Gold Price Forecast: XAUUSD heads to mitigate the hourly bullsh impulse

|

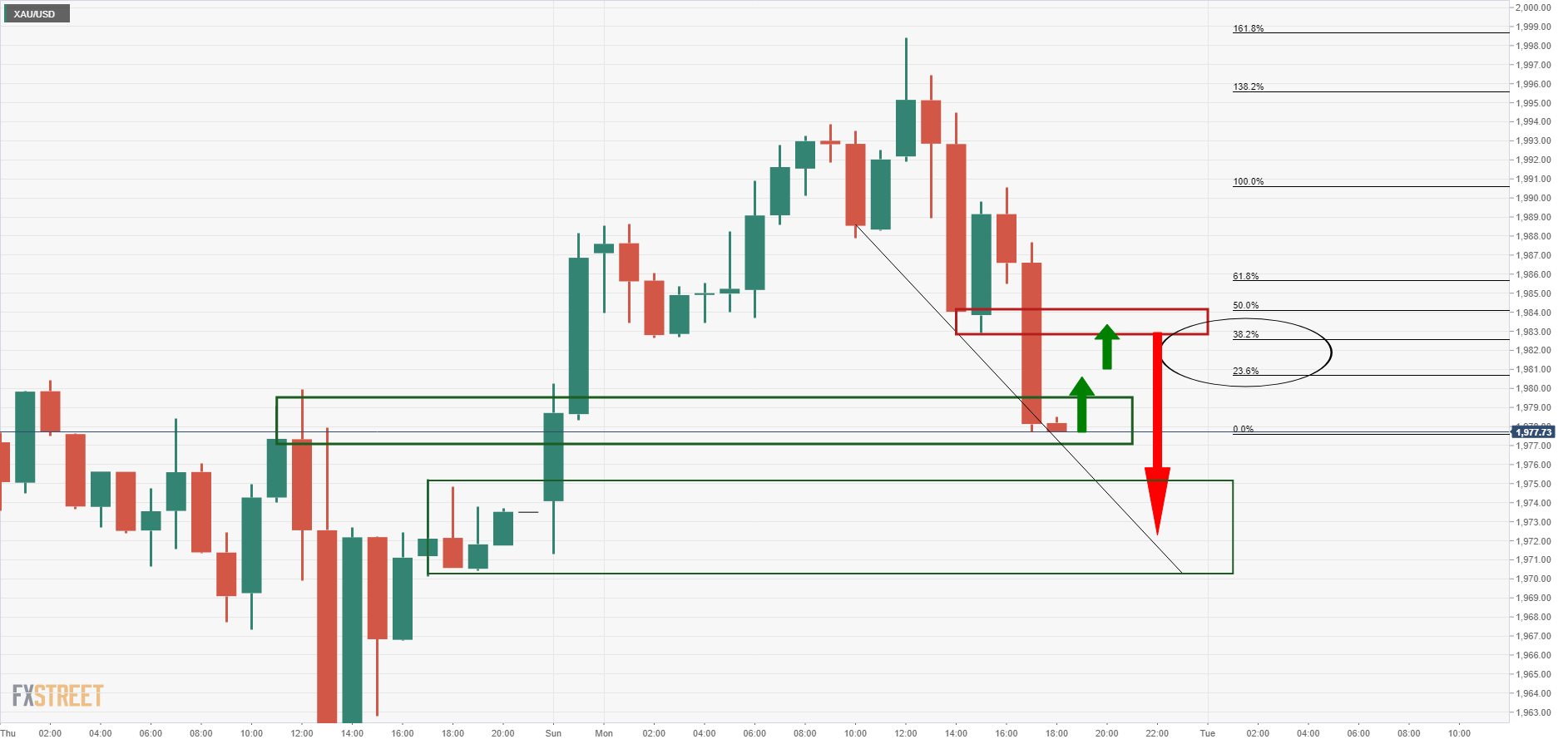

- The Gold Price continues to move in on a firm area of hourly support structure completing H1 H&S.

- Elevated inflation, recession risks and the Russia-Ukraine war continue to boost the precious meta's safe-haven appeal.

- This week's speech from Fed Chair Jerome Powell will keep precious metal traders on their toes.

Spot gold (XAU/USD) continued to fall in the New York session and is eyeing a test of the lows of 14 of April rally near $1,970. At the time of writing, the gold price remains up on the day by 0.2% at $1,977 and has travelled between a high of $1,998.46 and reached a low of $1,972.08 so far.

Rates moved higher again in a data-light session, and this has supported the US dollar. There was minimal data flow over the Easter break which left the focus on central bank sentiment and the US 10-year yields that rose 2.5bps to 2.853%.

Overall, the focus remains on the Federal Reserve and the central bank is signalling its intent to reach neutrality by year-end by starting an aggressive quantitative tightening regime. Outflows from gold markets have been scarce as participants are happy to retain some optionality against the Fed's stated plan amid growth concerns. This has underpinned the gold price despite a strong US dollar and gold price came within a whisker of hitting the $2,000 level on Monday.

Also read: Gold Price Forecast: XAUUSD needs to crack this level to take on the $2,000 mark

“We are of the view that the Fed is broadly in-sync with the move toward the vicinity of neutral by the end of 2022, with Governor Brainard supporting that view recently. Chair Powell's remarks in an IMF panel on the global economy will get the focus of the attention,” analysts at TD Securities explained.

"While the Fed is signalling its intent to reach neutrality by year-end, and to start an aggressive QT regime, outflows from gold markets have been scarce as participants are happy to retain some optionality against the Fed's stated plan amid growth concerns,” the analysts added.

Indeed, heads of both the IMF and World Bank have in recent days announced that global growth forecasts will be downgraded amid the stagflationary impulse of the Russo-Ukraine war. With news over the weekend pertaining to the Russo-Ukraine conflict negative (peace talks look on the verge of collapsing), geopolitical risk and ongoing demand for inflation/stagflation protection looks set to continue supporting gold.

Analysts also note stagflationary risks from China, with the country still battling a persistent Covid-19 outbreak and Shanghai still under strict lockdown, and in Europe, which is feeling the pressure to toughen energy sanctions on Russia.

Fed member James Bullard spoke on Monday and offered further insight on the outlook for Fed policy. Bullard is one of the bank's most hawkish and has called for interest rates to reach 3.0% this year.

US inflation is "far too high," he said on Monday, repeating his case for increasing interest rates to 3.5% by the end of the year to rein in inflation expectations and slow what are now 40-year-high inflation readings.

"What we need to do right now is get expeditiously to neutral and then go from there," Bullard said at a virtual event held by the Council on Foreign Relations, adding that he doesn't expect to need to raise rates by more than half a percentage point at any meeting.

He said that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that unemployment, now at 3.6%, will go below 3% this year.

Meanwhile, the mega event of the week will be a speech from Fed Chair Jerome Powell later this week, where he is expected to solidify expectations for a 50 bps rate hike at the coming Fed policy meeting.

Gold Technical Analysis

The price had moved in on a firm area of hourly support:

The price was expected to reset the prior lows as resistance and then mitigate the remainder of the price imbalance below targeting the $1,970s.

The price is making progress:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.