction: Upside in wave 3.

Details: Looking for continuation higher in wave (5) which given the length of wave 1 could easily reach the next TradingLevels at 3000$.

MercadoLibre Inc., (MELI) 1H Chart

MELI Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Positoin: Wave {ii} of 3.

Direction: Bottom in wave {ii}

Details: Looking for a wave {ii} as we seem to have what appears to be a triangle in wave (b), therefore a three wave move that fits the wave {ii} narrative.

This analysis of MercadoLibre Inc., (MELI) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

MELI Elliott Wave technical analysis – Daily chart

The daily chart analysis indicates that MELI is currently in wave 3 of (5), showing strong momentum. This wave is expected to continue moving higher, with targets possibly reaching $3000 based on the length of previous movements. The outlook remains bullish, and traders should watch for signs of further upside.

MELI Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, MELI appears to be in the corrective phase of wave {ii} of the ongoing advance. The formation of what looks like a triangle in wave (b) supports the narrative of a three-wave corrective structure. The expectation is for this correction to complete, setting up for a continuation higher in wave {iii}.

Technical analyst: Alessio Barretta.

MELI Elliott Wave technical analysis [Video]

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.