Mark Stock Price: Remark Holding inc may rise thanks to stake in firm co-founded by Dr. Oz, other reasons

|

- Remark Holdings is set to open moderately lower, alongside other stocks.

- A small stake in a company backed by Dr. Mehmet Oz may help the shares rise, especially if it reaches an IPO.

- Demand for coronavirus-related products could also boost NASDAQ:MARK.

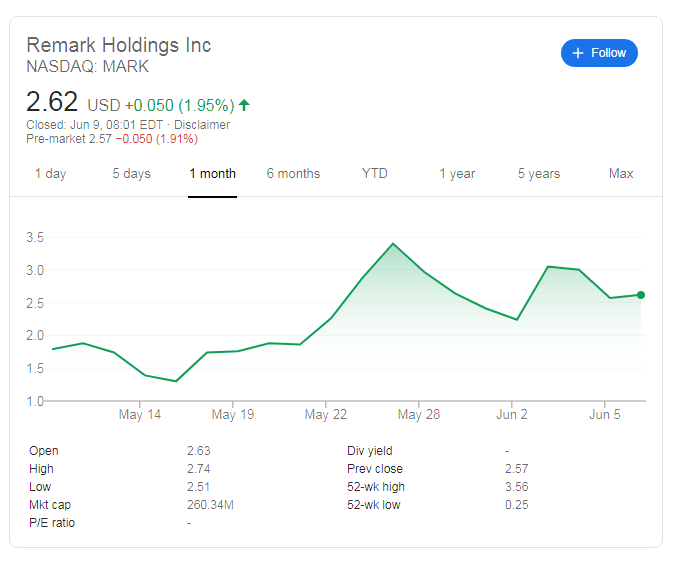

NASDAQ:MARK is trading around $2.50 in pre-market trading, marginally lower. That comes after Remark Holdings Inc advanced to $2.62 on Monday, alongside the broader stock market.

It has set a higher lows but also lower highs in recent days – a narrowing range in comparison to May's rally from around $0.50 to a peak close of $3.40. Where next for the stock?

Mark stock news

The S&P 500 is set for a correction after erasing all the losses for the year. Investors are becoming more cautious ahead of Wednesday's Federal Reserve decision. The central bank may opt to take a break after stimulating the economy in response to the coronavirus crisis, and the robust rally needs occasional breathers.

Another fear is the second wave of COVID-19 cases. While Europe, most of Asia, and the original US hotspots have the disease under control, cases are rising in other American states and in Latin America.

That may be favorable for Remark Holdings, which makes thermal scanners, such as those used to detect people who have a high fever. The kit, already in use in the company's home state of Nevada, joins other AI products that are in demand, especially in China.

The Las Vegas-based company also received a "strong-buy" recommendation from Zacks, potentially sending additional investors its way.

Another reason to rise could be Remark's stake at Sharecare. The startup firm was co-founded by celebrity doctor Mehmet Oz and is also backed by Oprah Winfrey and Sony. If the company goes for an IPO, Remark's holding in the small firm could further boost its worth.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.