Gold Price Analysis: XAU/USD bulls seem tiring before $2,000

|

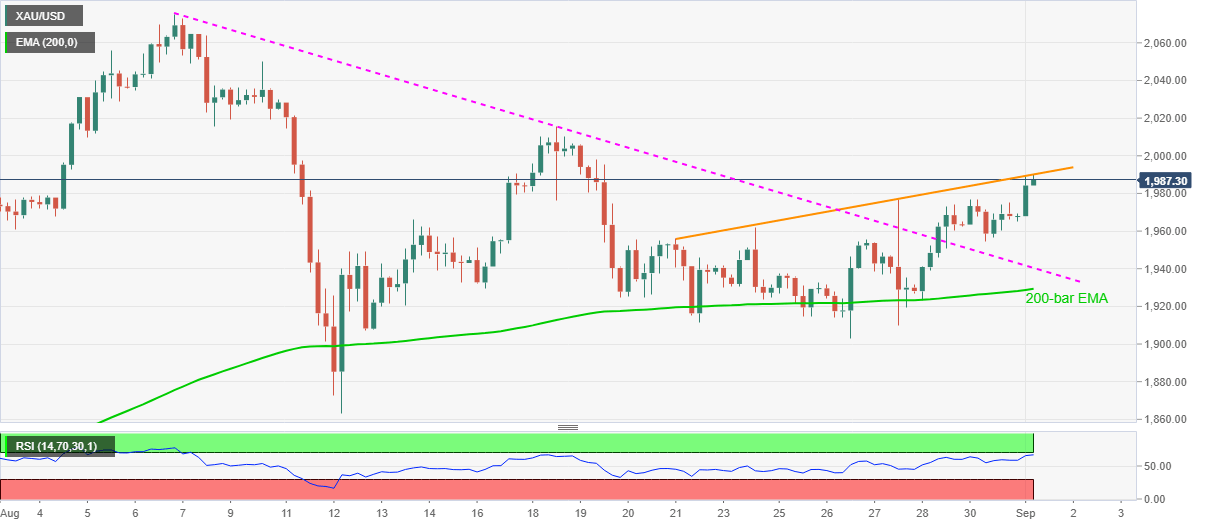

- Gold prices rise for the third day to attack two-week top.

- Sustained break of one-month-old resistance line, now support, favors the bulls.

- Overbought RSI, short-term rising trend line challenges the buyers.

Gold prices print 1.09% gains, trades around $1,989.40, as traders in Europe gather for Tuesday’s bell. In doing so, the yellow metal portrays a three-day winning streak to probe the highest levels last seen on August 19.

However, overbought RSI conditions on the four-hour (4H) chart joins the upward sloping trend line from August 21 to challenge the bullion’s further upside around $1,990.

Hence, the quote’s pullback towards the weekly low near $1,954 can’t be ruled out but the further weakness will depend upon how well sellers dominate below a falling trend line from August 06, at $1,940.

Alternatively, the commodity’s bullish momentum beyond $1,990 will easily pierce the $2,000 threshold while targeting the August 18 peak near $2,015/16.

In a case where the upward trajectory gains acceptance past-$2,016, the record high near $2,075 and the $2,100 round-figures can entertain the buyers.

Gold four-hour chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.