GBP/USD Price Analysis: Bulls take the reins on the longer-term trajectory towards 1.38 area

|

- GBP/USD bulls in the driver's seat on a longterm analysis.

- The higher volume nodes are located in the 1.3820/30 area.

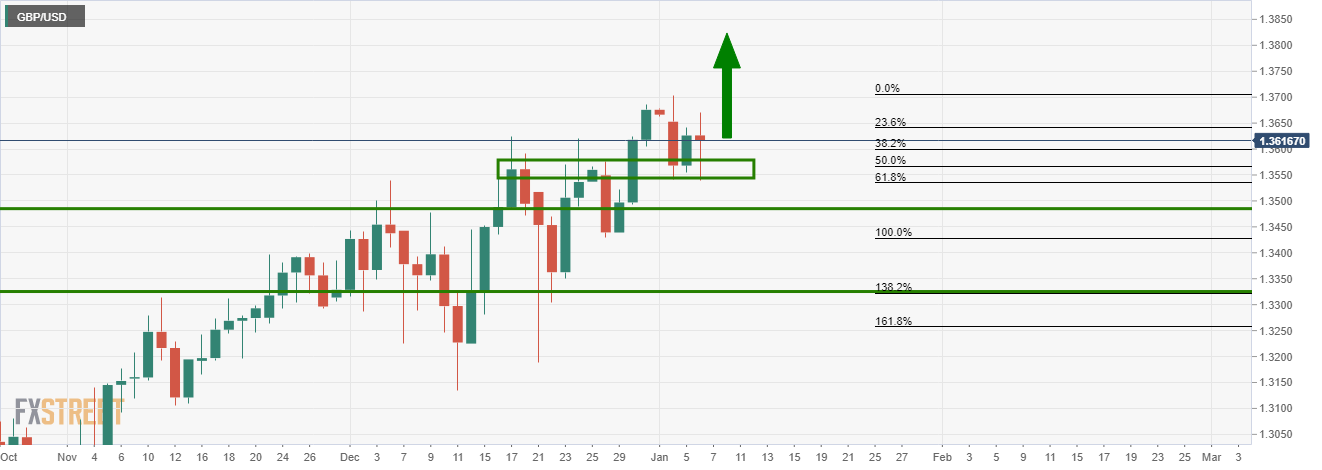

As per prior analysis at the start of the year, GBP/USD Price Analysis: Bulls seeking a 1.3750 daily extension, the pair has indeed forced its way to the target.

Prior analysis, monthly & daily charts

Live market

Low volume nodes point to a continuation

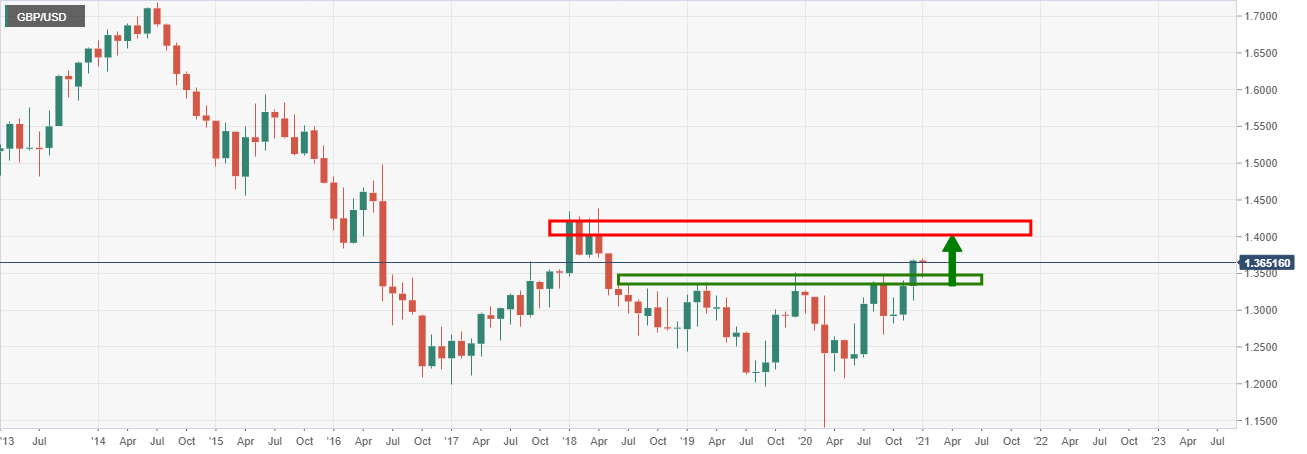

The move to the upside could be part of an even deeper move into resistance forecasted in the following analysis from back in December:

