GBP/USD Price Analysis: Sellers attack 1.3400 with eyes on three-month-old support line

|

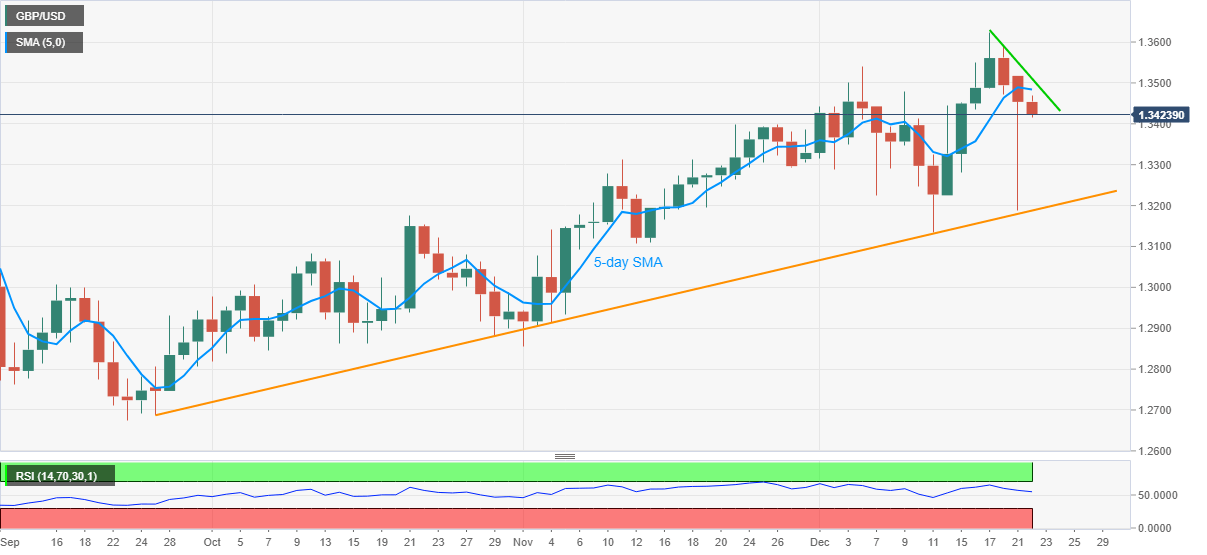

- GBP/USD drops to the fresh low of the day, extends losses below 5-day SMA.

- Lower high formation since last Thursday, US dollar gains keep sellers hopeful.

GBP/USD refreshes intraday low to 1.3415, down 0.28%, during early Tuesday’s trading. The pair dropped to the lowest since December 11 the previous day before bouncing off an ascending trend line from the late-September. Though, a daily closing below 5-day SMA backs the recent lower high pattern to favor the bears.

As a result, the early November high near 1.3315 is likely returning to the chart while the stated support line, at 1.3187 now, can please GBP/USD bears afterward.

Although the quote is likely to stay above the mentioned trend line support, any further downside below 1.3187 needs to break October’s high of 1.3176 to keep sellers in the driver’s seat.

Meanwhile, an upside break of 5-day SMA, at 1.3482 now, will be challenged by a falling trend line from last Thursday, currently around 1.3510.

Further, during the quote’s sustained run-up past-1.3510, the recently flashed multi-month high near 1.3625 will be in the spotlight.

GBP/USD daily chart

Trend: Further downside likely

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.