GBP Price Analysis: A a break of critical 1.3514 exposes low volume nodes to 1.3820

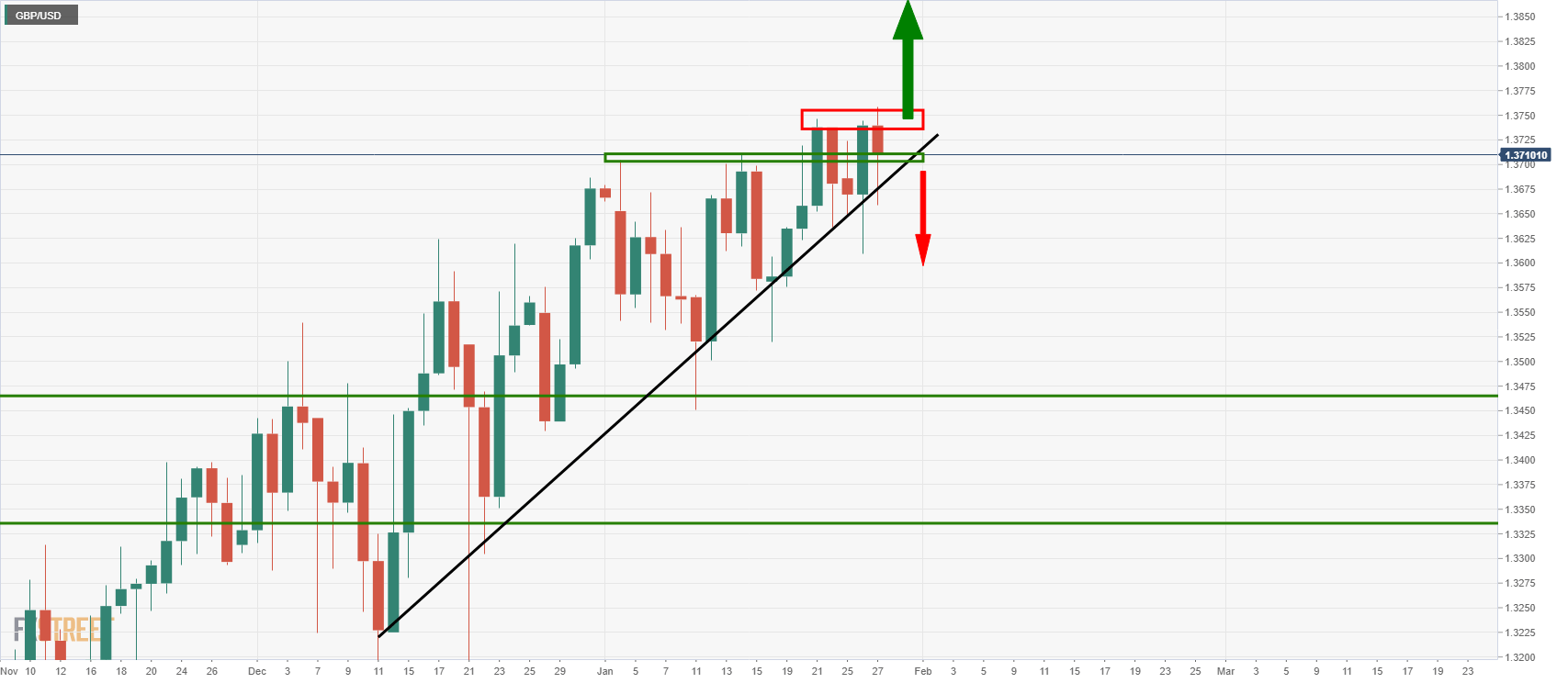

Current 4-hour chart

Meanwhile, the price is trapped, as displayed on the above daily chart, between key support and resistance while ascending along the dynamic trend line support.

The support is fortified by the 21 moving average and MACD is bullish while above zero which leaves an upside bias.

An upside continuation can target a -0.618% Fibonacci retracement level of the latest bullish impulse on the daily chart at 1.3833 as the pair progresses towards higher volume nodes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.